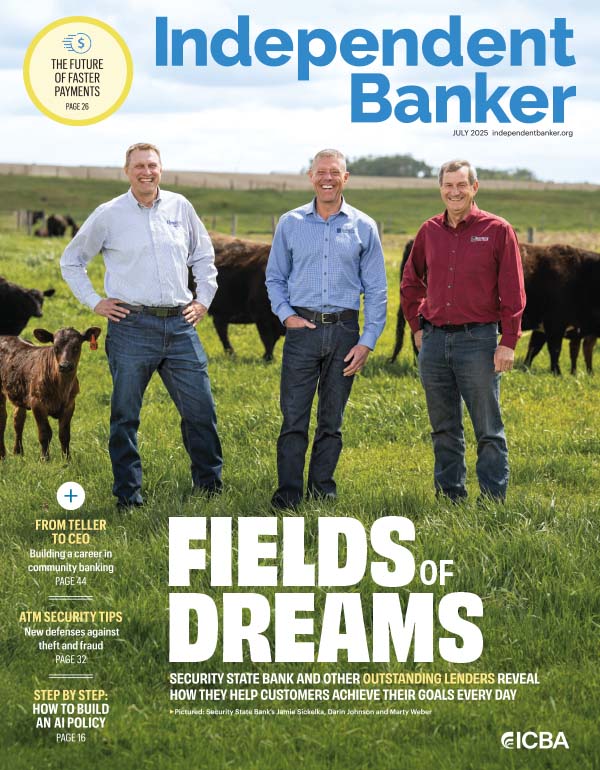

If your community bank scrapped its strategic plan at some point in the past year, you’re not alone. And the new year is still full of unknowns. Now, community bank CEOs are charting a path through these unclear conditions to overcome the challenges ahead and better prepare their banks for the future.

Will a COVID-19 vaccine return some stability to daily life? Will a new administration bring a shift in bank regulation and compliance? Will the economy begin to recover, allowing the Federal Reserve to increase interest rates and loosen interest margins compressed beyond recognition?

It’s a very different start to the year than in January 2020, when growing deposits was the biggest challenge on the horizon for a majority of community banks, according to last year’s Community Bank CEO Outlook survey.

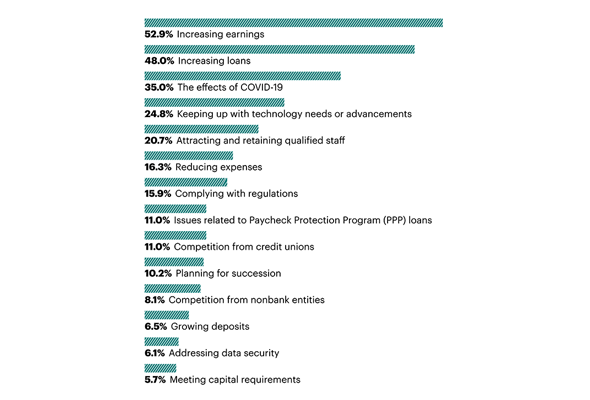

What will be your community bank’s greatest business challenge in 2021? (Respondents could select up to three)

Now, community banks are flush with deposits as Americans save for a rainy day and as Paycheck Protection Program (PPP) loans are forgiven. Just 6.5% of respondents say growing deposits is a top concern this year.

Instead, community banks are worried about profitability. While increasing earnings has always been important (cited as a top concern by a third of banks in 2020), it’s now a necessity, according to the 52.9% of chief executives who say it’s one of their three biggest challenges.

When it comes to goals, 20% of respondents say profitability or revenue growth is a top goal, 8% want to improve net interest margins, 4% want to maintain asset quality and 5% aim to improve efficiency or reduce expenses.

“Our biggest challenge is two things: the combination of the surge in liquidity and the very low interest rate,” says Greg Kistler, president and CEO of $1.1 billion-asset Central Bancshares Inc. in Muscatine, Iowa. With soft loan demand and low bond rates, the company’s two community banks—CBI Bank and Trust and F&M Bank—have few attractive options for deploying excess funds. “Net interest income is always the single largest component of revenue,” Kistler adds.

Bank of the West, a $600 million-asset community bank in Grapevine, Texas, has been seeing a steady stream of income from lending, yet vice chairman and corporate president Cynthia Blankenship isn’t expecting much growth in revenue.

