The Department of Justice and other banking agencies are evaluating a new potential M&A framework. What does this mean for community banks?

Jenna Burke: Are Changes to Bank M&A Rules on the Horizon?

September 04, 2023 / By Jenna Burke

The Department of Justice and other banking agencies are evaluating a new potential M&A framework. What does this mean for community banks?

A little over a year since the Federal Deposit Insurance Corporation (FDIC) first issued a request for information on bank mergers and acquisitions under the Bank Merger Act, the Department of Justice (DOJ) and leaders within the federal banking agencies are expressing interest in updating existing M&A rules.

ICBA is working to ensure that any new regulatory framework promotes a strong community banking industry and protects local communities.

Bank mergers are scrutinized under DOJ Bank Merger Guidelines that were last updated in 1995, when the banking industry looked very different. As ICBA has repeatedly pointed out, this framework is outdated and no longer reflects either the realities of the competitive field or the advances in mobile and online banking that have taken place since 1995.

These guidelines reflect an era when there were no fintechs and much smaller credit union and Farm Credit System (FCS) competition, and interstate branching had just recently been introduced. The seven largest U.S. banks didn’t yet have the same combined market share of deposits as the rest of the banks combined.

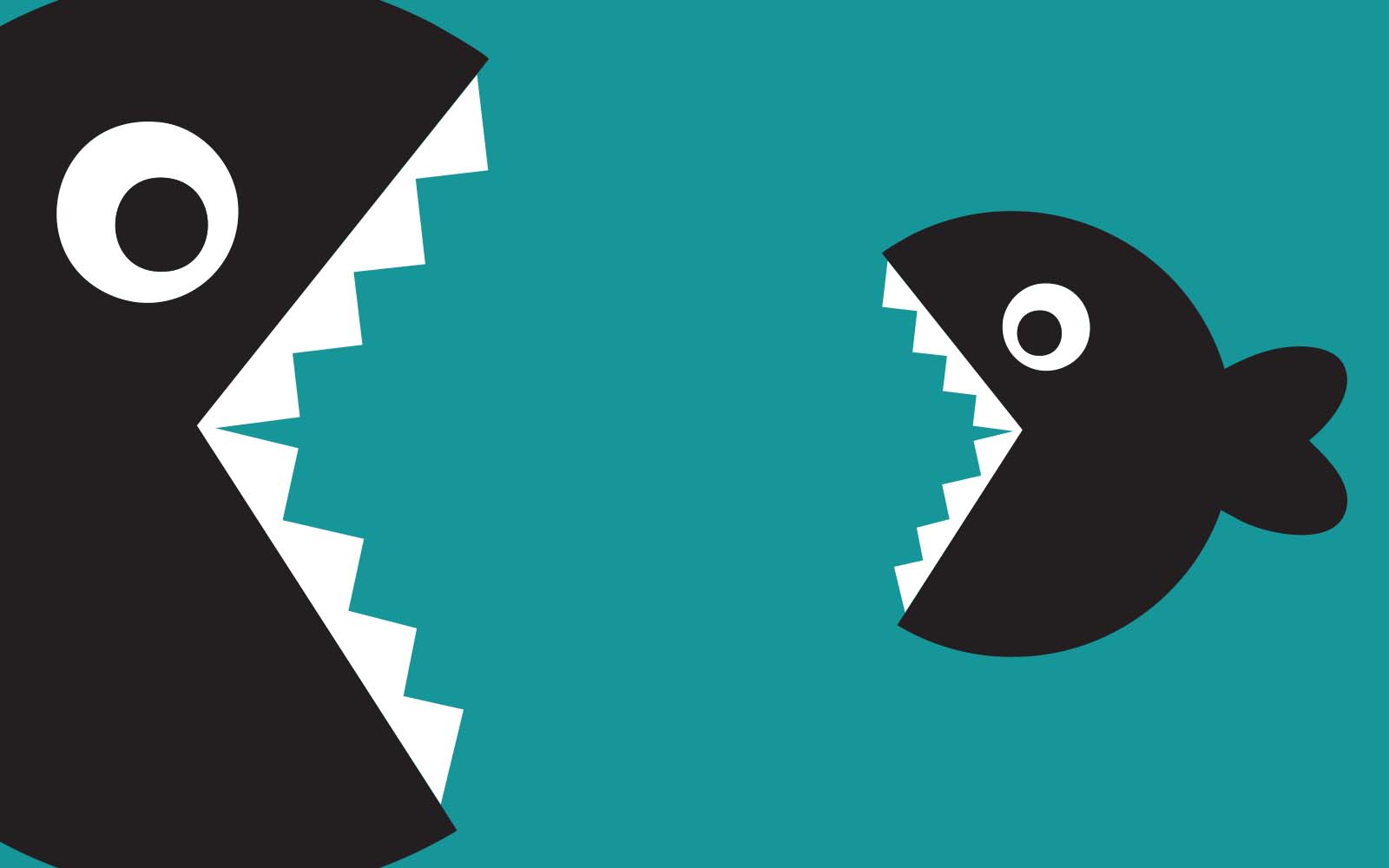

Today, this outdated framework often delays or even prevents community bank mergers that would preserve community bank presence in communities, especially small rural communities, while all too often green-lighting megamergers of too-big-to-fail banks.

Renewed M&A interest

In June, assistant attorney general Jonathan Kanter once again shined a spotlight on bank M&As in a speech where he said that it’s time “to take stock of how the department is fulfilling its statutory role in bank merger enforcement” to ensure it reflects the realities of the current market and preserves competition. Acting comptroller of the currency Michael Hsu also reiterated his previous calls to update the framework in February, citing concerns over diminished competition and increased systemic risk if the rules don’t evolve with the marketplace.

The DOJ invited comments on its Bank Merger Guidelines in 2020 and again in 2021 after President Joe Biden issued an executive order calling for an update of bank merger guidelines. The FDIC also published a request for information in 2022 seeking comments on the bank merger regulatory framework.

As the DOJ and banking agencies reevaluate the current, restrictive M&A framework, ICBA will continue to urge the adoption of … policy changes and the modernization of the existing framework.

Agency leaders’ demonstrated interest in revisions to the bank merger framework, coupled with a framework that has not been updated in nearly 30 years, suggests more concrete proposals to modernize bank merger regulations could be forthcoming.

As the agencies review public comment and evaluate possible changes to the framework, ICBA encourages the FDIC and the DOJ to coordinate with the Office of the Comptroller of the Currency (OCC) and the Board of Governors of the Federal Reserve System to revise the framework based on three key principles:

