Whether it’s earnings, loans or deposits, growth is the single biggest business goal for community banks in 2018. And while most are seeing at least some benefit from the second-longest economic recovery since World War II, community banks are still concerned with evolving challenges, including cyber threats, regulatory burden and tight competition, all while tweaking operations for the best results.

Those are the findings of ICBA’s 2018 State of Community Banking Survey, which asked community bankers for insights into their operations and strategies for the upcoming year. Given the opportunity to write in their top business goal, a full 66 percent of respondents mentioned some sort of growth. That includes 22 percent who aim to grow earnings, 20 percent citing loan growth, 13 percent citing unspecified growth and 11 percent citing deposit growth.

A continuation of strong earnings is the chief goal at the Citizens Bank of Clovis in New Mexico. The $353 million-asset bank increased earnings for each of the last three years and was well ahead of its 2017 target this fall. Growth was fueled by commercial and ag lending, with a loan-to-deposit ratio of 65 to 70, compared with 45 to 50 in years past, thanks to picking up some participations, adding new loan officers and opening a new loan production office in 2016, according to president Kent Carruthers.

New lenders have helped the community bank keep pace with a changing local economy, one where former retail stalwarts like Sears are going out of business and dairy farmers from California are moving in. With more than 100,000 milking cows in the area, the local cheddar cheese plant is undergoing its third expansion, making it the largest cheddar cheese manufacturing plant in the world, Carruthers says. Wet weather has been a boon for winter wheat, which is harvested in June, and many are planning to buy cattle to graze on the bounty.

With every respondent reporting that lending is at least one of its key profitability drivers, loan origination software is of increasing interest, mentioned by 22 percent of respondents. New Market Bank in Lakeville, Minn., is one of those banks. The bank had been holding off adopting the technology since most of its loan growth comes from commercial customers who work directly with lenders and not the retail sector. However, says Anita Drentlaw, president of the $109 million-asset bank, New Market is now seriously considering it.

“I think more and more people expect to go on the website and have a decision made quickly,” she says. “If we can’t continue to keep up with those things, we could miss out.”

Lending isn’t the only source of income that banks are eyeing. Seventeen percent are looking to credit and debit card services, with at least 9 percent looking into instant issuance. Seven percent are looking at revenue from investment portfolios to drive profitability, 7 percent are looking to payments and 6 percent are looking to wealth management/brokerage services.

Badger Bank in Fort Atkinson, Wis., is among the latter group, having beefed up its wealth management and trust staff, and formed a good partnership with a broker, says Steven Dehnert, president and CEO of the $140 million-asset community bank. Badger Bank is also close to introducing instant card issuance to its branches, which it hopes will win over customers and help with its major 2018 goal: asset growth.

Dehnert says his bank needs to grow more scale to keep up with rising compliance, IT and health insurance costs. The priority is organic growth, but it’s also willing to entertain strategic acquisitions.

“We’re spending a lot on cybersecurity, along with the data center we’re a part of,” says Dehnert, who also cites HMDA and TRID as major costs. “We’re making sure we have good firewalls, defenses and layered defenses.”

Recruitment: Finding and keeping the best

More than a quarter of community bank respondents say attracting and retaining qualified staff is one of their top three business challenges—and it’s not just an issue for rural banks. New Market Bank in Lakeville, Minn., a suburb of Minneapolis–St. Paul, is operating in a tight labor market, with just 3 percent unemployment and companies in other industries paying high salaries and signing bonuses.

To find good talent, the community bank has been seeking out recent college graduates with majors in philosophy, music and other areas where it can be harder to find a job, says bank president Anita Drentlaw.

“Even if we can’t keep them forever, because they might want to do something in their field, we can get some good years out of them,” she says.

Steven Dehnert, president and CEO of Badger Bank, in Fort Atkinson, Wis., thinks more community banks will turn to employee stock ownership plans (ESOPs) to compete, especially since credit unions can afford to pay employees more and offer better benefits since they don’t pay taxes. The employee-owned bank has been fielding calls from other community banks interested in how its ESOP works.

“In essence, our employees are working for themselves,” says Dehnert of the pitch he uses on college seniors and young graduates. “The better the bank does, the better it is for their retirement accounts.”