“Our loan growth has been pretty flat. I think fee income will stay flat. I think just that everything will stay pretty flat,” she says, making an exception for small increases in small business lending, and a booming business in mortgage. “It’s hard to tell with this economy. If we can get a vaccine and things open up, small businesses will revive.”

“We’re doing everything we can in our communities to help support [Main Street] businesses and sustain cash flow for a little while. I just worry about how long this will continue.”—Cynthia Blankenship, Bank of the West

Flagship Bank: Focus on growth remains

After completing a core conversion in late 2020, Flagship Bank in Clearwater, Fla., is finally able to offer state-of-the-art treasury management services to the owner-managed businesses it serves. Treasury management is a popular offering among community banks looking to serve small business customers who aren’t coming into the branch nearly as often as they used to. It’s one more tool in the $300 million-asset community bank’s goal to grow by $100 million assets in 2020.

It’s a stretch goal, says CEO and vice chairman Bob McGivney, who, along with chair Paul Wikle, leads the team that bought the 14-year-old community bank a little over a year ago—but it’s not impossible. Flagship Bank has already doubled in size since it was bought in October 2019, and that’s leaving out the effect of Paycheck Protection Program (PPP) loans. It also added two offices, with plans for two more offices in 2021.

“The first hundred million was low-hanging fruit,” says McGivney, whose team is made up of local bankers with decades of experience in this market. “The business we want to acquire isn’t new business. We’re just going to get back what five community banks sold a few years ago.”’

“For all community banks, the question is: Do you have the discipline and all of the other attributes that you need? We’ll either prove it or we won’t. I think we will.”—Koger Propst, ANB Bank

The curveball of COVID-19

Blankenship is among the 35% of community bank CEO respondents who say one of their greatest business challenges is something that wasn’t even on their radar this time last year: the ongoing impact of COVID-19.

Blankenship wonders how long the small manufacturers, restaurants and other Main Street businesses that Bank of the West counts as customers will be able to hold on. The bank made 1,000 PPP loans, saving more than 10,000 jobs, but another shutdown could imperil those businesses. “We’re doing everything we can in our communities to help support those businesses and sustain cash flow for a little while,” she says. “I just worry about how long this will continue.”

That uncertainty for customers and communities, paired with the economic and political implications of COVID-19, has Koger Propst, president and CEO of $3.3 billion-asset ANB Bank in Denver, monitoring the situation carefully. The bank has been aggressive with PPP, deferrals and other tools to aid customers.

“I’ve been in banking 37 years, and this is definitely the most uncertain environment I feel I’ve ever been in,” Propst says. “What we’ve done to prepare for that, even though we haven’t seen an increase in problem loans, is to significantly raise loan-loss provision expenses, provide flexibility to borrowers, loan deferrals, waiving floor rates, and other actions, just to be conservative.”

“We’ve encouraged supervisors to do special things for employees like award a spot bonus if someone is doing exceptional work. We’re encouraging people to be creative in the branch.”—Pete Johnson, Opportunity Bank of Montana

At $1.2 billion-asset Opportunity Bank of Montana in Helena, Mont., staffing and protecting employees will continue to be the bank’s greatest challenge heading into 2021. With 22 locations across the state and more than 350 employees, the bank has worked to reduce fatigue and keep morale high while utilizing a rotational schedule with two separate teams to limit exposure.

“We’ve encouraged supervisors to do special things for employees like award a spot bonus if someone is doing exceptional work,” says president and CEO Pete Johnson. “We’re encouraging people to be creative in the branch.

Opportunity Bank of Montana is not the only community bank that’s trying to build a better work environment. Roughly one in five CEOs say attracting and retaining qualified staff is among their bank’s greatest challenges.

