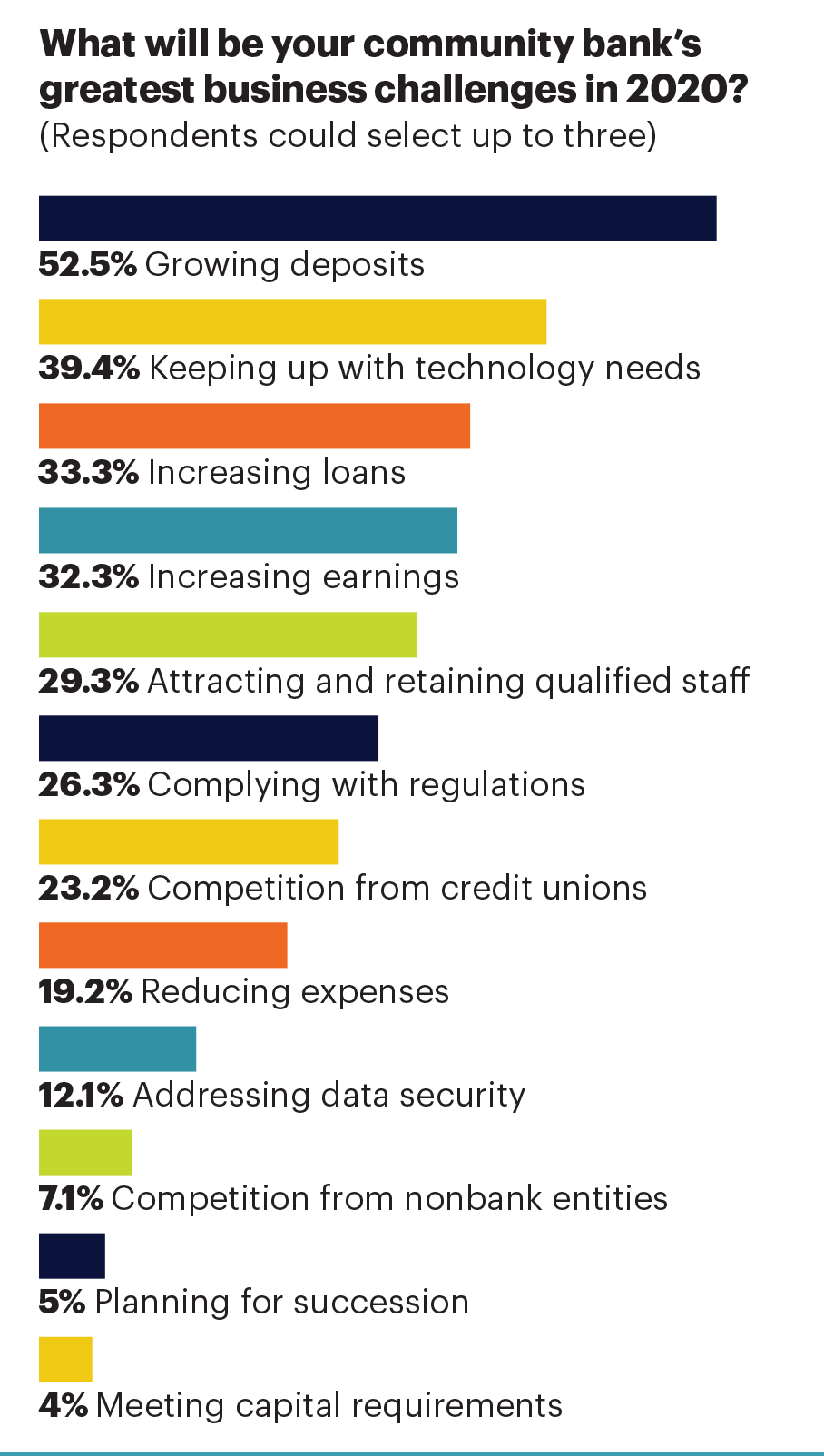

Ask any self-help guru, and they’ll tell you that the path to growth combines awareness of the outside world with the ability to understand and improve one’s internal workings. Ask a community bank CEO about the path to growth, and they’ll tell you the same. After all, growth—particularly in deposits, loans and profits—is the major business challenge community banks face in 2020.

