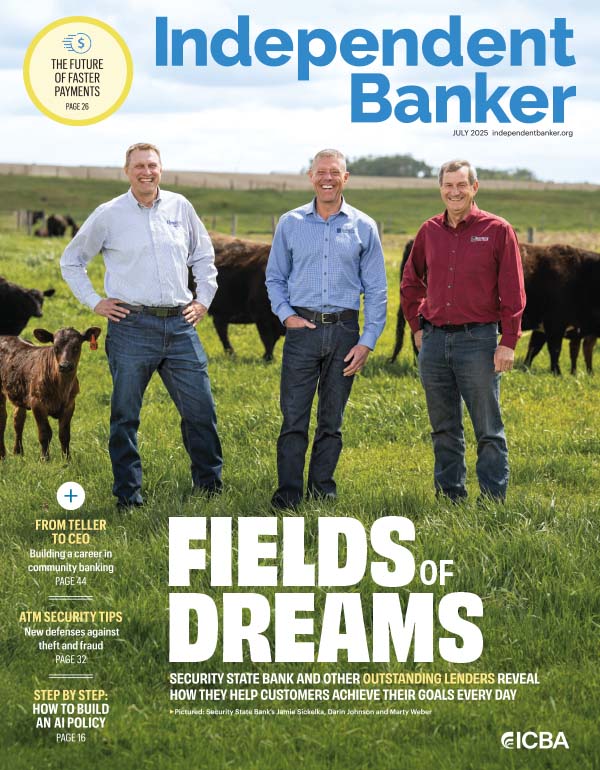

No one has a clearer view of a community bank than its CEO. From strategic decisions to everyday operations, the CEO goes between the board and management to ensure mission-driven performance.