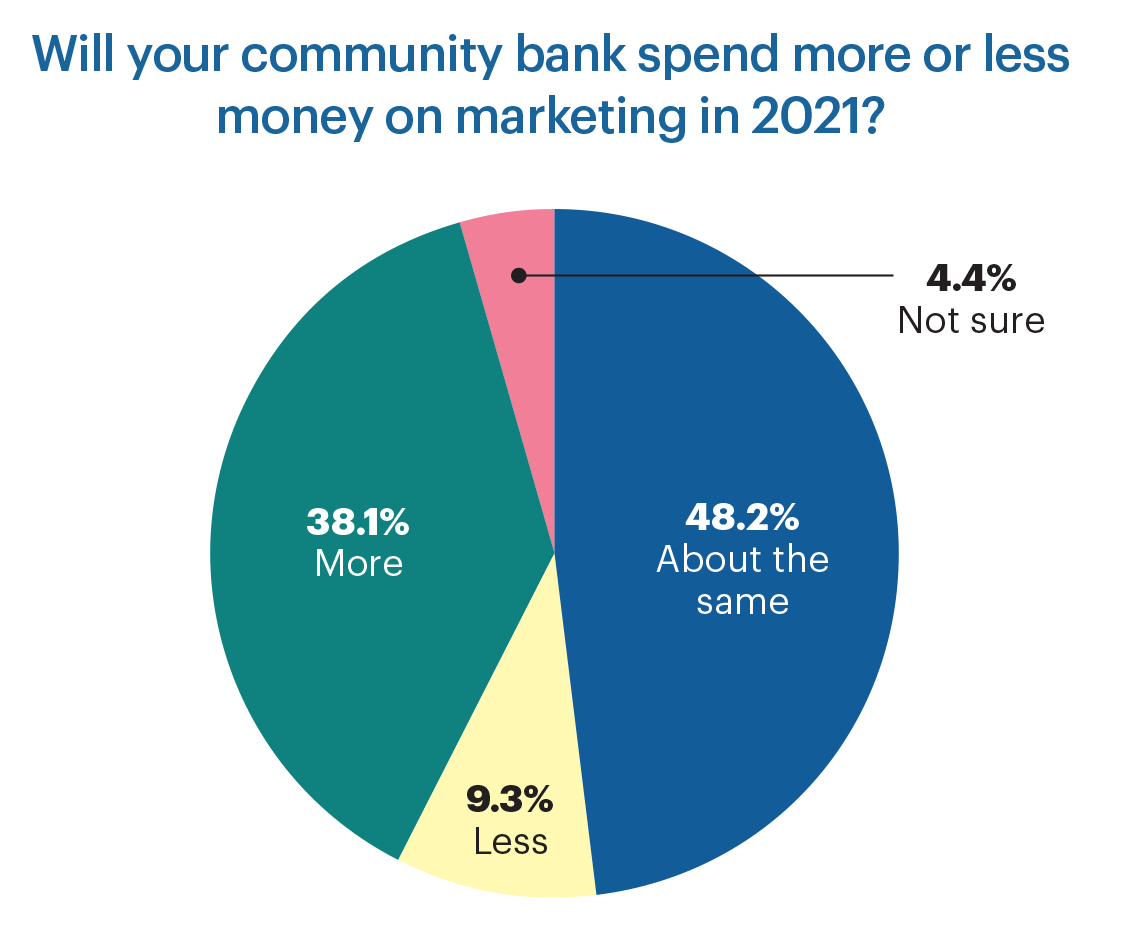

Boosting marketing budgets

When it comes to marketing, slightly fewer community bank CEOs plan to boost their 2021 spending compared with 2020. Almost half of CEO respondents (48%) say they will spend about the same on marketing as last year, up from 41% last year. But 9% say they will spend less—almost double the amount in 2020.

Those that plan to spend more plan to spend substantially more. The median community bank respondent plans to increase spending by 10%, and the average is 30%. Just 7% plan to run a new marketing campaign.

For the second year in a row, two-thirds of bankers plan to allocate more time and dollars to digital marketing. The median CEO says they will allocate 15% more.

Bank of the West is one such bank that plans to spend more on marketing. When adjusting to a more remote environment this year, the community bank wasn’t fully utilizing the digital products it owned. Now, it plans to dedicate resources to educating customers on the ease of digital banking and the increase in the bank’s digital footprint.

“Community bankers get complacent sometimes and assume customers know all the products and services they can deliver,” says Cynthia Blankenship, vice chairman and corporate president of Bank of the West. “Only until we went through this pandemic, and customers were forced to move to those products and really look at what we have available, was there any widespread awareness.”

Eyeing future loan growth

With a bounty of deposits, community bank CEOs are even more focused on loan growth than the past two years. Nearly half (48%) of CEOs say increasing loans will be among their greatest challenges in 2021—up from 33% in 2020. It’s also the top goal of 14% of community bank CEOs.

Not everyone is optimistic that growth is likely. “I don’t see any meaningful growth in loan revenue; however, we are starting to see good customers wandering away from competitors who are experiencing change,” Propst says. “I think there will be continued weakening of net interest margins.”

