What a difference three years makes.

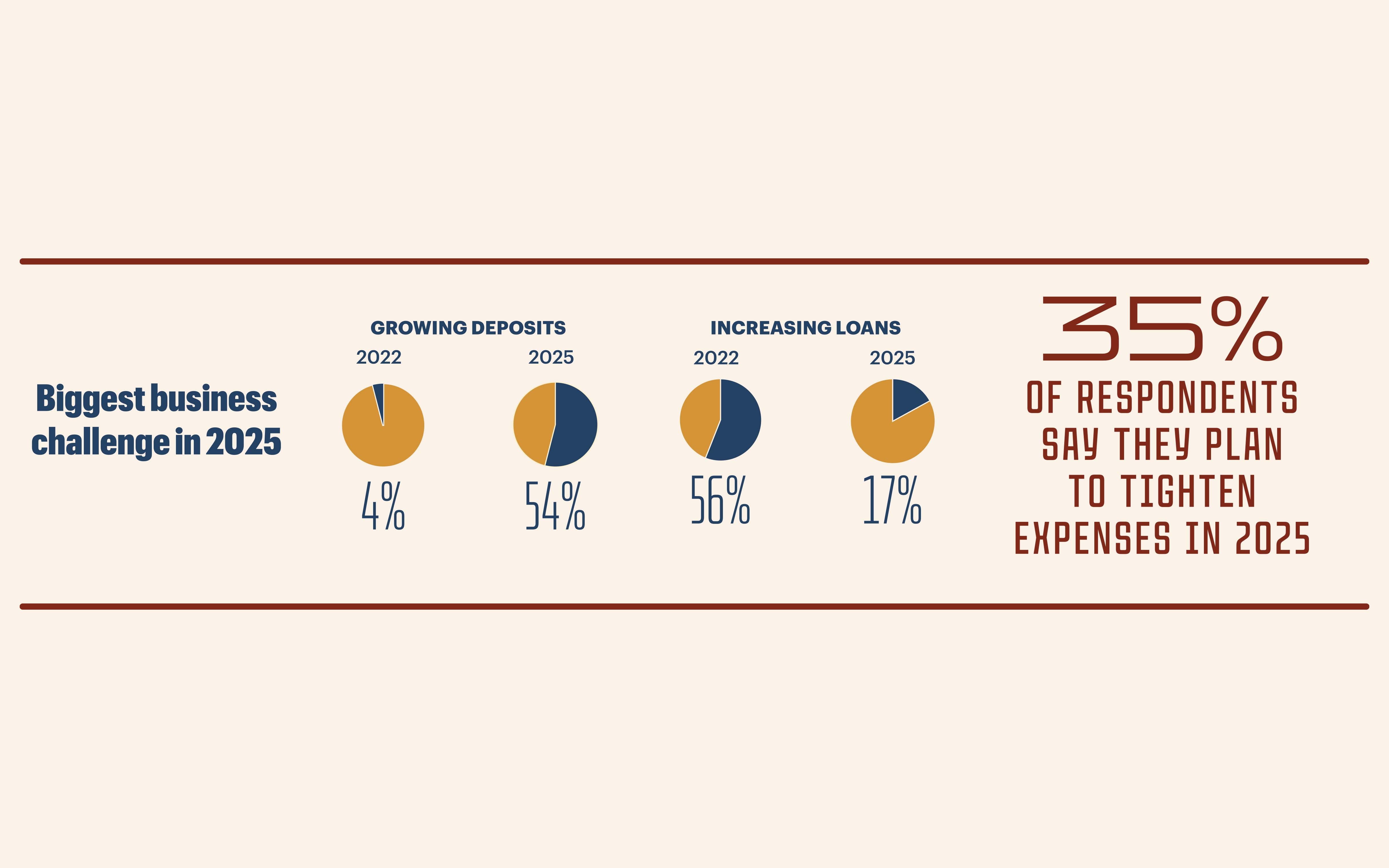

In 2022, as the financial industry was emerging from the effects of the COVID-19 pandemic, 56% of community bank leaders who responded to Independent Banker’s Community Bank CEO Outlook survey said their biggest business challenge was making more loans to offset a flood of deposits. Just 4% said it was growing deposits.

This year, these results have been flipped: More than half (54%) of community bank executives say their biggest challenge in 2025 is growing deposits. Just 17% said making more loans is their top priority.