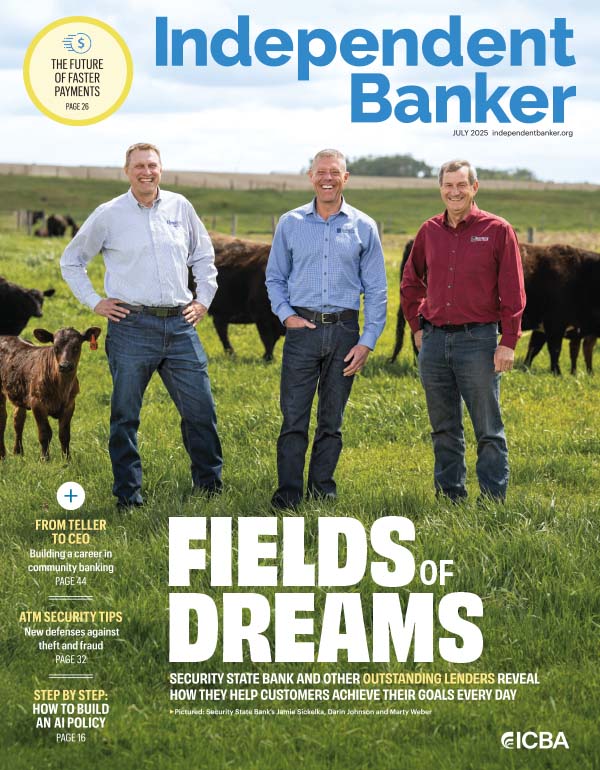

Those are the findings of this year’s Community Bank CEO Outlook, which asks community bank chief executives about their expectations for the year ahead and how they plan to deal with them.

The top challenge: deposit growth

Building on last year’s momentum, growing deposits continues to rank among the greatest business challenges for community banks. Half of respondents (53%), including $414 million-asset First Citrus Bank in Tampa, Fla., are focused on core deposit growth in 2020.

“It’s about executing and getting traction on the balance sheet,” says president and CEO Jack Barrett. He says checking accounts are First Citrus Bank’s bread and butter.

The community bank has hired two core deposit rainmakers for the first time ever to help achieve its deposit mandate and is opening its first new office in a decade across the bay in St. Petersburg, Fla. It’s also opening a loan production office.

Just as important, the community bank has made internal improvements, with senior managers dedicating nearly 500 hours to new systems, processes and execution road maps. The goal is to put a structure in place that will allow it to grow into and flourish as a $600 million-asset bank, Barrett says.

First Citrus Bank is also enhancing its internal culture. The senior management team “is clicking, and it’s contagious,” he says. “That’s the soft stuff that will drive the financial outcomes that we’re seeking to attain. If we don’t have the right operating framework qualitatively, all the checking accounts in the world don’t matter. We still need the appropriate risk management framework in order to capitalize, harness, leverage and arbitrage those beautiful low-cost funds.”

Growth is also the name of the game at $700 million-asset Brentwood Bank in Bethel Park, Pa., as the bank “plays the scale game,” according to CEO Thomas Bailey, who aims to grow the bank around 9%. Last spring, the mutual holding company acquired a one-branch mutual bank. It’s open to other acquisition opportunities but expects mostly organic growth.

Bailey says the reason Brentwood Bank is focused on growth is that it sees it as necessary in order to compete and provide the technology the customers need.

Prairie Community Bank in Marengo, Ill., is tackling its growth objectives by opening a branch in a new market 20 miles away in Elgin, Ill. Its existing market is stagnant, says president and CEO Dianna Torman of the $122 million-asset community bank.

Prairie Community Bank will use a universal banking platform with a cash recycler to eliminate the teller line and save on personnel costs. If successful, it’s a model Torman hopes to introduce to other branches over time.

Independent Banker’s survey found branch networks are poised to grow at 22% of community bank respondents, while 68% have no plans to open or close branches.

Community Bank in Joseph, Ore., is among the 4% of banks that anticipate having fewer branches by the end of 2020.

“We have one branch slated for closure in early 2020,” says Tom Moran, president and CEO of the $420 million-asset bank in northeast Oregon. “We’re open to further branching in our markets if the opportunity presents itself, but we couldn’t gain sufficient market share in that area.”