While Propst expects to gain some income when the bank reinstates fees it waived for customers when the pandemic began, he doesn’t expect them to have a dramatic impact.

“I hate to say this, but for as long as I’ve been in banking, we’ve been asking, ‘How do we diversify revenue away from NIM and increase fee-based revenue?’” he says. “The reality of it is, unless you get into low-rate environments like now, with banks selling into the secondary market of mortgages where you have just a massive stream of income coming in, we are who we are. We rely on net interest margins and the idea of meaningfully increasing fee income is just playing on the margins.”

Others are more hopeful. Opportunity Bank of Montana has a good pipeline of commercial real estate and commercial lending, and Johnson anticipates “decent” growth. While lending activity slowed when the pandemic first hit, Montana’s economy has been resilient, and there is pent-up loan demand, Johnson says. Some of the community bank’s markets are seeing strong growth, especially as city dwellers continue to move out West, he adds.

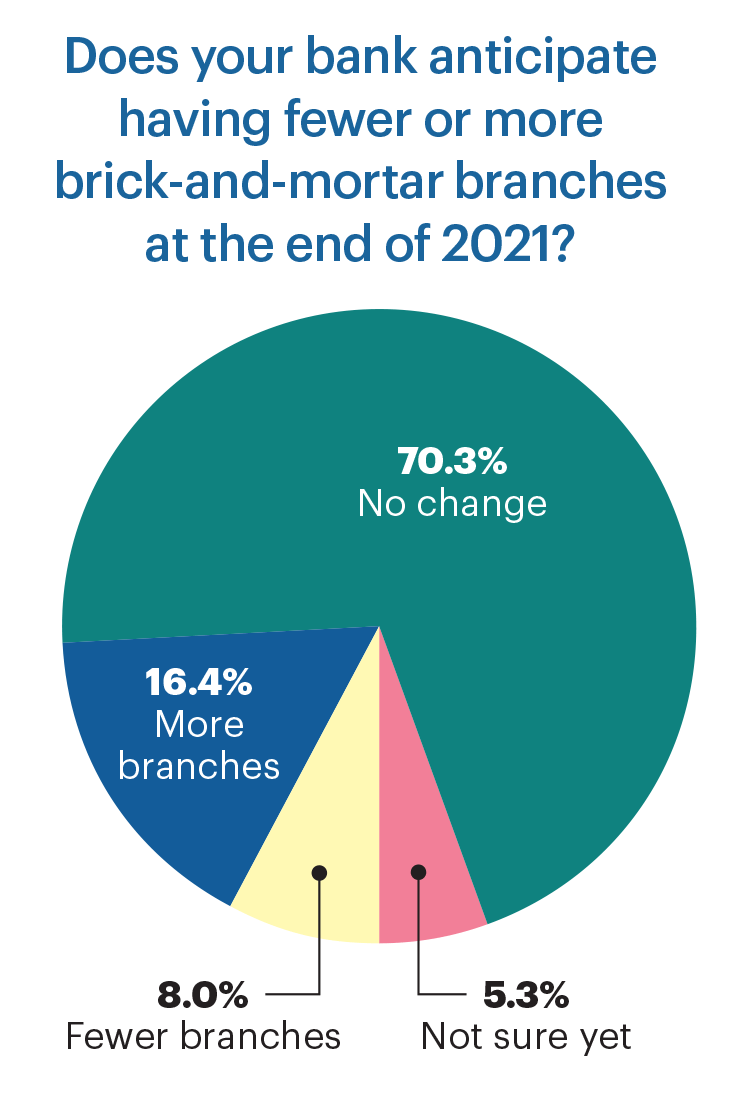

Flagship Bank in Clearwater, Fla., plans to grow relationship deposits and loans by expanding into new markets and “reintroducing community banking” to potential customers, making it among the 16.4% of community banks that expect to have more brick-and-mortar branches by the end of 2021. The vast majority—70%—expect no change in their network.

“For every market we go into, we hire our team first and then we worry about real estate,” says Bob McGivney, CEO and vice chairman of the $300 million-asset community bank. “It’s the antithesis of ‘build it and they will come.’ That doesn’t happen. If you don’t have relationships, you won’t grow in that market.”

