» LESS THAN $250 MILLION

Key Community Bank: Leading by example

By Roshan McArthur

At the heart of Key Community Bank’s work culture is connection. The leaders of the Inver Grove Heights, Minn., community bank encourage communication and learning, instilling a sense of camaraderie among their small team.

The $80 million-asset community bank has one branch and 13 employees. Within that tightly knit group, there’s the bank’s leadership team, comprising president and CEO Greg Dennis, chief lending officer Jon Girard, vice president of operations and compliance Kristine Hendrickson, and executive vice president and chief financial officer Michele Boeder. Dennis says the four leaders function as a unit to make sure Key Community Bank’s culture is open and encouraging.

We’re in a position where we can make people work to their strengths. It’s our job as management to put a team together so that the strengths are complemented.—Greg Dennis, Key Community Bank

“We have the simplest of simple mission statements that I think tries to encompass what our culture is,” he says. “Our mission is, ‘Making life better.’ And that’s for our employees and customers—everybody that we work with. We try to live that with our employees every day, and we all interact with all of our employees every day, so that’s where it begins.”

Keeping up communication

The leadership team has an open-door policy and hosts weekly meetings for all employees where each person is encouraged to speak up about what they are working on and voice any concerns they may have. Keeping the lines of communication open has allowed the community bank to foster mentoring relationships, empower all staff to make decisions and guide employees to positions that work best for them.

Dennis admits that the bank’s size makes achieving those goals easier. “We don’t have to have specific job descriptions to try to fit people into,” he says. “We’re in a position where we can make people work to their strengths. It’s our job as management to put a team together so that the strengths are complemented by people who may have different strengths. People appreciate when somebody else is better at something than they are, but they’re also appreciated for what they bring.”

This flexibility helped Key Community Bank through the early stages of the pandemic, especially when it came to the Paycheck Protection Program (PPP). “We just figured it out on the fly, as did everybody,” Dennis says, “but I think we did a great job together. It was just a matter of everybody pitching in, and that’s part of the culture of everybody trying to support each other and help each other do what needs to be done.”

And when there are successes like that, the community bank celebrates them. Sometimes that takes the form of gift cards for staff who catch a fraudulent check or go above and beyond job expectations.

“We try to recognize really good things that our employees do so that they feel valued, because some of those things are out of the ordinary and they should be recognized that way,” Hendrickson says.

Even on the most typical of work days, Boeder says, Key Community Bank’s culture shines through.

“It’s the hundreds of little decisions and little interactions that we have every day with our staff,” she says. “We try to be purposeful about them and have those interactions be part of growing and being positive, [such as] giving somebody an opportunity to try something or listening to an idea. Those hundreds of little things are what our culture is.”

Be willing to do any job

As a small organization, the team at Key Community Bank has learned to be flexible. So, when it hires new team members, the community bank looks for people willing to try new things.

Executive vice president and chief financial officer Michele Boeder says the leadership team sets the example they want to see. “We are all willing to do any job as leaders,” she adds. “If that means answering phones, making coffee, vacuuming the floor, whatever it is that needs to get done, we’re probably going to do it first rather than ask someone else to do it.”

That way, instead of telling people what to do, they’re showing them. “We’ve got to have done it before in order to train somebody else how to do it,” says president and CEO Greg Dennis.

» $250 MILLION TO $499 MILLION

First Federal Savings & Loan: Where careers are made

By William Atkinson

First Federal Savings & Loan has been in business since 1955, focusing on mortgage lending and deposit accounts for the Gulf Coast. In addition to its main office, the $325 million-asset community bank in Pascagoula, Miss., has five branch offices serving southern Mississippi.

As a community development financial institution (CDFI), the bank has a special focus on supporting economic development in economically disadvantaged local communities.

The value we put in our long-term employee relationships automatically breeds a positive work environment for them to share that legacy with our customers.—Alan Renfroe, First Federal Savings & Loan

It does good work for its employees, too: The bank was named a Best Place to Work in Mississippi by the Mississippi Business Journal every year since 2016. Now, ICBA has named it one of 2021’s Best Community Banks to Work For.

There are plenty of reasons for this. “We truly believe that First Federal is a great place to work,” says president and CEO Alan Renfroe. “Our low employee turnover, tenure of our staff and ability to attract employees from other institutions all attest to that. Our employees are trusted to know their responsibilities and are allowed to work with the support of management.”