It's All About Raising Deposits

The shift in focus from making loans to growing deposits is mainly due to the temporary effects the pandemic had on the financial marketplace three years ago. The Paycheck Protection Program (PPP) injected short-term cash into business coffers and bank deposit accounts, lessening customers’ need to take out traditional bank loans.

“We will be emphasizing deposits more than we have the past few years because the pandemic created such an influx of money that we were deposit-heavy for so long,” says Sarah Getzlaff, CEO of $265 million-asset Security First Bank of North Dakota in New Salem, N.D. “Now that our loan growth has caught up, we need deposit growth to mirror loan growth.”

According to Scott McComb, chairman, president and CEO of $1.9 billion-asset Heartland Bank in Whitehall, Ohio, most community banks’ balance sheets are also wrestling with the rapid increase in interest rate costs for deposits. “Like most community banks, we’re still a spread shop, living off the difference between our earning assets and our liabilities,” he says. “So, it’s all about deposits.”

Alan Shettlesworth of Main Bank in Albuquerque, N.M., agrees. “Protecting our net interest margin at all costs is paramount,” says the president and CEO of the $270 million-asset community bank. “Not that we got away from it, but when we have high interest rates and lots of competition for depositors, we just have to get better at it.”

What About Loans?

Of course, this doesn’t mean that community bank CEOs don’t want to make loans. “We’re going to stay loan-focused, especially small business loans,” says Joe Rottinghaus, president of $108 million-asset Conway Bank in Conway Springs, Kan. “We’ve got a great niche there and great board members who are involved in their own small businesses, so we plan to be very much focused on growing loans.”