“For every market we go into, we hire our team first and then we worry about real estate. It’s the antithesis of ‘build it and they will come.’ That doesn’t happen. If you don’t have relationships, you won’t grow in that market.”—Bob McGivney, Flagship Bank

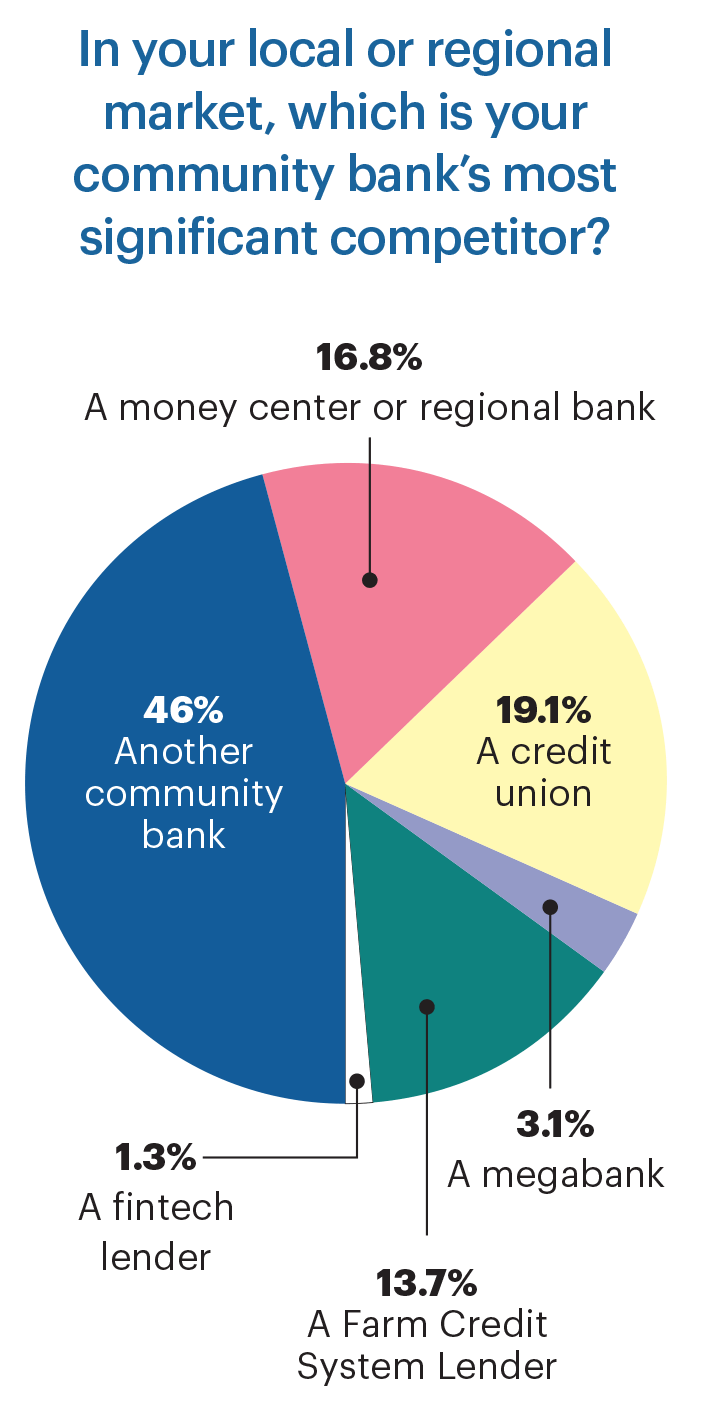

Competition remains varied among community banks. While most competition comes from noncommunity banks, 46% of executives say other community banks remain their most significant competition. Meanwhile, 16.8% pointed to money centers or regional banks, down from 23.3% in 2020. One in five report a credit union is the biggest competitor in their market.

The Farm Credit System has always competed with Central Bancshares Inc.’s two banks, says Kistler, but it has been especially aggressive over the past six months. He’s not the only one who has noticed a change. A Farm Credit System Lender is the main competitor of 13.7% of community banks—up from 7.8% in 2020.

Eyes on tech upgrades

While nearly 40% of community bank executives said keeping up with technology needs or advancements was a top business challenge in 2020, only a quarter are prioritizing technology in 2021. Just 4% say technology is their top business goal.

Many bankers interviewed say that’s because they’ve already invested in new core systems and upgraded digital offerings. When technology is brought up, it’s most often in the context of ensuring stronger banking relationships in a socially distant world—including online loan applications and account opening and treasury management services.