Compliance

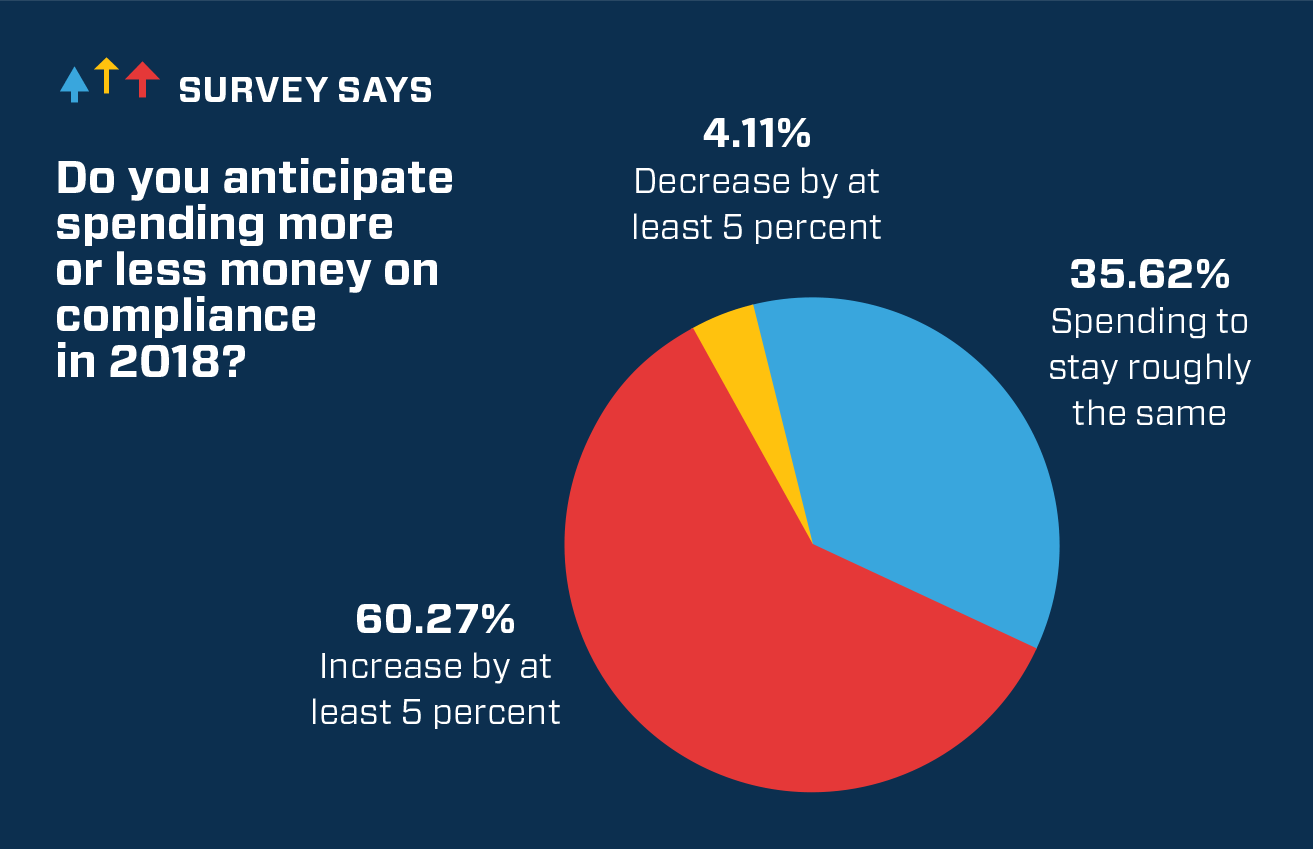

Last year was a hopeful one for community bankers looking for a reduction in their regulatory burden, but it is a hope that has yet to pan out. About half of community banks (46 percent) report that complying with regulations is one of their top three challenges, down from 58 percent last year. Sixty percent expect to spend at least 5 percent more on compliance this year, similar to the 62 percent figure from last year.

That figure will be closer to 30 percent at $325 million-asset Northview Bank in Finlayson, Minn., according to William Loew, executive vice president. Residential mortgages make up 79 percent of the bank’s loan portfolio, and the combined burden of TRID and HMDA has caused the bank to add a full-time employee to its two-and-a-half-person compliance team. It also frequently pulls in its internal auditor, making it more like a four-person team.

“HMDA is becoming a nightmare for banks with the added reporting,” Loew says. “Everyone is still struggling to get it right the way it is, and it’s going to get worse.”