The community bank’s “sense of purpose” is to provide its legacy of service to the communities it serves with the deposit and loan products they need. “It’s our highly personal and courteous service that sets us apart,” Renfroe says. “The value we put in our long-term employee relationships automatically breeds a positive work environment for them to share that legacy with our customers.”

Growing long-term careers

So, how does First Federal Savings & Loan prepare its employees for success?

“We offer one-on-one training for new hires and in-person educational updates as needed,” says Jennifer M. Garlich, vice president and director of marketing. “Management also encourages employees to participate in webinars to increase job awareness and learn new procedures.”

The community bank recommends employees attend conferences to network with other bankers and discover new ideas, she adds. It’s part of the community bank’s conscious effort to give staff opportunities to advance within the organization. In fact, Garlich says, most members of management began their careers as tellers, loan processors, collection officers or bookkeepers at the bank.

“By applying their knowledge and good work ethic, individuals are rewarded with positions of increased responsibility and benefits,” she adds.

Engaging employees

At First Federal Savings & Loan, leaders know that keeping employees engaged is critical to their satisfaction. The community bank keeps up a dialogue with staff that goes both ways. For example, the bank publishes an employee newsletter called FirstWithYou that keeps everyone updated on the bank’s products and services, as well as personal milestones. “Some of the best input we receive comes from participating in employee surveys, like the one related to us winning this award,” Renfroe says.

The community bank’s friendly work environment is also a key component to keeping workers satisfied. “We have casual days where employees can dress down, football Fridays … and many paid lunches throughout the year,” Renfroe says. “We also celebrate holidays and milestones like birthdays and anniversaries with food and fellowship.”

Keep staff satisfied with benefits

Leaders at First Federal Savings & Loan believe offering a comprehensive benefits package not only attracts good employees but also keeps existing employees satisfied.

The community bank provides first-class healthcare and retirement benefits, including paying employee premiums for health, dental, vision and long-term disability insurance. It also offers 50% paid premiums for these benefits for employee dependents. “We also offer a 401(k), up to 40 days of paid annual leave and an annual bonus,” says Jennifer M. Garlich, vice president and director of marketing.

Another benefit is supporting the civic and social organizations that are important to its employees. “For example, we sponsor charity golf tournaments, Little League teams and events that our employees are personally invested in,” Garlich says. “We also host family-friendly events like Mardi Gras parade cookouts, anniversaries and holiday parties.”

» $500 MILLION TO $749 MILLION

Mauch Chunk Trust Company: Creating value for all

By Katie Kuehner-Hebert

Mauch Chunk Trust Company is an empowering place to work, say employees of the $610 million-asset community bank in Jim Thorpe, Pa.

“I polled my branch managers and assistant managers about what it’s like for them to work here, and the words that kept coming up are teamwork, camaraderie [and] employee recognition. They really feel valued here,” says Louise Jenkins, Mauch Chunk’s customer banking manager.

Moreover, the bank’s workplace culture is customer-focused and family-oriented from the top down. All the department chiefs know everyone by name, and they are fully engaged with the employees, Jenkins says.

“[President and] CEO Pat Reilly will often drill down to every employee in every department, asking them how they are doing, whether the bank is doing well by them as an employer, how the bank is doing well by our customers and what could we do better,” she says. “He allows everyone to give input in the process, and that’s really nice.”

During the pandemic shutdowns, Mauch Chunk Trust gave employees a paid day off in addition to their regular time off on weekends “to give people time to decompress” while lobbies were closed, Jenkins says. The bank provided lunch once a week, too.

“[Leadership] really cared for people while we followed the mandates from our governor,” she says. “For the bank, it was really all about how our people felt through all of this.”

Make employees want to come to work

Leaders at Mauch Chunk Trust say they take their role to empower and influence employees seriously. “We try to create an atmosphere for them to succeed, whether it’s with the right training or the right equipment,” Reilly says, adding that improved communication systems can also make a substantial impact. “None of that is static; you have to get better all the time.”

The community bank has a competitive benefits package, including a health care plan with shared contributions, paid time off and an employee stock ownership plan (ESOP), Reilly says. “We need a good benefits package to attract good people, but what really makes a difference is providing them with opportunities to learn and grow and to create an atmosphere that makes people want to come to work,” he adds.