“For treasury management, people are really watching how funds are being spent, managing liquidity and being mindful of the amount of leverage they have in companies,” says vice chairman and corporate president Cynthia Blankenship of Grapevine, Texas-based Bank of the West, which is looking at treasury management software packages. “We’re trying to really be a partner with those small businesses and help them more in the money management area.”

Central Bancshares Inc. in Muscatine, Iowa, revamped its treasury management offering in 2020 but put its rollout on hold when COVID-19 hit, since it wasn’t possible to go out and call on customers as planned. “We’re hoping we’re able to get to rolling out that new treasury offering [in 2021] and have a better revenue stream for us,” says Greg Kistler, the holding company’s president and CEO, who is also eyeing online account opening.

Opportunity Bank of Montana in Helena, Mont., is planning to gradually begin replacing automated teller machines with interactive teller machines in 2021. It’s also planning to invest in customer relationship management (CRM) software to better track interactions with customers.

“As we’ve gotten bigger, it’s more important to track that interaction in a better way,” says president and CEO Pete Johnson.

Another area that’s grown bigger: fraud. The pandemic has widely increased the scale of fraud. Koger Propst, president and CEO of ANB Bank in Denver, has been investing in his bank’s core processes around fraud for years and will continue to do so.

“We’ve been fortunate we’ve done well in that area,” he says, “but we have to keep allocating resources.”

Mortgage lending remains strong

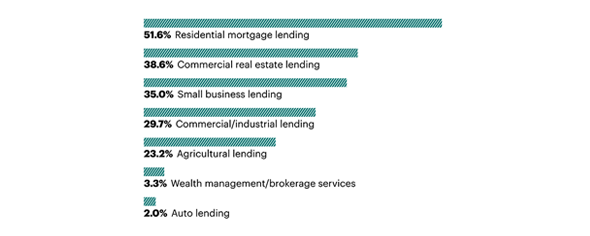

As in years past, residential mortgage lending is expected to drive profitability in 2021. About half of respondents (51.6%) say it’s among the top two anticipated revenue streams next year—up from 47.5% in 2020.

The Bank of the West saw mortgage activity more than triple in 2020, with many customers seeking cash-out refinances to build cash reserves or pay off other debt, Blankenship says. “The only increase in profitability will be in the mortgage area, with maybe some small increase in small business lending,” she adds.

Kistler believes 2020’s boon in mortgage income won’t continue at the same rate in 2021. “We’re assuming for next year the refinance activity will be half of what it is this year,” he says. “We hope that purchase activity stays level.”

Which of these revenue streams is most likely to drive your community bank’s profitability in 2021? (Respondents could select up to three)