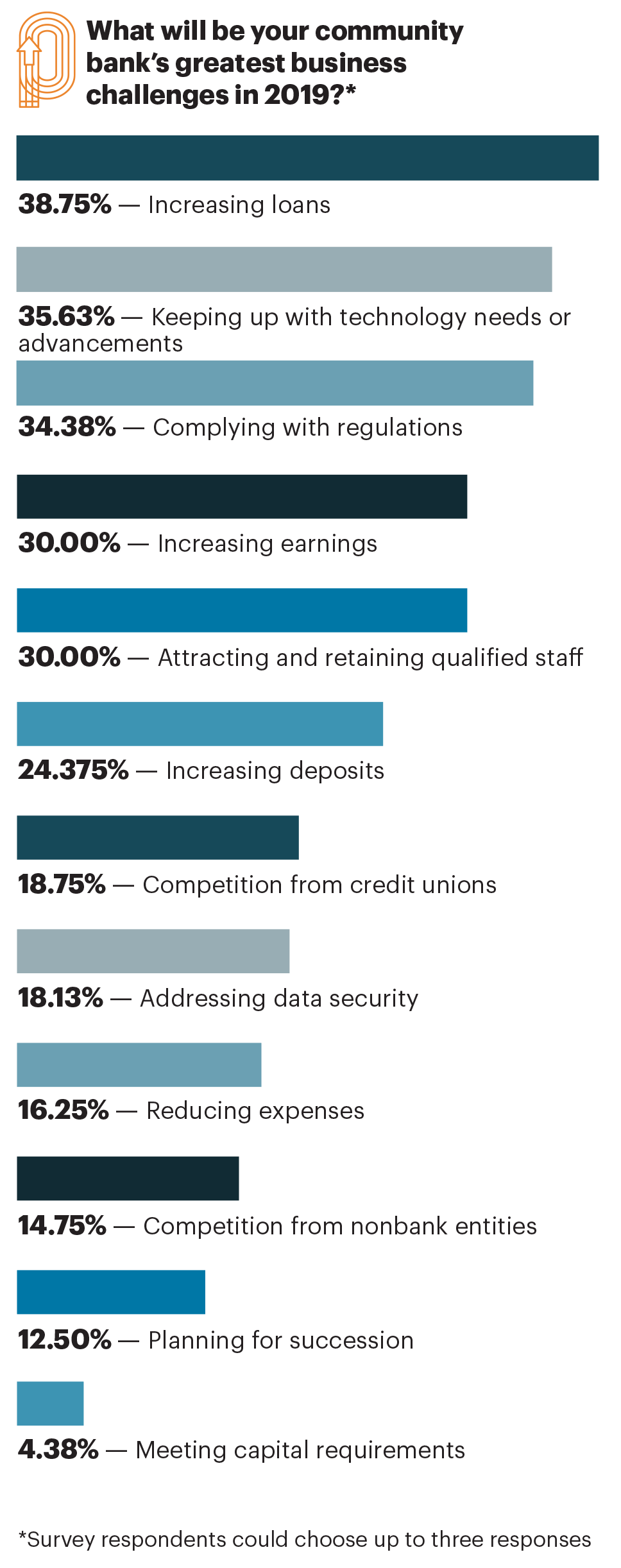

That’s why Independent Banker approached these community bank leaders to get a clearer look at what 2019 holds for the industry and their institutions. From increasing loans and deposits to addressing technology and compliance, the Community Bank CEO Outlook uncovers the biggest challenges facing community bankers and the steps they’re taking to meet them.

Lending

Loan growth remains the key driver of community bank profitability, particularly commercial and industrial lending (61 percent), small business lending (49 percent) and residential mortgage lending (41 percent). A strong economy has boosted lending in some areas but has also presented some surprising challenges.

“I think the biggest challenge is there has been a slowdown, not a screeching halt, in loan generation,” says Thomas Duryea, CEO of $282 million-asset Summit Bank in Oakland, Calif. “There is just heightened competition, which also impacts the pricing on your loans.”

Duryea notes other factors in his Bay Area market. Commercial real estate refinancing boomed in 2015 and 2016, and there is little refinancing left to do. Coupled with tax cuts, businesses have more cash on hand and can finance themselves. After 10 percent loan growth in 2018, Duryea expects high single digit growth in 2019. “Maybe we are just returning to more normalized lending,” he says.

Tom Marantz, chairman and CEO of $995 million-asset Bank of Springfield in Illinois, expects to see the most growth in commercial lending. He also sees selling more mortgages to the secondary market in the community bank’s newer St. Louis market.

“We’re trying to do things better and better and make it as easy as possible for customers to bank with us,” he says.

Regulation often makes that harder, Marantz notes, particularly the qualified mortgage rule.

“It’s our money. We’re not out there to lose it,” he says. “Responsiveness and flexibility is where we’re going to survive and what’s needed.”