Big Horn Federal Savings Bank in Greybull, Wyo., faces similar regulatory challenges, with CEO and president John Coyne III naming the need to balance regulatory obligations with the expectations of its customers and communities as his bank’s biggest challenge. The mutual bank’s customers have grown accustomed to flexibility when it comes to mortgages, and customers have been confused by things like the bank losing the ability to waive escrow. One solution has been to increase the financial education budget threefold to help customers and other community members learn about banking and personal finance.

“We’re trying to find measures to create safety and soundness appropriate from a regulatory burden standpoint, and still have the community touch we’ve had since the beginning in serving those communities,” Coyne says.

Community bankers still hold out hope for change. “Regulation is hopefully going to get better under the administration we have,” says David G. Courey, chief financial officer at $46 million-asset Cowboy State Bank in Ranchester, Wyo. He expects to spend 15 percent more on compliance this year.

Seeking efficiency

At Cowboy State Bank, 2018 will be all about increasing efficiency in order to meet compliance costs and other goals. The community bank would like to “get to a point where we’re not spending all our money on policies and regulations” and “get to an ROA [return on assets] position comfortable to everyone,” Courey says.

To do this, the bank is switching from a core system to a service bureau to reduce the share of IT, accounting and back-office activities done in-house. Boosting efficiency is the first step in its ultimate plan to grow both organically and by acquisition. Cowboy State plans to open a satellite office in the next few years, having seen its commercial lending increase after moving and replacing a small, outdated branch in 2016. It’s also in talks with other small community banks, says Courey.

Big Horn Federal Savings Bank has also made many investments in its locations and staff over the past few years, putting up a new branch, expanding its ATM networks and investing in its people, Coyne says, but the question is always whether the mutual is making the best decisions to ensure longevity.

“If we hoard our capital and don’t invest it, we’ll likely be in a scenario where we’re targeted for acquisition,” he says. “If we spend our capital trying to make sure we’re creating defensible positions on all levels, we run the risk of not being able to absorb a shock to the system. Ultimately, we need to find balance.”