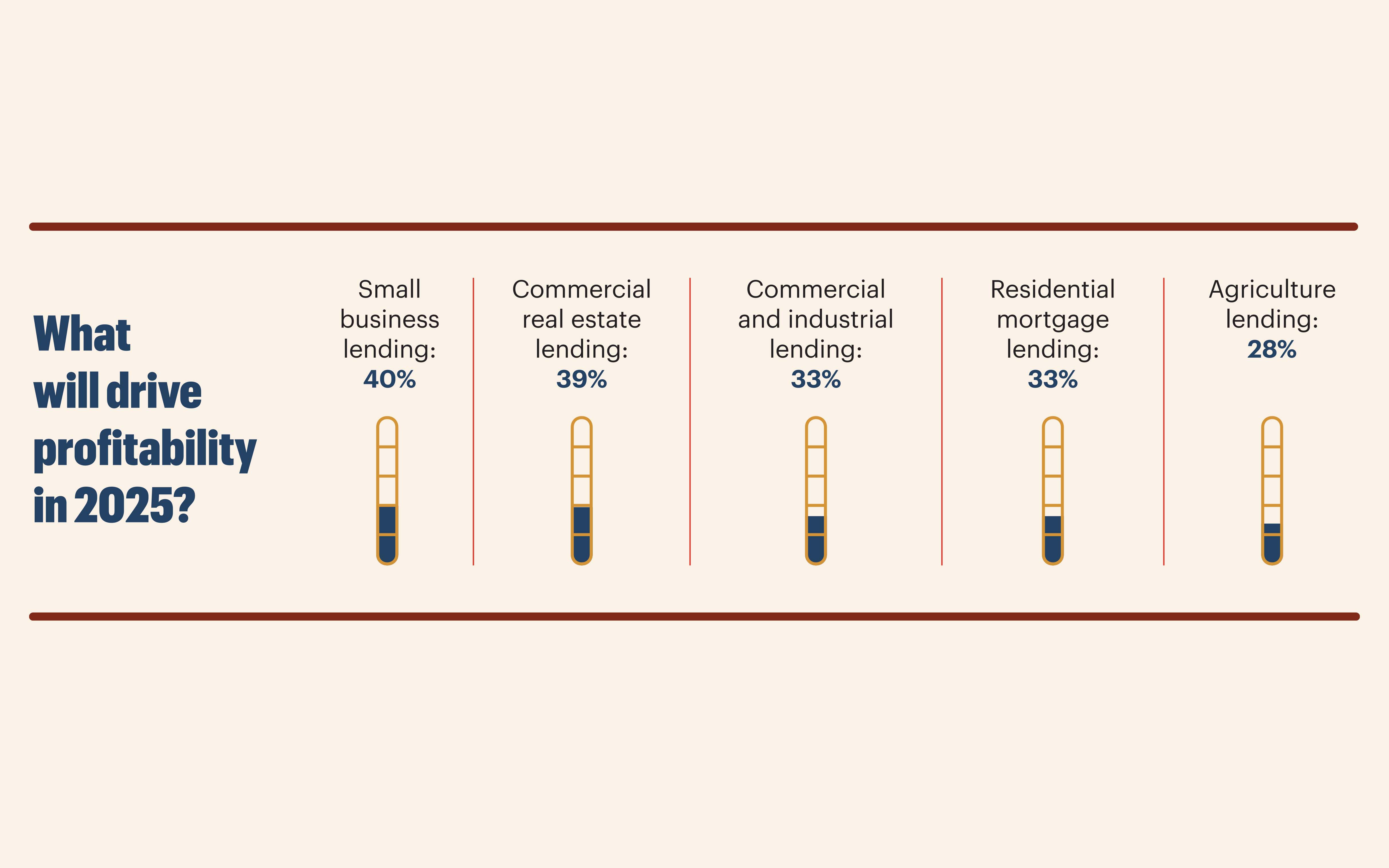

Lending remains the main profit driver for most community banks, according to the survey. Small business and commercial real estate (CRE) lending were cited as the revenue streams most likely to drive profitability in 2025, followed by commercial and industrial (C&I) lending, residential mortgage lending and agricultural lending. CEOs view nonlending services like wealth management/brokerage, credit and debit card services, payment services and insurance as minor contributors to profitability in 2025.

CEOs also anticipate loans as the revenue source that will grow the most in 2025, led by small business, CRE, residential mortgage and C&I loans. Conversely, just 8% of respondents said noncore banking activities (such as subsidiaries, insurance and travel) were the revenue source that will grow the most.

In some markets, however, loan demand remains tepid. “If you ask around, everybody’s trying to figure out why there’s not a lot of loan demand,” says McComb. “Smaller community banks are actually taking up the slack right now because [some have excess] liquidity. Most of them are at low loan-to-deposit levels, like 60% or 70%. They have plenty of wood to burn as far as making new loans. Those with higher loan-to-deposit ratios have had to pull back [lending to nondeposit clients].”

The uncertainty surrounding the election also kept a lot of businesses on the sidelines over the past year or so, according to McComb.

“Once we have more certainty in the political environment,” he says, “I think businesses will be looking to borrow and grow again.”