Budgeting for increasing compliance costs

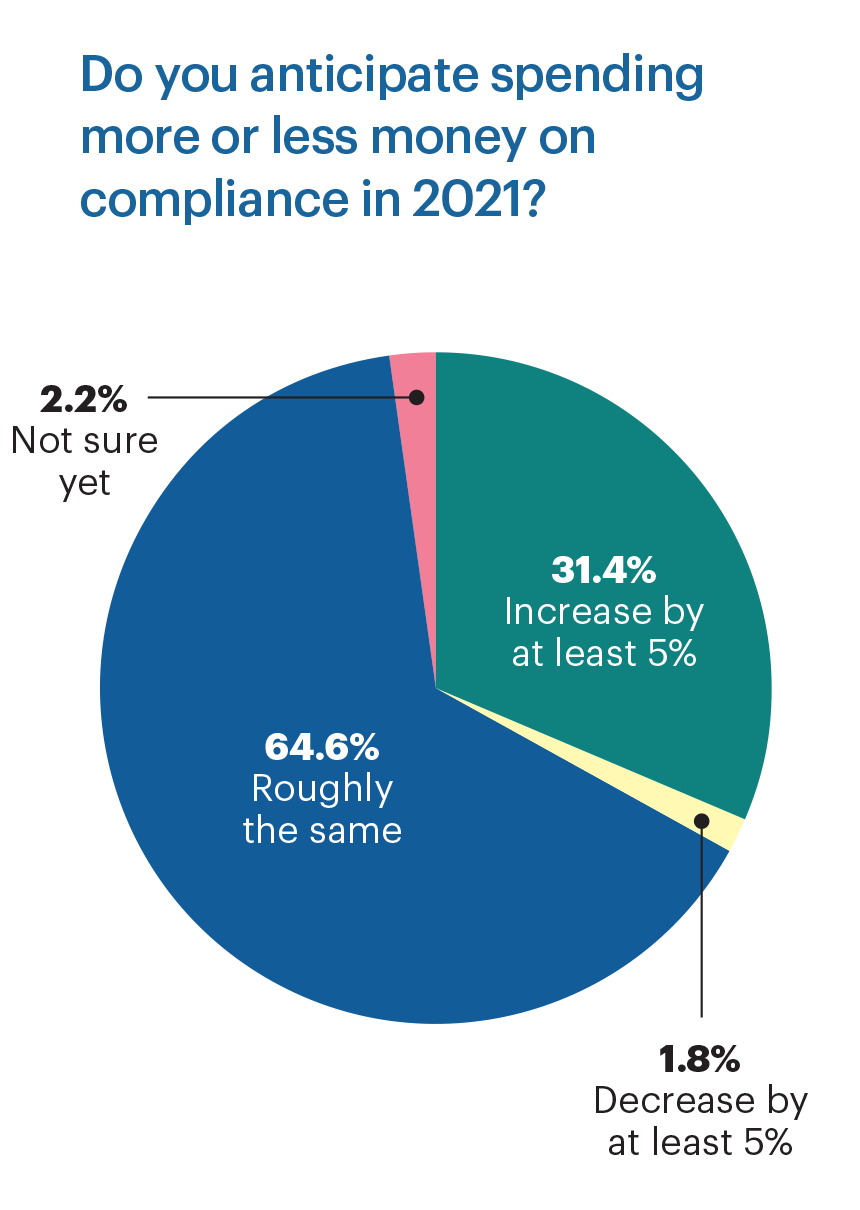

ANB Bank in Denver has a robust and appropriate compliance program and a good compliance culture, but it’s not something president and CEO Koger Propst takes for granted. He says compliance is fragile by nature, and the bank will have to maintain its level of investment to ensure its continued success.

That sentiment is a theme among community bank CEO respondents to our survey, with 64.6% anticipating spending roughly the same amount on compliance in 2021 as they did in 2020. Another third expect compliance spending to increase by at least 5%. Just 1.7% expect compliance costs to decrease by 5% or more. These figures are almost identical to 2020’s survey findings.

Bank of the West in Grapevine, Texas, will be transitioning to a more efficient platform and hiring more staff.

“With any process or pandemic, you really want to make sure you’re crossing your t’s and dotting your i’s,” says Cynthia Blankenship, vice chairman and corporate president. “Traditionally, we’ve had really good ratings, but that’s something we don’t want to let slip through the cracks.”

The silver lining

Though many community bankers expect 2021 to be a challenging year full of unknowns, many plan to continue business as usual as best they can.

Central Bancshares Inc. completed an acquisition at the end of 2019 and merged the new bank into one of its existing banks in June 2020. Kistler says his two community banks’ most important goal will be smooth operations.

“Our most important goal in the short run for next year is to make sure that we’ve adequately integrated both those employees and customers and that we’re effectively servicing them,” he says.

Propst of ANB Bank feels ready for the year ahead. He believes his community bank has the fundamentals it needs to succeed. “2021 will bring a different set of challenges … We may foresee some, but a lot will be different,” he says. “For our bank, for all community banks, the question is: Do you have the discipline and all of the other attributes that you need? We’ll either prove it or we won’t. I think we will.”

From our sponsor

How is your organization handling the ecommerce boom?

COVID-19 has caused the world to adapt to a new, unprecedented normal. This includes how your customers want to interact with their financial institutions as well as how they want to shop. According to the 2020 “Generation Pay” Report, 58% of consumers are spending more money online than ever before. How is your financial institution adjusting to meet these new needs of the consumer? Are you providing contactless payment options that can be used at any store? Can your consumer’s card be integrated with Apple Pay, Samsung Pay, etc., to allow quick and frictionless online shopping?

Meeting customers where they are means expanding your digital presence, creating engaging loyalty experiences and educating consumers on the benefits. That’s a tall task at any time, but it’s one that financial institutions of all sizes must strive for, to provide essential services to your customers.

Mike Kresse, Senior Vice President, Head of Card and Money Movement, FIS