Planning who’s next in line

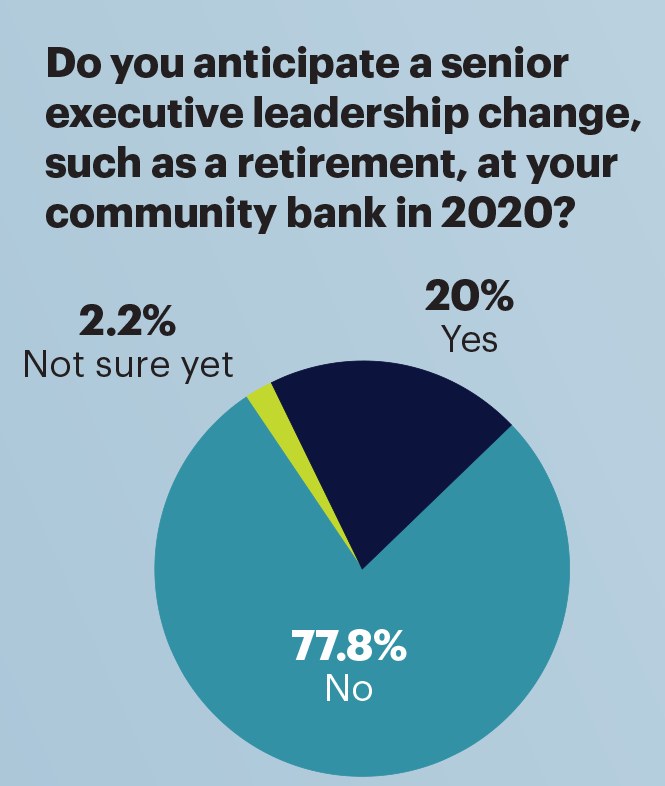

One in five community bank CEOs expect a senior leadership change, such as a retirement, in 2020, which is the same as last year. Yet, planning for succession appears to be a less pressing concern. Just 5% report planning for succession as one of their top three business challenges, compared with 12% in 2019. The benefit for financial institutions that don’t expect any retirements is that departments like compliance are staffed with people steeped in knowledge and experience, notes Thomas Bailey, CEO of Brentwood Bank in Bethel Park, Pa., who isn’t expecting any retirements at his bank. As in any industry, however, that poses a challenge: Some long-tenured employees don’t have the most up-to-date technological knowledge. “As we grow, we are strategically considering how to add new perspective, so we remain current with technology trends,” he says.

Aiming for robust financials

Profitability is the single most important business goal for a quarter of respondents, with deposits and growth not far behind (22%). Bankers plan to support that goal with fiscal discipline, maintaining interest margins and keeping the loan portfolio strong—the top priority at 10% of community banks.

The interest rate environment and the potential for a flat yield curve is the biggest challenge to profitability at Brentwood Bank, in the suburbs of Pittsburgh. “We’re definitely a spread bank,” Bailey says. “We make the loans and gather the deposits. There’s not a lot of fee revenue.”

The commercial real estate lender is ramping up its residential lending to drive profitability in 2020. It’s hired an additional residential originator and brought in an expert on the bank’s new loan software. The goal is to make the most of its investment by maximizing its functionality and automating the loan process.