Deposits

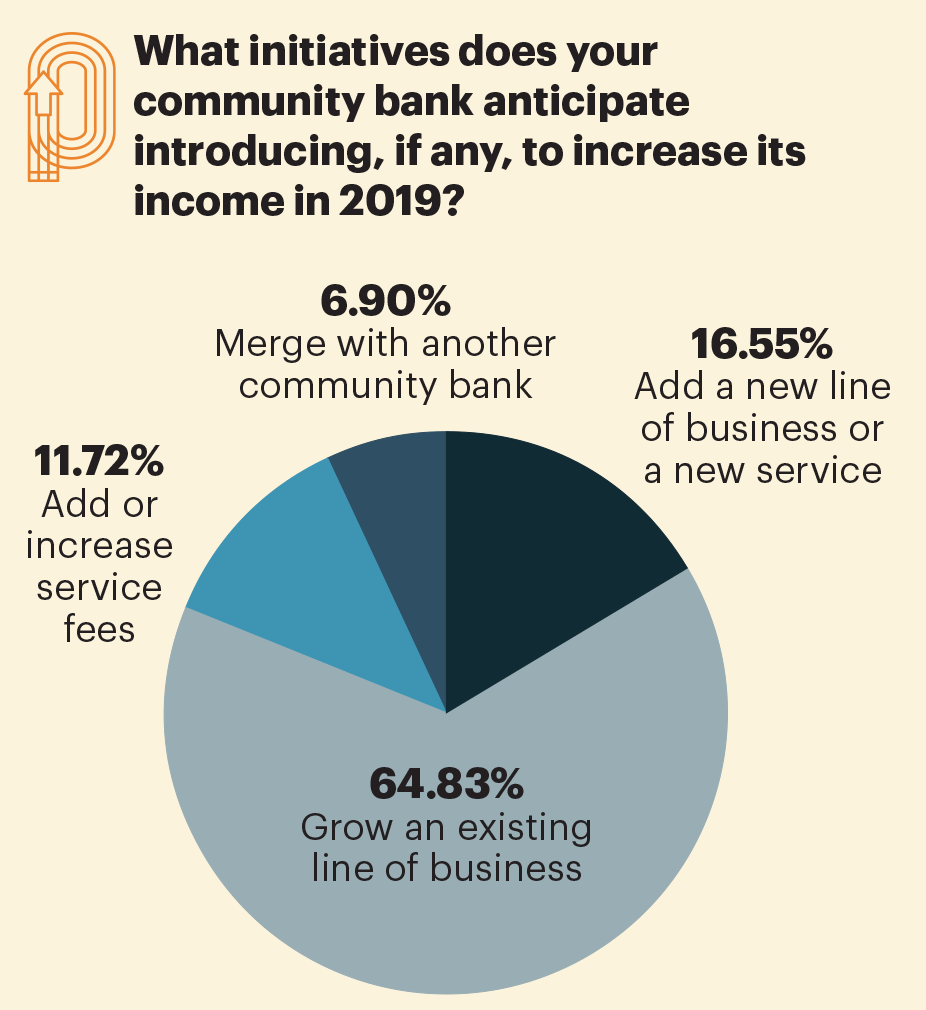

Nearly a quarter of CEOs said that increasing deposits was a top concern. It was also a common initiative among the 65 percent of community banks looking to increase income by growing an existing line of business. Durand State Bank in Durand, Ill., is introducing new deposit products with variable rewards, including cash back or a higher yield, in an effort to raise deposits.

Building branches

Three-quarters of community bank CEOs expect to see no changes to their branch network in 2018, while 23 percent anticipate having more branches, and 2 percent expect to close branches.

While the Farmers Bank in Frankfort, Ind., is looking to grow, president and CEO Karen Gregerson isn’t convinced that new brick-and-mortar branches will be worth the investment.

“The challenge is if fewer and fewer people are going into brick and mortar, it’s an awful expensive channel to have just to have a billboard every day,” she says.

Bank of Springfield plans to expand its footprint with at least one new branch, and it plans to hit $1 billion in assets in 2019. The community bank currently has 12 branches in Illinois and one more in the St. Louis area.

“I’d rather we grow our own problems,” says CEO and chairman Tom Marantz of his preference for organic growth over acquisition.

The $105 million-asset community bank has increased its marketing budget between 50 and 70 percent as part of its efforts, much of it in digital marketing, says president and CEO Kathy Sutherland. It’s also training staff in new customer service protocol.

“I’m hoping that with increased deposits, and along with the variable reward accounts, it would increase our interchange income and noninterest income,” she says.

Abbeville First Bank in Abbeville, S.C., is looking to increase low-cost deposits and improve margins by going after mid-size and larger businesses and municipalities in its county, says president and CEO Andy Timmerman.

This move is made possible by a core processing upgrade that will be completed next June and will allow the $78 million-asset community bank to service more complex deposit relationships.

The bank has already made inroads with lowering cost of funds. “We’re chipping away at that now, but by then we’ll have the tools and platform that can handle analysis and suites and things like that that larger depositors need,” Timmerman says.

