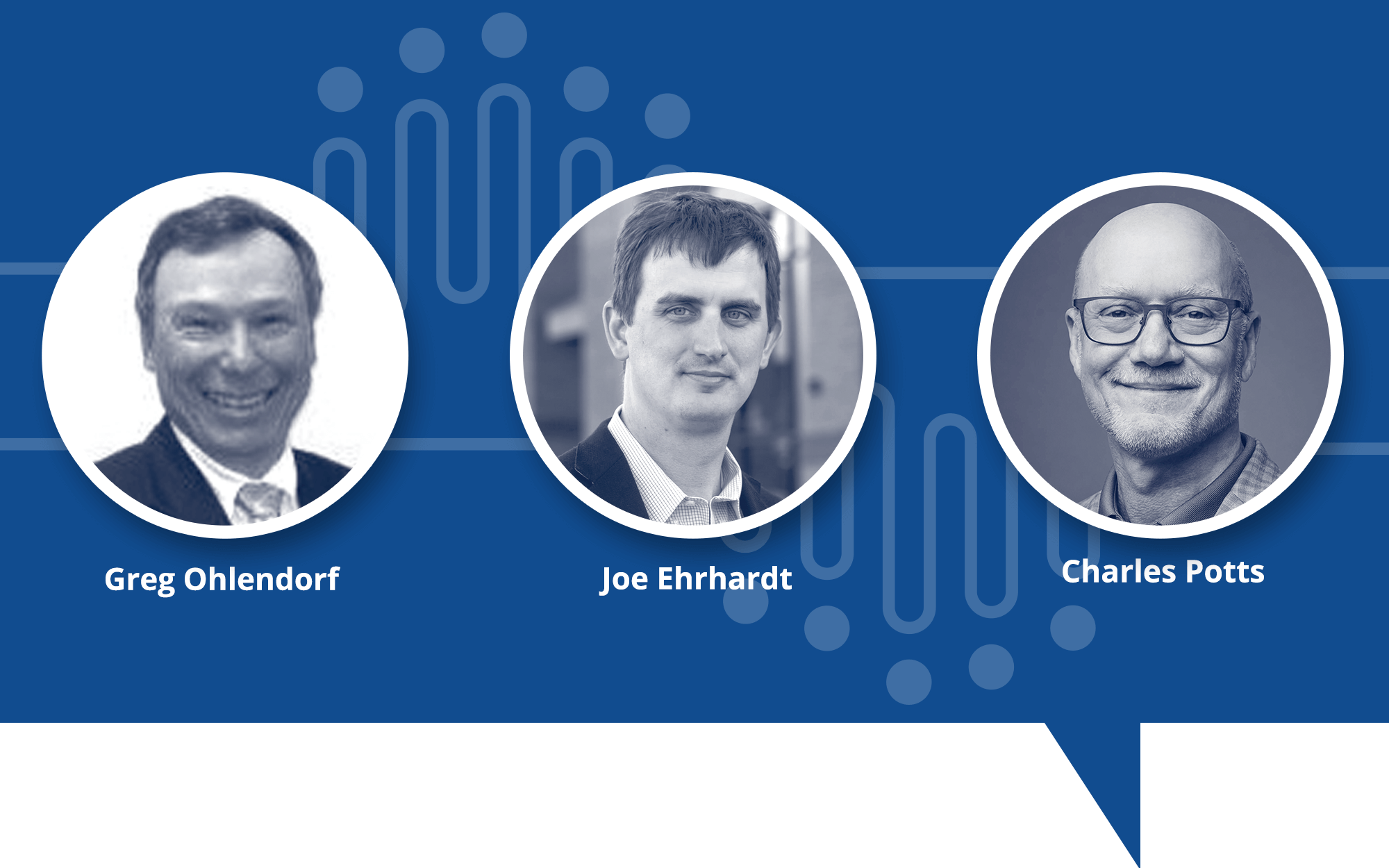

Institutions of all sizes have raced to the finish line and wrapped up their annual capital plan and stress testing this April. What made this year’s exercise unique is that it coincided with the onset of the banking crisis. If you were one those organizations that considered capital stress testing to be merely a regulatory exercise that relied on hypothetical scenarios and carried little value, you surely paid special consideration to the integration of interest rate, liquidity, and capital risks in this year’s stress testing. In today’s economic conditions of high inflation, high interest rates, deposit volatility, and recession risk, it is important that your institution continues to translate these economic conditions into balance, income, and capital projections. This will assist you in designing strategic and tactical actions to help manage income and capital risks. Therefore, capital stress testing should be an important component of your ongoing risk management function. That is, if only the process were efficient and repeatable.

Learn more.

Compliance & Risk

|

May 31, 2023

Capital Stress Testing: More Than Just a Regulatory Exercise

SPONSORED | In today’s environment of high inflation, high interest rates, deposit volatility, and recession risk, it is important that your institution translates these economic conditions into balance, income, and capital projections. Capital stress testing is more than just a regulatory exercise.