It’s all about the loans

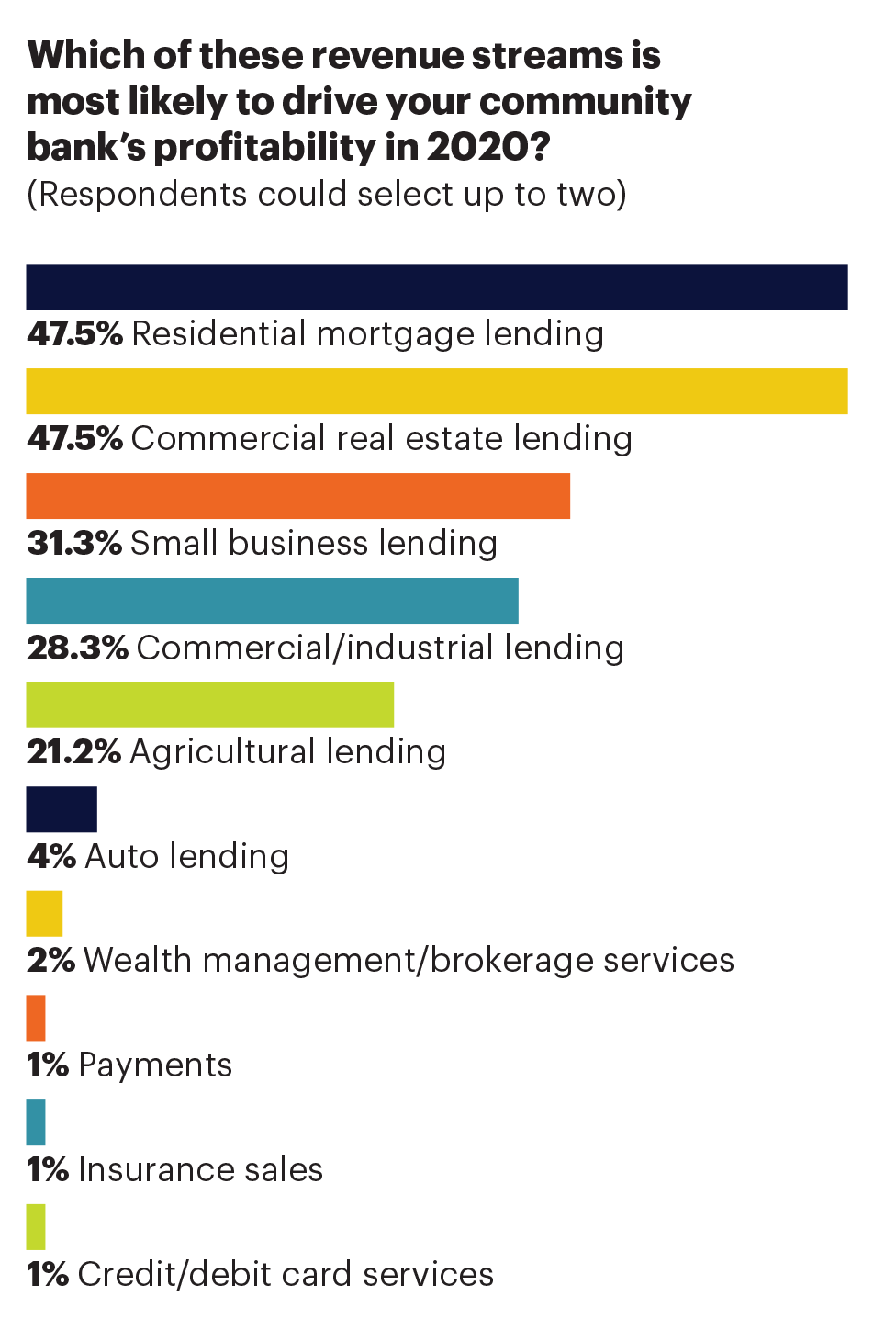

Loans remain the top driver of community bank profitability, the survey shows, particularly residential mortgage and commercial real estate lending (47% of respondents). Loans are also expected to be the largest source of revenue growth in 2020.

One-third of respondents cite growing loans as a top challenge, down from 39% in 2019, and 13% say it’s their bank’s single most important business goal for 2020.

Golden Valley Bank in Chico, Calif., experienced a huge influx of deposits after one of the most destructive wildfires in U.S. history destroyed 14,000 homes in a neighboring community in late 2018. Loan growth hasn’t kept pace with a surge in deposits—a result of insurance proceeds and charitable giving, says Mark Francis, CEO of the $346 million-asset community bank.

“With the tremendous deposit growth and just good loan growth, our securities portfolio has ballooned, definitely providing a boost to profitability,” he says.

“With the tremendous deposit growth and just good loan growth, our securities portfolio has ballooned, definitely providing a boost to profitability.”—Mark Francis, Golden Valley Bank

Community Bank is hopeful that technological investments within the loan department, including updating its loan origination system and making workflow changes to streamline the underwriting process and simplify the loan experience on the customer side, will help boost lending and overall revenue.

“For us, loan growth has been challenging, largely due to the characteristics of the rural markets we bank,” Moran says. “We’re hoping that some of the changes we made will help us to kickstart into 2020.”

“For us, loan growth has been challenging, largely due to the characteristics of the rural markets we bank. We’re hoping that some of changes we made will help us to kickstart into 2020.”—Tom Moran, Community Bank

The bank has invested in a deposit origination system. The goal is to grow its deposit market share in newer markets and protect it from poachers in more mature markets.

“It’s not traditionally competitive on the deposit side, but over the last year or two, deposits seem to have become more in favor within the industry, and our rural markets haven’t been left out of that,” Moran says. He adds that Community Bank competes primarily with super regional banks and a few sophisticated credit unions.

Prairie Community Bank is also gearing up for increased lending. “We’re focusing on loan growth this year,” Torman says. “In 2018, we had about 8% loan growth, and we’re looking to increase that. 2019 was pretty flat.”