The competition

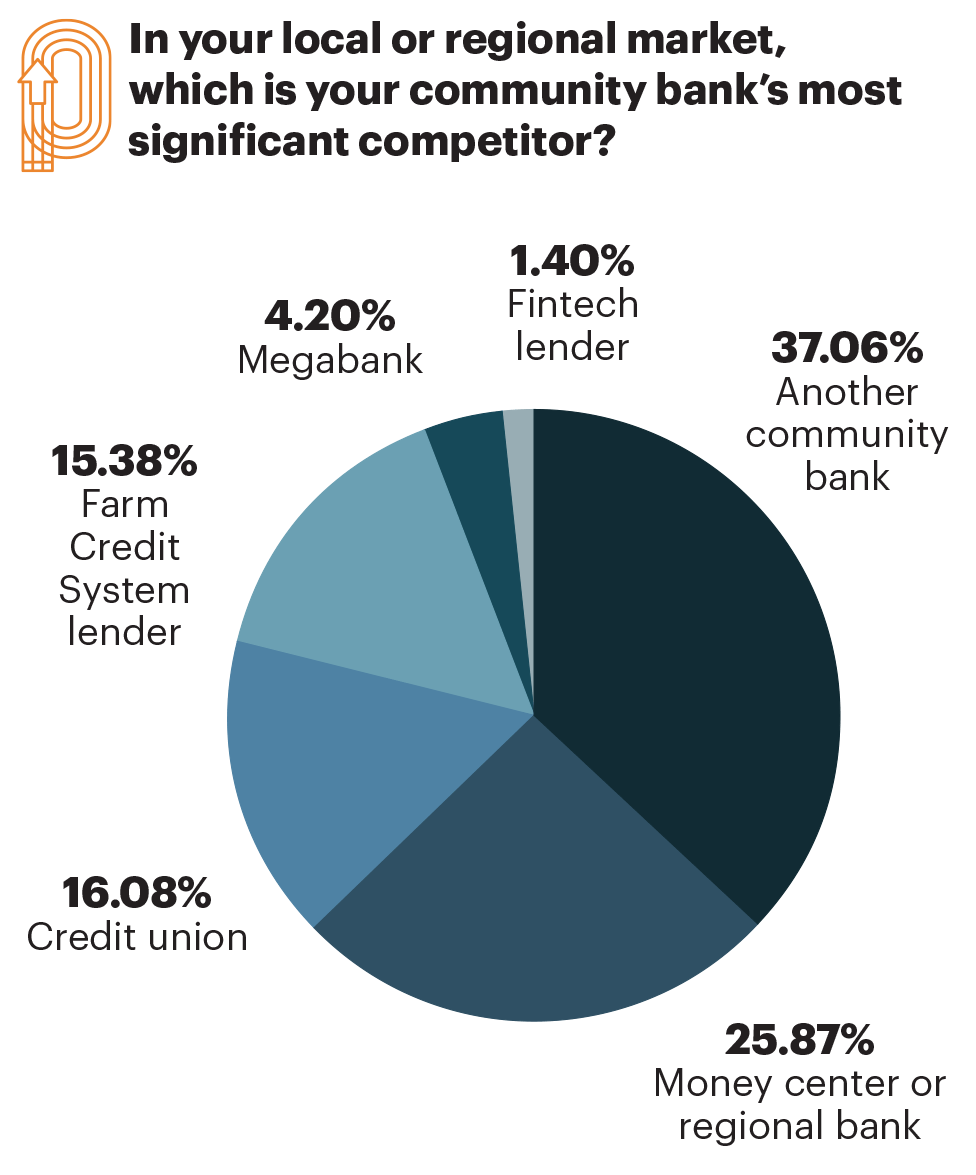

Competition remains fierce. Thirty-seven percent of community bank CEOs who responded to our survey say that another community bank is their top competitor. Others says their primary competition comes from a money center or regional bank (26 percent), credit union (16 percent) or Farm Credit System lender (15 percent). For now, megabanks and fintech lenders are much smaller concerns (4 percent and 1 percent, respectively).

Competition from credit unions is the biggest business challenge facing $93 million-asset Pineries Bank in Stevens Point, Wis., where one- to four-family residential loans makes up 65 percent of the loan portfolio, and business loans and home equity lines of credit (HELOCs) make up the difference.