One perk for all employees is that they get a paid day off on their birthday, Jenkins says. That came about when Reilly was meeting with employees and “taking a pulse on how it was going for them.”

“One employee said that it would be great if we could have our birthdays off and he said, ‘Done,’” Jenkins says. “That’s one of the benefits of working for a small community bank. When you say something, people actually listen to you so they can make happy employees.”

Making lives better

While taking care of stakeholders is important, Reilly and the bank’s management team have tried to emphasize “a balanced approach” by putting customers first, which has translated into a purposeful mission that employees embrace.

“Yes, we’re in the business to make money, but I say that you have to earn money; you’re not entitled to it,” he says. “That means you’ve got to give good value to your customers, and everything has to start there. We try to drive that point home with our staff. Make the customer successful and then the bank will be successful, and we’ll share in that success.”

You want to create an atmosphere where everybody feels like we’re all on the same side. We’re not wanting to get one over on the customer. We’re trying to make their lives better.—Pat Reilly, Mauch Chunk Trust Company

That also significantly enhances the community bank’s workplace culture, as most employees identify with customers just as they do with the organization, Reilly says.

“You want to create an atmosphere where everybody feels like we’re all on the same side. We’re not wanting to get one over on the customer,” he says. “We’re trying to make their lives better.”

Happy employees drive results

Bank employees should enjoy coming to work. “I hate to see people miserable, so we try to create a pleasant atmosphere, and I think that goes a long way,” says CEO and president Pat Reilly.

Louise Jenkins, Mauch Chunk Trust Company’s customer banking manager, has one recommendation for other community banks to create a more fulfilling workplace: “Listen; really, truly listen.”

“The frontline people are the ones who engage with your customers,” she says. “In the end, happy employees equal happy customers. That’s what I focus on.”

» BETWEEN $750 million AND $999 MILLION

Community National Bank & Trust of Texas: Listening pays dividends

By Ed Avis

When employees at Community National Bank & Trust of Texas think they have a better way to do something, management listens. In fact, the $968 million-asset community bank in Corsicana, Texas, has two employee committees, the Operations Advisory and the Focus Forward Group, that consider new ideas.

“The Operations Advisory includes representatives from every location and the [chief operating officer],” says CEO Rusty Hitt. “It’s a work group where they talk about processes, pain points and products. And the Focus Forward Group is where we try to get perspective of the younger demographic and add some new products as a result of that.”

The respect that the community bank’s leaders show for employees’ suggestions is just one reason Community National Bank & Trust of Texas was selected as a 2021 Best Community Bank to Work For. Other key reasons are its generous benefits package and healthy work-life balance.

“The bank treats everyone as if they are all very important,” says Michelle Fonseca, a cultural ambassador at the bank. “They show it in the little things, like Rusty going around and asking someone who has been out for a couple of days, ‘How are you feeling? Are you feeling better?’ Those are the little things that make me never have to say, ‘Am I in the right place?’ Because I’m über in love with this organization.”

Employee ideas that pay

Hitt says the ideas generated by the Focus Forward Group have been essential to the community bank’s growth in the digital era. For example, the committee initiated both an online account opening process and the bank’s rewards debit card. During the pandemic, the group’s suggestion to develop an online document-signing process paid off, since the lobby space had a limit on customers.

“We did over 2,000 PPP [Paycheck Protection Program] loans, and it would’ve been much more difficult to do that without DocuSign,” Hitt says.

Generous benefits package

Community National Bank & Trust of Texas’ 187 employees also enjoy a healthy benefits package, including no-cost health insurance and a match of employee contributions to their 401(k) up to 5% of their salary. Another key benefit is a profit-sharing plan that pays the same percentage to every employee, from tellers to executives.

“We discuss the plan in a meeting every month, not just how we are doing, but how each employee can impact the bottom line,” Hitt says. “So, whether they are income generators or can save on expenses, they all understand the impact they can have.”

There is only one single month that we don’t recognize someone who has been here for over 20 years. For me, that speaks volumes.—Michelle Fonseca, Community National Bank & Trust of Texas

An innovative team-building benefit is the All Star Program, in which employees are allotted one $50 gift card per quarter that they can give to a fellow employee who does something special beyond their normal duties. For example, several employees gave their $50 gift cards to a maintenance worker who helped a customer whose car had stalled in the drive-thru.