Overhauling consumer-facing tech

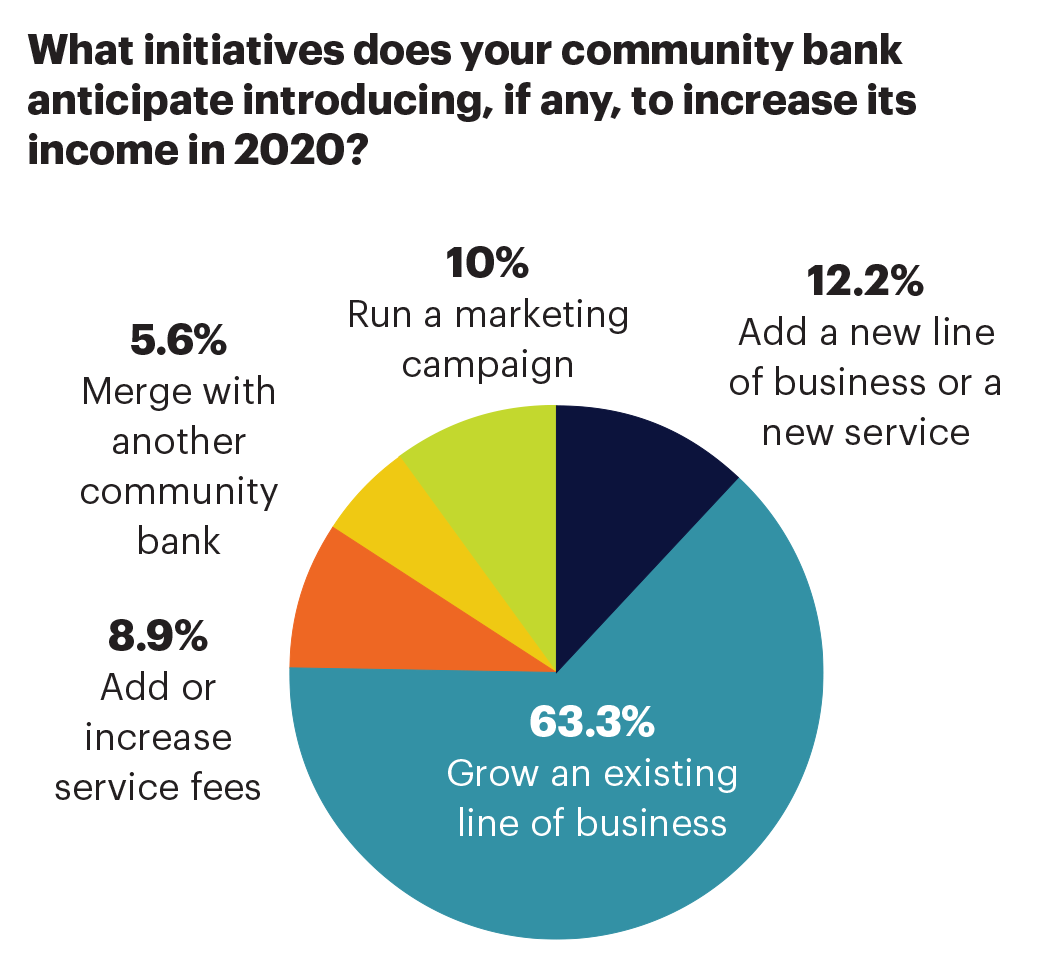

Most community banks aren’t looking to make a big technological leap. Nearly two-thirds of respondents (63%) plan to grow existing business lines in 2020, while 12% plan to add a new line or service.