“I’m not normally one to complain a lot about the competition or complain about credit unions specifically, but in our particular marketplace and much of Wisconsin, we have a higher concentration of those financial service organizations, and they continue to build more branches,” says Paul C. Adamski, president and CEO of the one-branch community bank. “It brings in not another just another competitor but a competitor generating loans at considerably lower interest rates.”

The good news, notes Adamski, is that the local economy tends to remain steady due to its university and other solid employers, keeping loan and deposit demand constant.

Technological upgrades

Improving technology is a top concern at 36 percent of community banks, with respondents citing both customer-facing and operational upgrades. Just over 20 percent of community banks are planning to improve their mobile offerings in 2019.

The Pineries Bank is planning a core conversion that will improve the customer experience, including upgrading mobile banking and introducing features such as person-to-person (p2p) transactions, mobile deposit capture and deposit analysis for commercial customers. The community bank is also hoping to boost non-interest income and to “right size” fee sheets by charging the new, larger depositors it hopes to attract, including two or three money service businesses.

“We know we aren’t going to be able to offer the cutting edge on everything, but if we can keep up, then we can better take advantage of our niche of being a very hands-on bank.”—Andy Timmerman, Abbeville First Bank

“We know we aren’t going to be able to offer the cutting edge on everything, but if we can keep up, then we can better take advantage of our niche of being a very hands-on bank,” says Timmerman, who also mentions the challenge of finding growth in a declining rural market.

Other community bank CEOs feel like they have all the right offerings. The challenge is communicating that to potential customers.

“We already have a lot of products: merchant capture, mobile deposit, p2p payment. It’s getting the word out that we have all the technology they can get from a national bank here at a smaller bank.”—Karen Gregerson, The Farmers Bank

“We already have a lot of products: merchant capture, mobile deposit, p2p payment,” says Karen Gregerson, president and CEO of $550 million-asset The Farmers Bank in Frankfort, Ind., which has also expanded from its legacy market into the more crowded Indianapolis market. “It’s getting the word out that we have all the technology they can get from a national bank here at a smaller bank.”

About 13 percent of respondents say their community bank is considering loan origination software, while 11 percent mention p2p payments, especially Zelle, and 9.6 percent are eyeing online account opening. A handful are considering the possibility of virtual tellers or unmanned branches.

When it comes to operational technology, the most frequently mentioned technologies include core upgrades (13 percent), loan origination (10 percent), instant issuance (8 percent), customer profitability software (6 percent) and regtech or compliance software (5 percent). Others mentioned leveraging the full capabilities of their existing software to improve efficiency, plus making a general effort to outsource activities.

The Farmers Bank has just extended its core contract and undergone business improvement processes. For example, it’s just completed the processes for its mortgage banking area, developing initiatives to eliminate duplicate entry of data, and improving systems communication to make the process smoother for both customers and staff. In the finance area, the community bank has upgraded some of its financial analysis tools, including a new general ledger, accounts payable and fixed assets with more robust reporting.

Despite its tendency to attract headlines, cybersecurity did not receive much attention in the survey, though it remains an issue in terms of cost and strategic decisions at Bank of Springfield.

“We’re spending much more on computer services, and security is a big issue,” Marantz says. “Plus, it makes you more cautious of what business you get into.”

Leadership & growth

About 20 percent of CEO respondents expect a senior leadership change at their banks next year, and 13 percent say planning for succession is a top business challenge.

That includes Bank of Springfield. The bank’s president of 22 years retired at the end of 2018, and an executive vice president, who is a former president of the local chamber of commerce and a well-respected leader in the community, was promoted to replace him. “It’s been a big process for us, over a three- to four-year process of training people,” Marantz says.

Investing in people is a major initiative of Bank of Springfield’s long-term strategic plan. The bank has programs for summer interns and management trainees to identify and foster talent. That places it among the 30 percent of community banks whose CEOs say attracting and retaining qualified staff is a great business challenge.