These generous benefits foster loyalty. “There is only one single month that we don’t recognize someone who has been here for over 20 years,” Fonseca says. “For me, that speaks volumes.”

A family feeling

Community National Bank & Trust of Texas’s family-first culture helps employees maintain a work-life balance. Michelle Fonseca, cultural ambassador, recalls joining the community bank and telling Misty Louthan, the bank’s senior vice president of human resources, that she was going to miss an event at her daughter’s school due to work.

“[Louthan] matter-of-factly told me, ‘You have to make time to tend to your family. We will always be here,’ Fonseca says. “And she was right. The bank has an understanding that there is a life outside of here.”

CEO Rusty Hitt agrees. “Part of our culture is that sometimes the bank might require more of your time, but other times not, and if it doesn’t, you don’t need to be here,” he says. “If it’s 3:30 and nothing is going on, go check on your kids.”

» $1 BILLION OR MORE

First State Bank: Where people are the most important asset

By Kelly Pike

Patrick Schully held his breath when he opened an email to all employees from First State Bank’s CEO in May 2008. Gas prices were at a record high, the economy was fumbling toward a financial crisis and he had only been at the community bank for two months. He feared the worst.

He needn’t have. Instead of layoffs or reductions, the board announced it was providing all employees with a “summer fun package”: $150 a month for four months. “You are our most valuable assets, and we hope to make summer a little brighter for all of you,” read the email, which Schully still has.

“It really sank in then how special this place is and how they value their employees,” says Schully, executive vice president and chief technology officer at the $1.5 billion-asset bank in Gainesville, Texas.

Treating employees as family is part of First State Bank’s mission statement. “There are a lot of companies that talk about work and family values, but not many really live it,” says CEO Ryan Morris, a fifth-generation community banker at the 116-year-old, family-owned bank. “We’re a family of bankers, and we really do treat our employees as family.”

First State Bank brings in a consultant for personality profiling, a process that helps employees understand their strengths and weaknesses, as well as how they can better work with colleagues who think differently.

“Just like any other family, we may not agree with everyone, but we have to find a way to get along,” Morris says.

Take care of community

When the pandemic-related shutdowns began in March 2020, First State Bank hatched a plan to help employees and struggling local restaurants. For three months, the community bank ordered lunch from local restaurants for all its nearly 300 employees every day. When implementing the Paycheck Protection Program (PPP) required long hours, the bank expanded the restaurant program to include breakfast and dinner for affected employees. All told, First State Bank bought close to 5,000 restaurant meals.

“We wanted to support our most hard-hit clients and keep staff safe and happy when they were putting in tough hours while dealing with fear and concern,” Morris says. Feeding people comes naturally to Morris, an accomplished grill master who often brings out the community bank’s smoker for events, he adds.

First State Bank comes together to recognize achievements. Each year, the bank hosts a service awards party to honor long-tenured employees and those who have gone above and beyond. The bank’s top honor, which is so exclusive it isn’t awarded every year, is the highly coveted Gold Pin.

Being able to take care of a community and our customers and our employees is a tremendous honor and responsibility.—Ryan Morris, First State Bank

First State Bank also offers a competitive compensation and benefits package, including a formal program where employees can earn recognition and paid time off for volunteering with nonprofits. Because of benefits like this, many employees have been with the bank 10, 20 or even 40 years.

“Being able to take care of a community and our customers and our employees is a tremendous honor and responsibility,” Morris says.

Invest in employee success

First State Bank dedicates a significant chunk of its budget to employee training, from banking school and certifications to leadership training programs. “We want everyone in the bank to reach their full potential,” says CEO Ryan Morris. “We recognize the value in helping people grow their careers.”

Brad Cox, a business development officer, has participated in three or four professional development programs since he started at the community bank a year ago.

“A lot of corporations and other jobs I’ve had really focused on productivity, where the thought of taking that much time for personal and professional development would be perceived as that the whole day should have been [spent] doing something more productive,” Cox says. “But it’s certainly paid off for me, and I think [the bank] will get their money out of it.”