Marketing: More Digital and Traditional

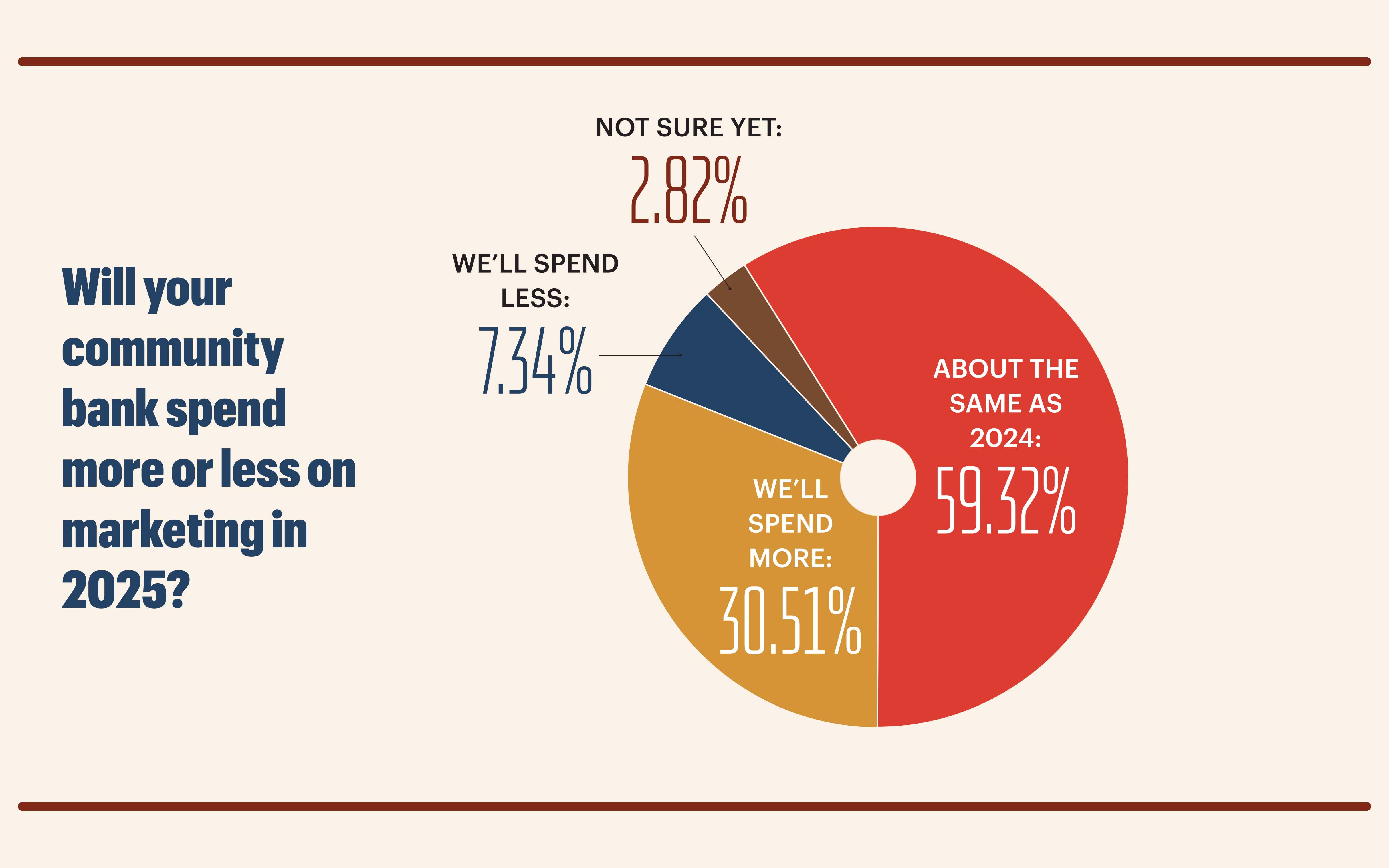

Marketing remains a priority for most community bank CEOs in 2025. This includes both traditional marketing, like television and print advertising, and digital marketing. More than half of community bank executives (59%) say their bank will spend about the same amount of money on marketing this year while 31% say their bank will spend more money on marketing in 2025. Just 7% say their bank will spend less.

Brattleboro Savings & Loan in Brattleboro, Vt., plans to invest in both traditional and digital marketing in 2025. “The local print newspaper is still very popular, so we will continue to advertise there,” says president and CEO Deborah Stephenson. “We’re also looking at different ways to use social media … to market to the younger generation.”

Most CEOs (59%) plan to allocate more marketing resources to digital marketing, primarily digital advertising and social media. Andy Johnson, chairman, co-CEO and CFO of Bank of Vernon in Vernon, Ala., says that while the bank is using digital marketing tactics like social media, it hasn’t seen a return on its investment yet. “It doesn’t really seem to be registering with our customer base right now,” he says. “But we’ll continue to use it and hope to build momentum.”

In the meantime, the community bank continues to use traditional media, including television and print, to reach its target market. “We also focus more on word-of-mouth recognition, so we might do more promotional advertising than anything else,” says Johnson.