Rather than grow out, the Pineries Bank has grown up, more than doubling the size of its single branch to accommodate future growth.

The bank was founded in 1997 with three employees. Today, it has the equivalent of 13 full-time employees with floor space for up to 30, including Adamski’s two grown children, who will take over the bank when he semi-retires in the next year or two.

“We made a commitment to stay independent for another 20 to 30 years. We’re excited for our legacy to continue in the community.”—Paul C. Adamski, Pineries Bank

“We made a commitment to stay independent for another 20 or 30 years,” he says. “We’re excited for our legacy to continue in the community.”

It’s a challenge all community banks will face as they try to demonstrate their relevance to customers while staying true to their relationship-based business models.

“There is no kicking back and enjoying the fruits of our labor,” Timmerman says. “We are constantly moving forward.”

Easing the compliance burden

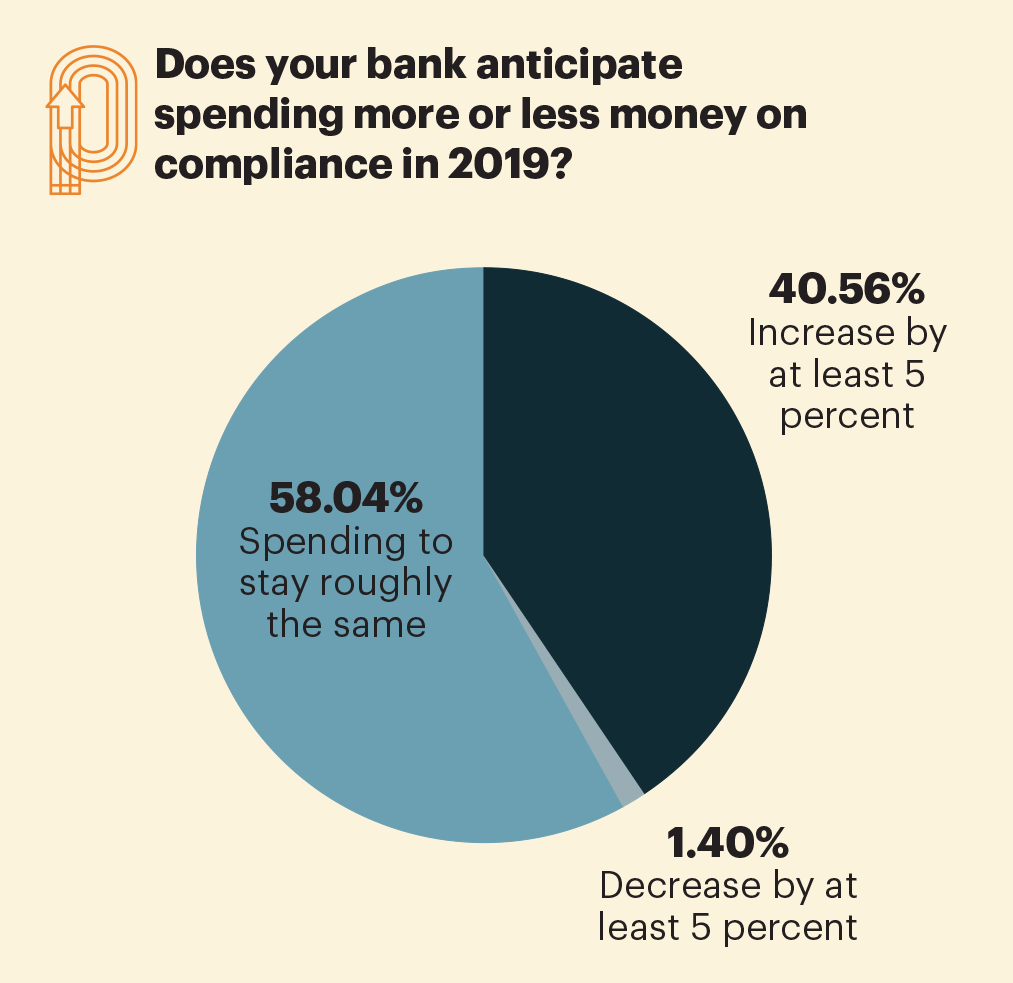

Thanks to the passage of S.2155 last year, 40 percent of community bank CEOs surveyed feel more positive about their regulatory burden. Compliance costs also appear to have leveled off for many institutions, with 58 percent of CEOs saying that spending on regulatory compliance will stay at 2018 levels. Just 40 percent expect to increase compliance spending by 5 percent or more, compared with 60 percent in a similar survey in 2017.