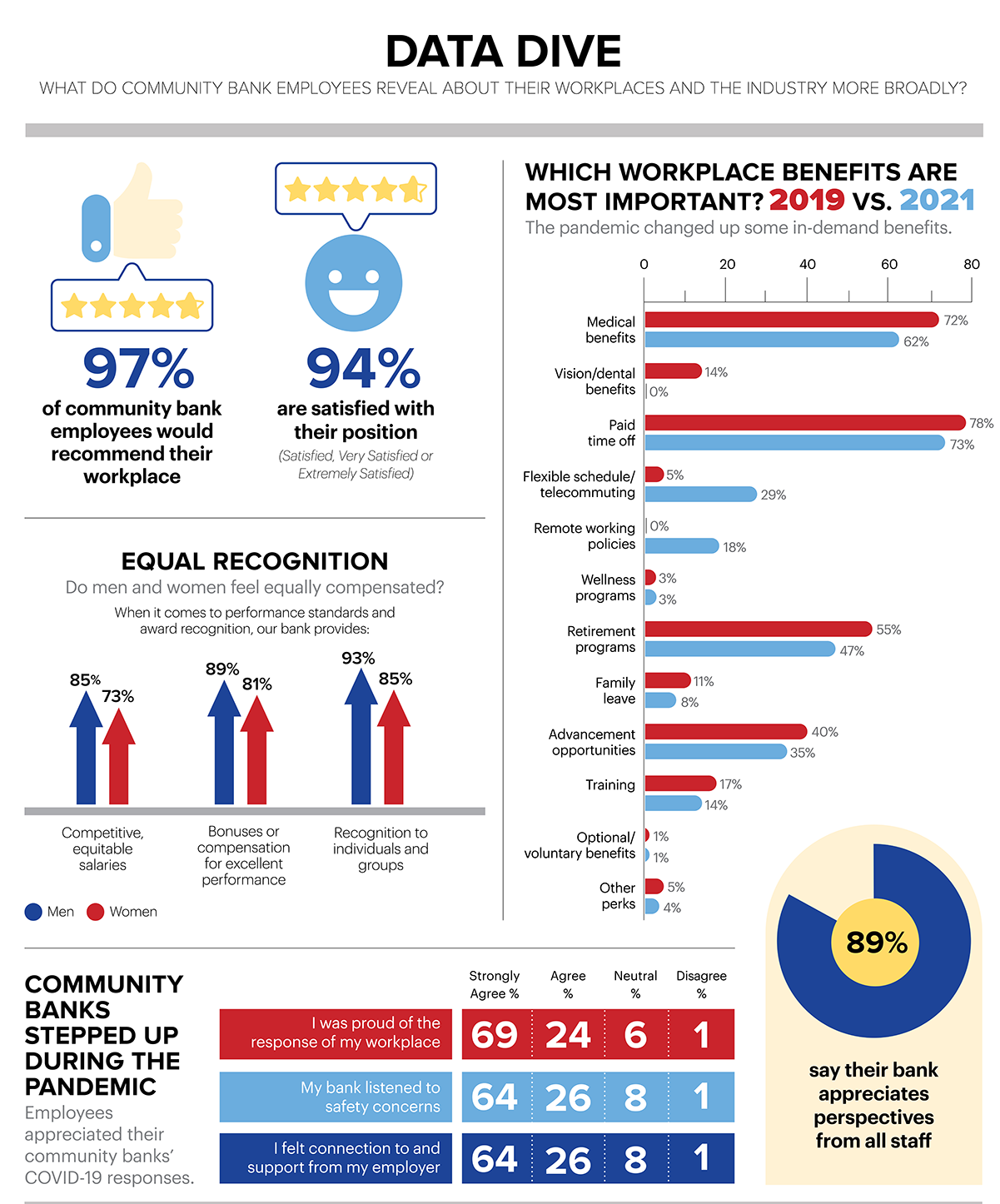

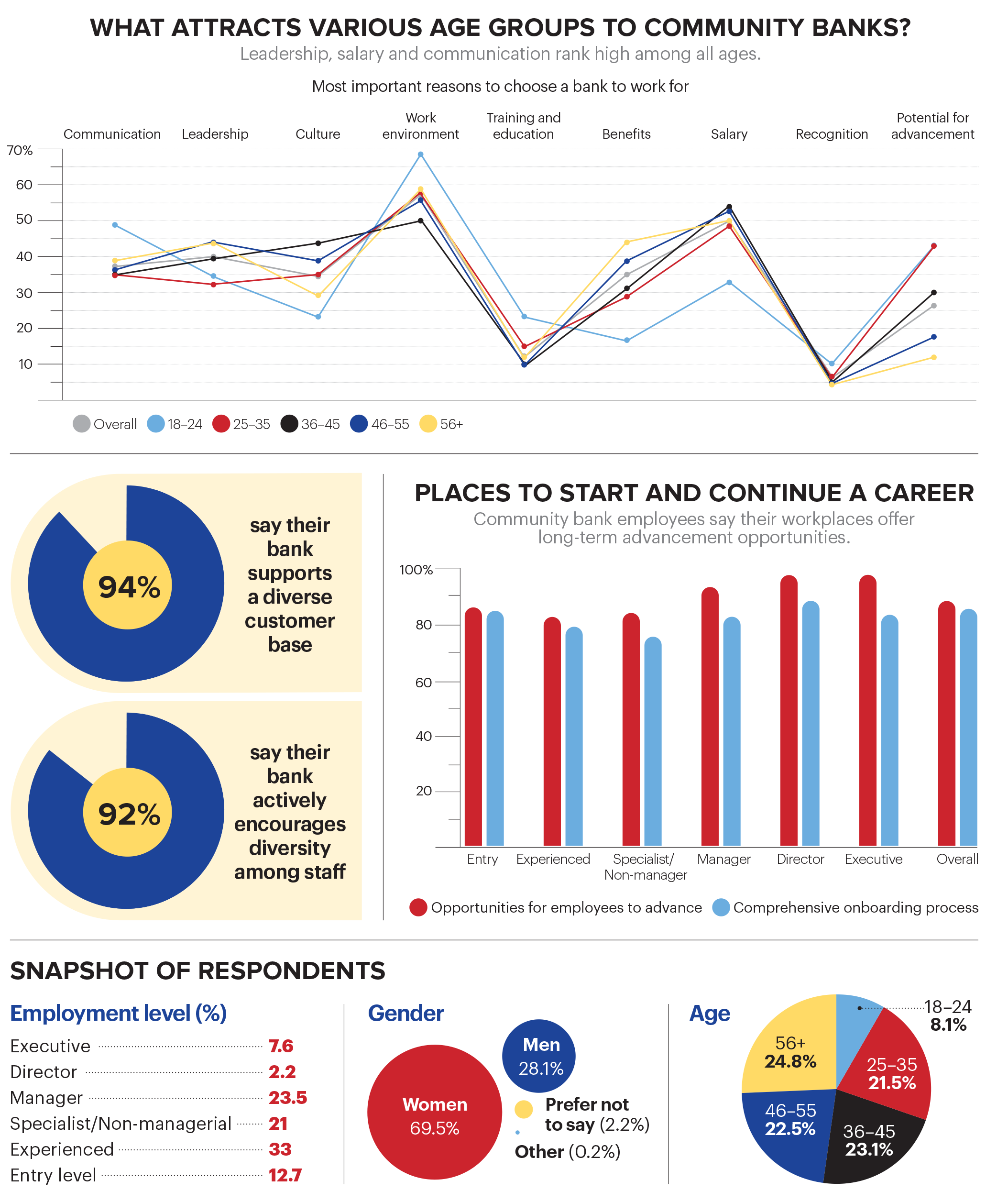

Methodology

Each self-nominated community bank’s full-time employees were asked to complete a workplace survey hosted by Avannis, an independent research agency. Access to the survey was protected by a PIN unique to each bank. Only community banks that met a minimum of 40% employee participation were eligible for recognition. The survey consisted of 48 scaled responses where positive responses earned the most points. For example, a bank whose employees selected only the most positive responses would achieve an index score of 100%. Eligible banks were then sorted into five asset classes. The community bank with the highest index score in each asset class was chosen as the winner in that class.

Roshan McArthur is a writer in California. William Atkinson is a writer in Illinois. Katie Kuehner-Hebert is a writer in California. Ed Avis is a writer in Illinois. Kelly Pike is a writer in Virginia.