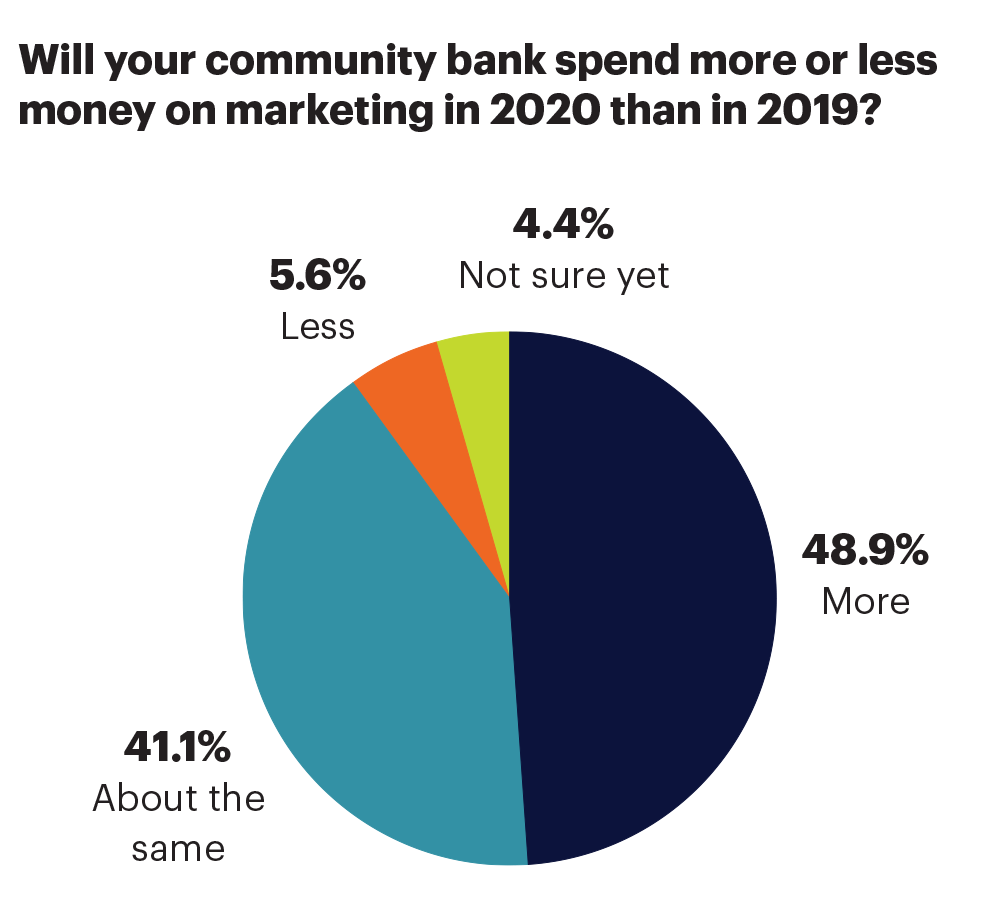

Many community bank CEOs, Barrett included, have offered technologies like mobile banking and remote capture for years and are now looking to refine existing offerings, such as First Citrus Bank’s website.

“Today, it’s a little too transactional, and we have an opportunity to make the virtual branch more engaging so it’s accessed as a resource for our clients, associates, shareholders and our community,” says Barrett, who plans to add content like articles and videos for consumers and small business owners.

The customer-facing technologies of most interest to community banks are online loan and/or deposit origination and updating mobile platforms and remote deposit. Person-to-person payments (14%), especially Zelle (6%), are also expected to be considered for adoption this year.

“We’re at a good spot in that service contracts are coming up,” says Bailey, who is in the RFP (request for proposal) process and is looking to beef up customer-facing technologies like mobile banking, online account opening and automating loan application process.

Compliance costs stabilize

In 2007, First Citrus Bank in Tampa, Fla., spent less than $25,000 on compliance. Now it spends close to $500,000. Fortunately, president and CEO Jack Barrett doesn’t think he’ll have to increase spending, a change he attributes to regulators like FDIC chairman Jelena McWilliams.

“I think she gets it; ‘it’ meaning less is more when promulgating banks to be an agent for social reform,” he says, lauding McWilliams’ transparency and sincerity. “She understands there is as much art as there is science in the community bank space.”