That’s not to say community banks aren’t worried about compliance. It still ranks among the top three business challenges for one-third of community bank CEOs, down from 46 percent in the last survey.

Tom Marantz, chairman and CEO of Bank of Springfield, finds overwrought regulatory burden a distraction from his core business of helping customers.

“Some of the last bill that has been passed has been very helpful, but HMDA requirements for banks our size is an enormous leap to get under control,” he says. “It takes time away from other areas of the bank, where we could be developing business instead filing out data fields.”

Durand State Bank is right at the HMDA threshold for the minimum number of loans for reporting. The bank will report until the mortgage thresholds/requirements are expanded, because president and CEO Kathy Sutherland fears falling out of practice might make the bank make mistakes down the road.

“Compliance is always going to be out on the forefront as one of the higher expense items, followed by technology” she says.

Boosting digital marketing

Marketing remains a significant line item at community banks, with many realigning their approach to fit an increasingly digital world.

Half of community bank CEOs expect to spend the same amount on marketing in 2019 as they did last year, while 45 percent expect to spend more—most commonly between 5 and 10 percent more.

As one survey respondent put it, “Community banking is in vogue. Time to hit the gas.”

Meanwhile, more than two-thirds anticipate allocating more marketing time and dollars to digital marketing, including social media, digital advertising and social media. About 30 percent of those CEOs expect to spend 20 to 25 percent more, 10 percent anticipate spending an additional 10 to 15 percent and 25 percent expect to spend 5 to 10 percent more. Several say they’ve hired digital managers or management firms.

The Farmers Bank in Frankfort, Ind., is dedicating 40 to 50 percent of its marketing budget to digital marketing as part of its push to increase brand awareness in a saturated market.

“We’re making a bigger play in that area and just started hiring a firm,” says Karen Gregerson, president and CEO. “We’re looking forward to see what we can do to increase awareness.”

Adding earnings

Increasing earnings and profits is a perennial issue for community banks. Many wonder what a rising interest environment will mean for the bottom line.

Summit Bank in Oakland, Calif., is enthusiastic about its future. Half of the bank’s loans are floating tied to prime, and its commercial and industrial loans—30 percent of its portfolio—are largely in floating lines of credit. “To have 50 percent of our portfolio floating in an upward interest moving environment will really benefit us,” CEO Thomas Duryea says.

Bank of Springfield is hopeful that customer profitability software will help them serve clients better while enhancing income.

“When we were much smaller and had one branch with $20 million, when you came back everyone knew everybody,” CEO Tom Marantz says. “It’s harder to know everyone now because I can’t see someone who comes into an office somewhere else. We’ve done a lot of manual reporting, but this will make it easier to know if a customer has been in. We want to know our customers better.”

From our sponsor

Before you establish growth targets, are you relevant to your next generation of customers?

Millennials are the largest generation to be born in the history of the United States—what products and services are you offering to attract the next generation? Digital offerings available on a mobile phone are a key driver, but perhaps the biggest driver of all is opportunity. A $30 trillion opportunity. Millennials are in line to inherit $30 trillion from their baby boomer parents. How they decide to bank this money—or not bank this money—will largely determine the success or failure of community banks. So, before you can target growth, a bigger question to ask yourself is, “how am I positioning my bank to be relevant and offer greater value compared to other choices in earning the next generation’s business?”

Keith Nolan, VP partner and alliance sales, FIS Payments