As you celebrate your customers during this Small Business Month, think about how you can advocate on their behalf and take time to honor how you support them.

Lucas White: Banking Outside the Box for Small Businesses

May 09, 2024 / By Lucas White

As you celebrate your customers during this Small Business Month, think about how you can advocate on their behalf and take time to honor how you support them.

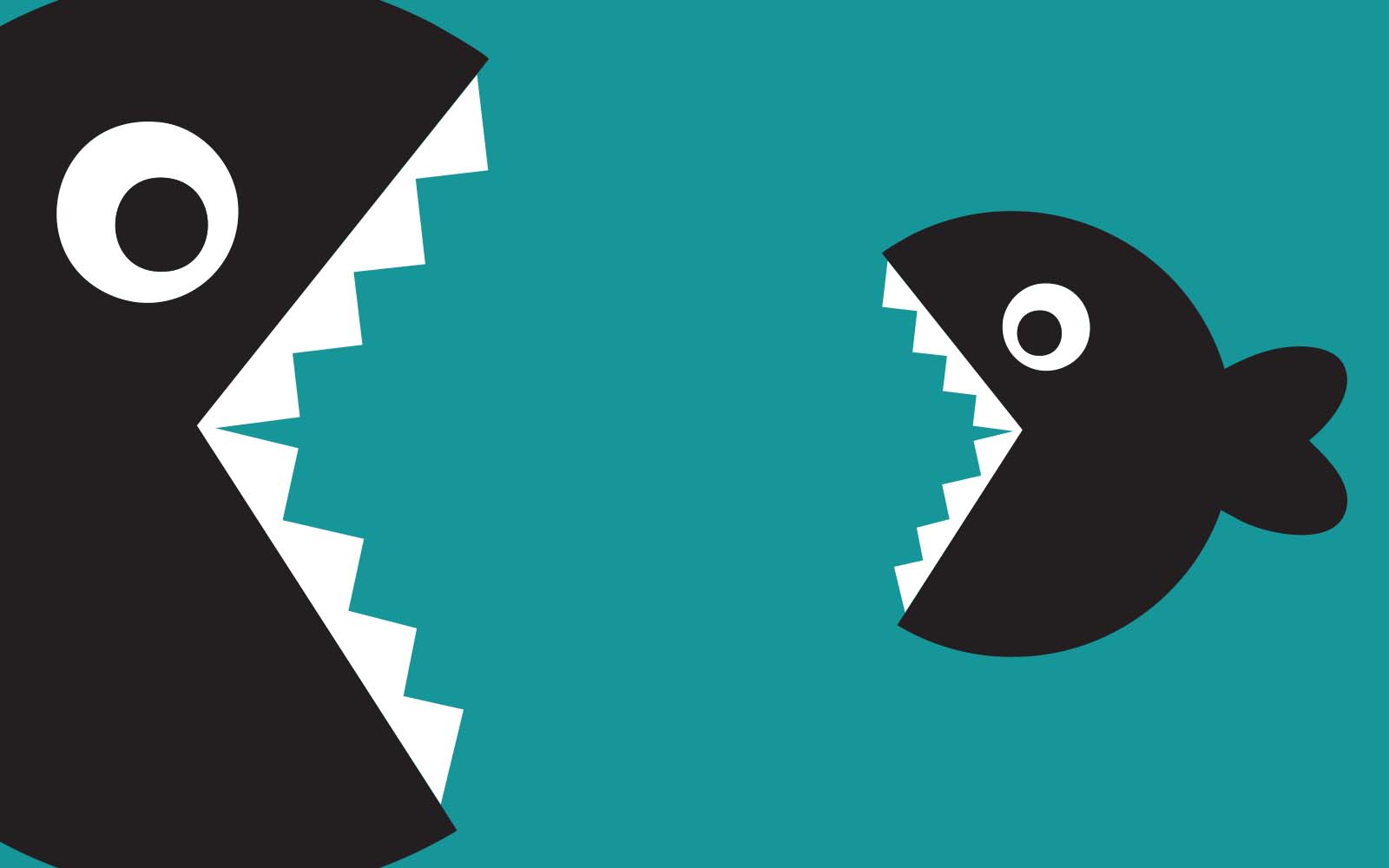

When it comes to serving small businesses, community banks just get it. We understand the day-to-day situation, and we also know local businesses shouldn’t have to try to fit into a mold made by much larger institutions. If we attempt to apply a single product to all small business clients, the shoe won’t fit. So, we customize, developing options geared to their unique needs.

In short, we don’t require small businesses to fit into our solutions box; we build the box around them.

For instance, at my bank, we developed a relationship with spouses who were looking for a home loan. They had been turned down by a large bank, and we were able to fulfill their needs—in multiple capacities. They also shared that it was a dream of theirs to own a nail salon, and after a few years, they were able to make the leap and turned to us for support. Their grand opening was planned for March 2020, but then the pandemic hit. We were immediately able to help by securing Paycheck Protection Program funds to keep their business afloat. By 2022, the salon had cleared over $550,000, and last year, we were able to finance their $2.9 million purchase of the strip mall in which their business operates.

Another client, a local farmer who raises cattle, decided he wanted to get more for his beef and open a butcher shop. We helped him finance the hoop barn to expand his operation and supported the opening of the physical store. We took on some risk, as the butcher shop was untested with only projected figures to go on. But we were creative and able to support them.

My Top 3

Community banks support a wide range of small businesses. Here are my most distinctive customers:

Amish carrier pigeon company

Paper shop that manufactured old-fashioned paper

Helicopter crop-dusting pilot

Community banks have countless stories like these, where we tailor a solution to particular requirements. Custom thinking allows us to meet disparate needs in ways that support our relationship-first model.

But regulations like Consumer Financial Protection Bureau’s 1071 rule will tie our hands, making it harder to get to yes. If we can’t collaborate with our borrowers to give them what they need, we’ll ultimately make fewer small business loans, which only hurts small businesses—the lifeblood of our economy. They need our advocacy more than ever, so that policymakers don’t continue to enact one-size-fits-all restrictions that will lessen their success.

So, as you celebrate your customers during this Small Business Month, think about how you can advocate on their behalf and take time to honor how you support them, because it takes out-of-the-box thinkers like community bankers to make small business dreams into realities.

Subscribe now

Sign up for the Independent Banker newsletter to receive twice-monthly emails about new issues and must-read content you might have missed.

Sponsored Content

Featured Webinars

Join ICBA Community

Interested in discussing this and other topics? Network with and learn from your peers with the app designed for community bankers.

Subscribe Today

Sign up for Independent Banker eNews to receive twice-monthly emails that alert you when a new issue drops and highlight must-read content you might have missed.

News Watch Today

Join the Conversation with ICBA Community

ICBA Community is an online platform led by community bankers to foster connections, collaborations, and discussions on industry news, best practices, and regulations, while promoting networking, mentorship, and member feedback to guide future initiatives.