Strategy

Staying open to opportunities

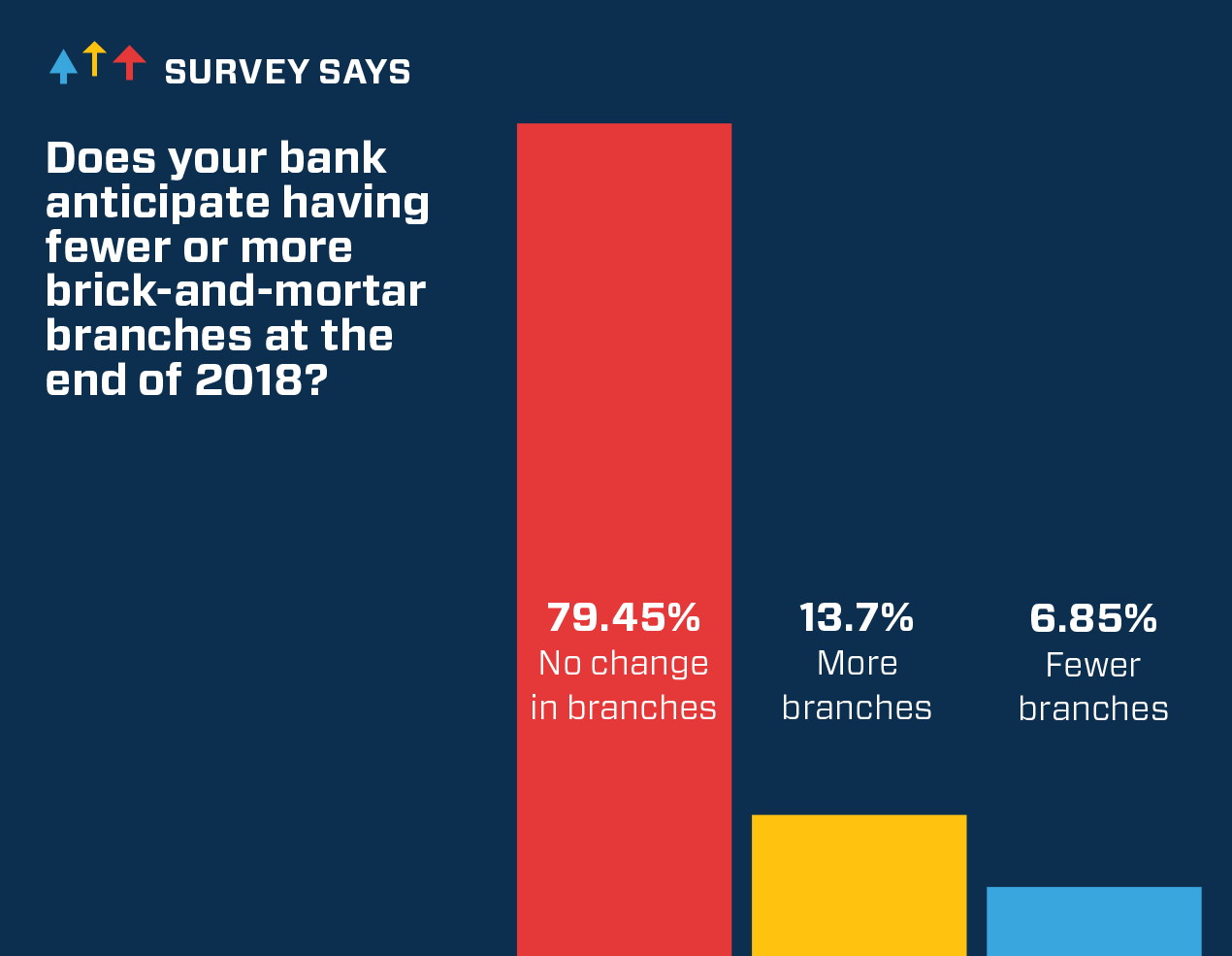

While 79 percent of respondents said they expected to end 2018 with the same number of branches, community bankers say they are always open to opportunities.

The Citizens Bank of Clovis in New Mexico stumbled into opening a new loan office when interviewing potential loan officers. A candidate from Ruidoso, N.M., three hours southwest, had 25 years of experience, made a strong impression and inspired the creation of a new loan production office.

“We decided that was the avenue to go by chance, but it’s worked well for us,” says bank president Kent Carruthers, who isn’t interested in new branches because the family-owned bank has enough deposits to support its lending. “We’re not really looking for it, but if someone came to us, for instance in Albuquerque, we might look at something like that.”

Other banks are set against any talk of mergers or acquisitions. The Garrett State Bank in Indiana had a solid ROE (return on equity) of 17.5 last year and plans to continue with business as usual.

Cybersecurity: Shoring up defenses

With the constant stream of dire headlines warning of cyber breaches, it’s no surprise that 18 percent of community bankers said addressing data security was among the top three challenges facing their bank. Six percent said technology, including cybersecurity, was their number-one goal.

“Data security is one of our highest priorities right now,” says Chalmer Dettler, president of Farmers and Merchants State Bank in Langdon, N.D. “With the recent Equifax breach and the increasing number of breaches there seem to be, more and more regulators are looking at banks’ data security, as they should be, and we’re concerned about it too.”

It’s a challenge to keep up, but John Coyne III, president and CEO of Big Horn Federal Savings Bank, in Wyoming, also worries that the cybersecurity resources necessary to provide products like mobile banking may be disproportionate to the number of customers using them. His bank tries to control exposure by limiting who it markets its mobile services to and only allowing customers to move money outside the bank using its mobile app after contacting them to verify the transaction.

Succession: Keeping the conversation going

When it comes to future leadership, most community bankers are confident where they stand. More than two-thirds don’t expect to see any senior executive leadership changes in 2018. Just 19 percent expect a change, and 12 percent are uncertain.

That doesn’t mean it’s not a priority. Located in Indiana, many of The Garrett State Bank’s executive team members are between the ages of 58 and 64, so it conducts an annual, non-binding survey to get a feel for members’ sentiments about retirement. While the community bank recognizes that people can and will change their minds about their plans, the annual survey is a way for the bank to paint a clearer picture of the next five to six years.

Getting the word out

It’s that balance that all community banks hope to achieve next year as they face off against fellow community banks, money center and regional banks, and tax-advantaged entities like credit unions and the Farm Credit System.