Promote a competitive playing field among banks of all sizes, credit unions, nonbank fintechs and farm credit associations

Prohibit “too big to fail” bank monopolies

Make it quicker and easier for small bank mergers that strengthen local communities with a continued community bank presence, including rural and low-to-moderate income (LMI) communities

ICBA recommendations for bank M&A updates

ICBA has written comment letters offering suggestions for furthering these goals. They include:

Creating a small bank de minimis exception where small banks benefit from shorter review time frames and those with less than $1 billion in assets are presumed not to create monopolies or anticompetitive effects

Assessing whether mergers involving banks with $100 billion or more in assets pose systemic risk or are too big to fail

Giving credit unions and the Farm Credit System the same weight as bank competitors when assessing the competitive landscape

Scrutinizing the impact of credit union bank acquisitions due to lack of Community Reinvestment Act (CRA) accountability

Measuring concentration beyond geographic boundaries such as fintech companies, large banks that lend nationwide, online lenders that compete with community banks and farm credit associations

Excluding community bank merger applicants from a higher burden of proof or a formalized consultation with the Consumer Financial Protection Bureau (CFPB) to evaluate convenience and needs

As the DOJ and banking agencies reevaluate the current, restrictive M&A framework, ICBA will continue to urge the adoption of these policy changes and the modernization of the existing framework.

At a time when community banks face increasing pressures of regulatory compliance while squaring off against competitors with far less regulatory scrutiny, community banks should be permitted to scale up and compete without undue scrutiny or restrictions on merger activities caused by an outdated merger framework. It’s an issue of fair competition—one that preserves consumer choice and access to community banks that are vital to local economies throughout the nation.

ICBA will continue to closely monitor progress on this issue and remain a strong advocate for revising the M&A framework in a way that strengthens the community banking industry and Main Street America.

Subscribe now

Sign up for the Independent Banker newsletter to receive twice-monthly emails about new issues and must-read content you might have missed.

Sponsored Content

Featured Webinars

Join ICBA Community

Interested in discussing this and other topics? Network with and learn from your peers with the app designed for community bankers.

Subscribe Today

Sign up for Independent Banker eNews to receive twice-monthly emails that alert you when a new issue drops and highlight must-read content you might have missed.

News Watch Today

Join the Conversation with ICBA Community

ICBA Community is an online platform led by community bankers to foster connections, collaborations, and discussions on industry news, best practices, and regulations, while promoting networking, mentorship, and member feedback to guide future initiatives.