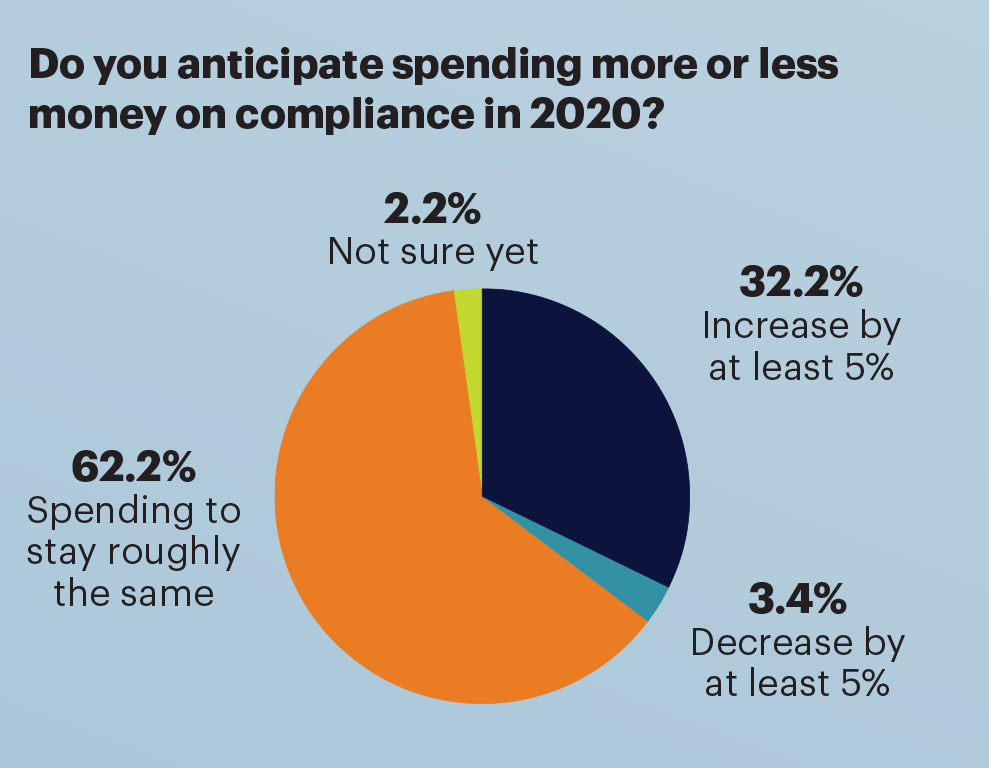

Barrett is not alone. Just 26% of community bank CEOs rank regulatory compliance as a top-three concern, the survey found, compared with 34% last year. Compliance spending continues to decline, with just 32% of CEOs expecting to increase their spending by at least 5%, compared with 40% in 2019 and 62% in 2017. Almost two-thirds (62%) expect compliance spending to remain the same.

Tom Moran, president and CEO of Community Bank in Joseph, Ore., is among the 32% of community bank CEOs who expect costs to increase by at least 5%. The bank is considering technology to increase efficiencies or at least bring more consistency to internal processes. He adds: “A lot of ink has been spilled, about compliance and regulatory reform targeting smaller financial institutions, but to date we are not really seeing a material change in that area that would warrant less of a spend.”

Change at the core

Looking internally to operations, 2020 is likely to be a big year for cores, as 23% of CEO respondents are looking at core software, including conversions, upgrades, searching for open cores and renewing existing controls.

Golden Valley Bank’s core software contract is up this year, so it’s in the process of negotiating a new one.

“The biggest change will be with the ancillary products connected to the core,” Francis says. “With the rise of fintech, virtually all of these ancillary products can be purchased from these new upstarts, many times for a better product at a lower cost. That’s the direction we are headed.”

Prairie Community Bank’s core contract is also expiring. The bank will look at new products like online account opening and an improved P2P payments solution after it decides whether to stick with its existing core or adopt another. It’s also eagerly awaiting the introduction of FedNow Service, a new interbank real-time gross settlement service that will enable banks to deliver end-to-end faster payments services to their customers.

Another 17% of community bank CEO respondents are looking at instant card issuance. Other popular operational improvements include loan and new account processing and automation, better document storage, and software that provides deeper insights into customers.

Rather than buy new operational software, Brentwood Bank is looking to more fully use what it already has. The community bank has brought on an employee dedicated to training.

It’s also monitoring the impact of Bank of America moving into a market dominated by PNC Bank. While the megabanks aren’t direct competitors, they drive customers’ technology expectations, Bailey says.

“Everyone is all charged up with how to compete against the large behemoths,” he says. “I just read that Bank of America has 22,000 people working on artificial intelligence.”

While Brentwood Bank can’t compete with that investment, Bailey hopes to be a close technological follower, adopting bots or other AI as needed in the not-too-distant future.

The technology question comes down to strategic planning, Torman says. “Are we going to be an innovative bank and spend the money to get there?” she says. “Our board has to make those decisions. It used to be the cost of compliance, and now it’s the cost of technology that could make our bank irrelevant.”

“Are we going to be an innovative bank and spend the money to get there? Our board has to make those decisions. It used to be the cost of compliance, and now it’s the cost of technology that could make our bank irrelevant.”—Dianna Torman, Prairie Community Bank

Despite the challenges, community bankers believe that the industry will continue to play an integral role in bolstering communities and economic growth.

“We can’t worry about what others are doing,” Bailey says. “We need to pay attention, but if we do the simple blocking and tackling consistently day after day, we are going to succeed. That’s the secret sauce or recipe for success, I think: not losing the focus on your customers and paying attention to their needs.”

“We can’t worry about what others are doing. We need to pay attention, but if we do the simple blocking and tackling consistently day after day, we are going to succeed.”—Thomas Bailey, Brentwood Bank

“Come back next year,” Barrett says. “We’re a great company today, but we keep getting better, and I’m excited for us.”