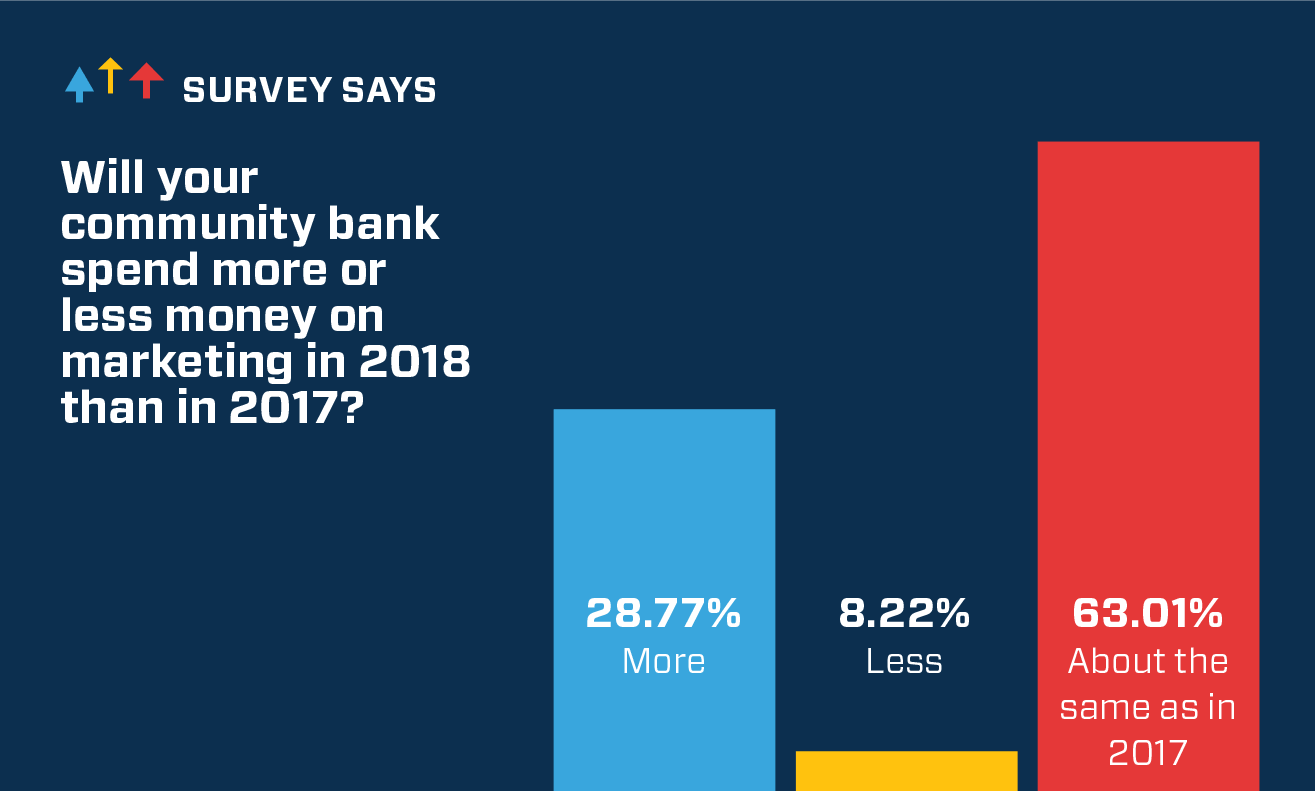

Part of that battle will be focused on marketing. Nearly three in 10 community bankers (29 percent) expect to spend more on marketing in 2018 than in 2017. Much of that marketing will be in the digital space: More than six in 10 community bankers (64 percent) expect to allocate more of their marketing time and dollars to digital marketing.

“We’re looking for ways to increase our web presence,” says Drentlaw, whose community bank uses platforms like Facebook and Instagram. “A lot more of our discussion [focuses now] on how to utilize social media.”

Meanwhile, The Garrett State Bank in Indiana will work to capture more of its mortgage customers’ deposit relationships and is eyeing online account origination, as are 7 percent of survey respondents, in addition to loan origination. But in the end, there’s no one perfect solution.

“We’ve been a higher-performing bank, and we want to stay there,” says Mark Fogt, president and CEO of the $225 million-asset community bank. “We have to do a lot to continue to originate residential loans and develop core deposits. That all feeds into the greater goal.”

Credit card lending is a strong focus for community banks

Choosing to implement credit card models to accommodate low- to mid-quality credit consumers will help community banks stand out among the competition. As interest rates are continually on the rise, capital costs surrounding transactional balances remain expensive and lower the profitability rate for future issuers. Secured card products with graduation programs are quickly gaining popularity.

One question for community banks to consider is whether their current graduation program offerings are designed to adequately support consumer maturity and life events. Millennials and other age segments seek many of the same credit card features and benefits such as rewards, competitive rates, low fees and balance transfer options. As millennials continue moving from debit to credit at a fast pace, banks that focus on lending to this age segment will witness an increase in credit adoption from these individuals. Community banks that choose to build their back-office infrastructure to support secure products can expect to thrive.

Kris Carrera, VP, GM Credit , FIS Payments

Kelly Pike is a writer in Virginia.