Hustling to outsmart the competition

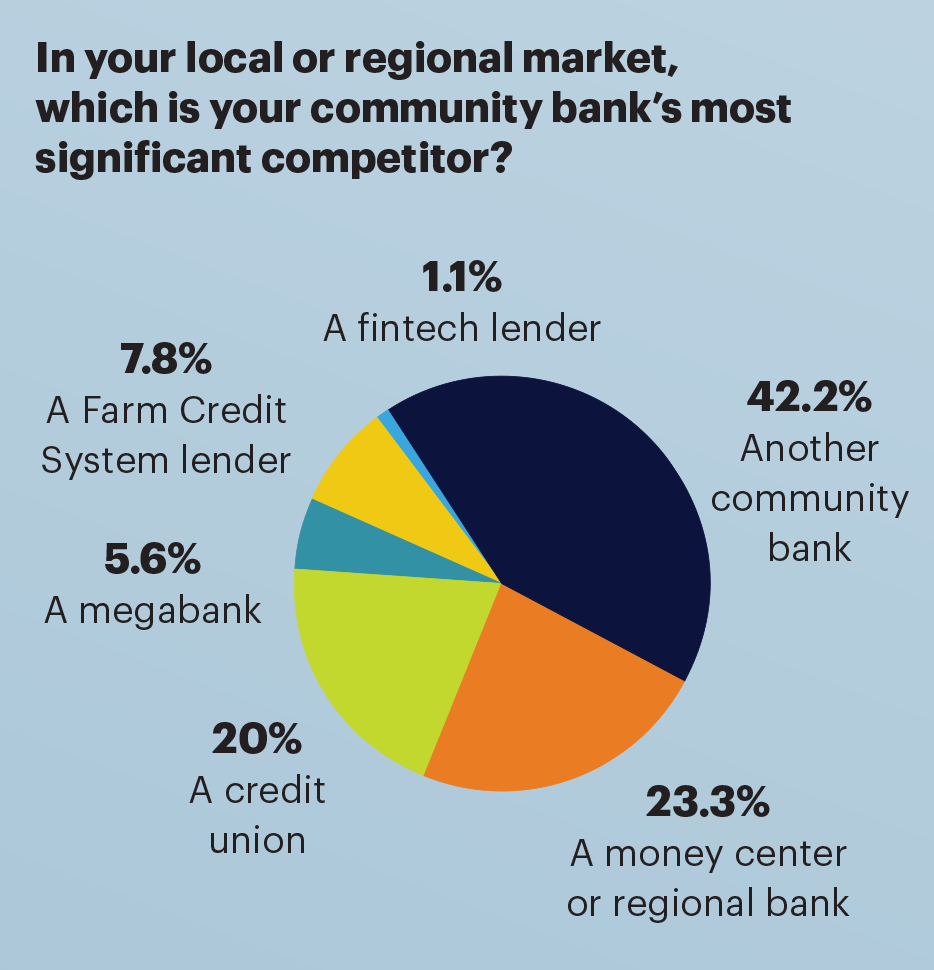

Community banking remains as competitive as ever, with other community banks reported to be respondents’ most significant competitors (42%, up from 37% in 2019). And CEOs are decreasingly worried about nonbank competition. Nearly 7% of CEOs say competition from nonbanks is a top concern, down from 14% in 2019.

“We have seen more new entrants into [commercial real estate] investment and real estate lending than ever before,” says president and CEO Jack Barrett of First Citrus Bank in Tampa, Fla. “We have out-of-state new entrants [and] out-of-market new entrants, and a large community bank in our market is now in the CRE lending space for the first time in over 30 years.”

Community banks’ long-term foe, credit unions, present the greatest competition for 20% of community banks, while Farm Credit System lenders are major players in 8% of community bank markets.

On a related note, 6% of respondents say remaining competitive and improving the customer experience is their number one goal for 2020.

From our sponsor

Before you establish growth targets, are you relevant to your next generation of customers?

Millennials are the largest generation to be born in the history of the United States—what products and services are you offering to attract the next generation? Digital offerings available on a mobile phone are a key driver, but perhaps the biggest driver of all is opportunity. A $30 trillion opportunity. Millennials are in line to inherit $30 trillion from their baby boomer parents. How they decide to bank this money—or not bank this money—will largely determine the success or failure of community banks. So, before you can target growth, a bigger question to ask yourself is, “how am I positioning my bank to be relevant and offer greater value compared to other choices in earning the next generation’s business?”

Keith Nolan, VP partner and alliance sales, FIS Payments