Differentiating Community Banks

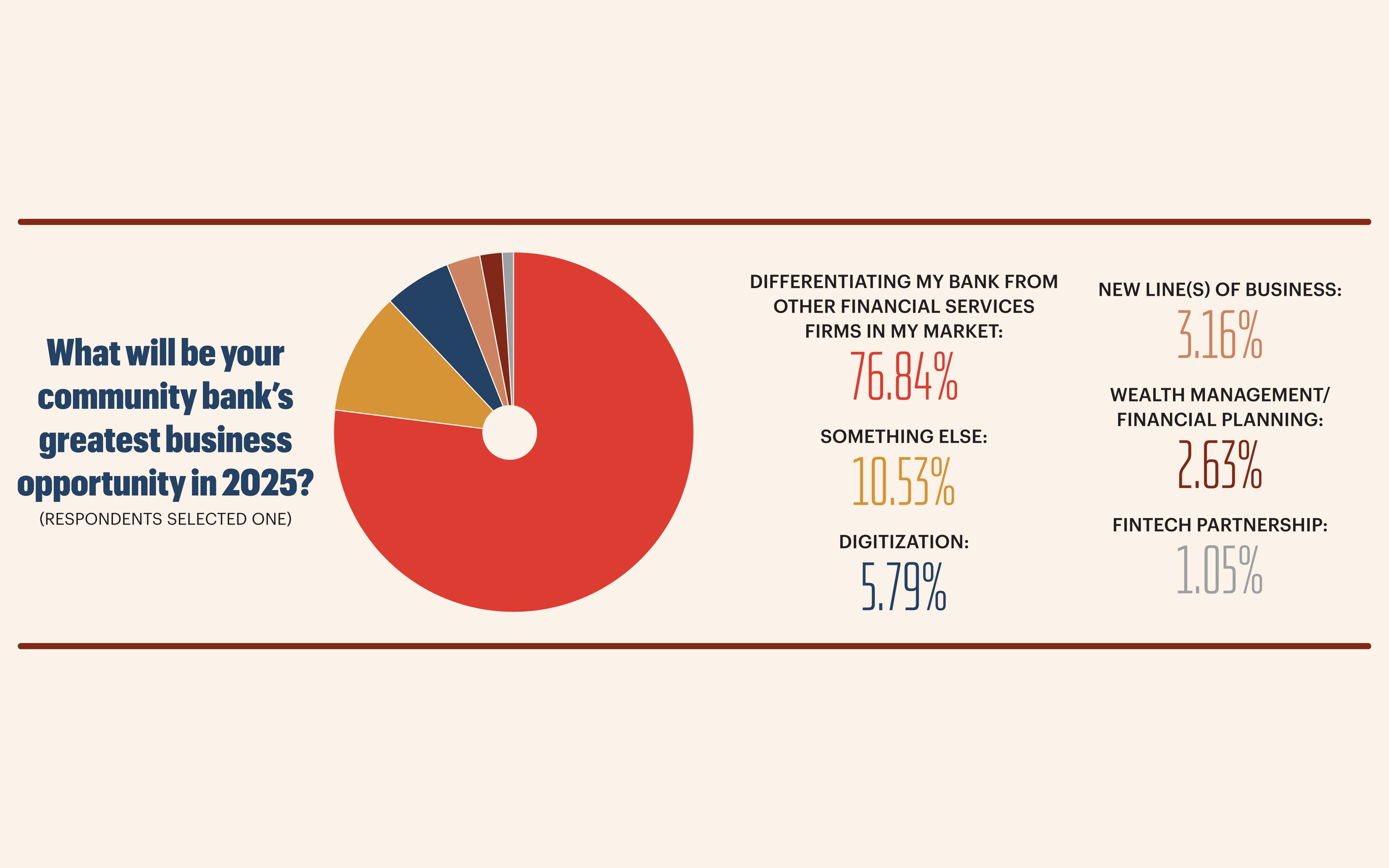

An overwhelming majority of CEOs (77%) said their greatest business opportunity in 2025 will be differentiating their community bank from other financial services firms in their marketplace.

Deborah Stephenson, president and CEO of $289 million-asset Brattleboro Savings & Loan in Brattleboro, Vt., says her bank is the only community bank left in the county. “We’re really going to emphasize the difference between us and larger regional banks in our marketing in 2025,” she says. For example, the bank’s marketing will emphasize how deposits are used to help homebuyers and small businesses in the local community.

Shettlesworth points out the fact that banking is a commodity business. “My bank’s money is just as green as every other bank’s,” he says. “So how do we differentiate ourselves? By responding quicker than everybody else and providing great customer service.” Customers love the local aspect of community banks, he adds, “but this only helps your bank if you respond well. That’s how we view competition.”

Yampa Valley Bank in Steamboat Springs, Colo., plans to roll out a new marketing campaign in 2025 with the motto “We Bank on People,” according to PJ Wharton, president and CEO of the $620 million-asset community bank.

“The campaign will focus on why local banking matters and the difference community banks like ours make in the community,” he says. “For example, we’re the number one economic driver and make more donations and sponsorships than any other financial institution in our community.”

The campaign will stress that when customers bank at Yampa Valley Bank, their money stays in the community instead of leaving the state like with big banks.

“Also, the big banks are shrinking their staffs and relying more on technology, while we’re investing in more staffing,” says Wharton. “We have [triple] the staff of our competitors because customers still like to have person-to-person conversations. Our lenders understand the local market and provide quick turnaround and flexibility, while some of the big banks are using AI for loan review and approvals.”

An Increased Focus on Treasury Management

More community banks today are expanding their product and service offering to include treasury management services.

“This is something I’ve been interested in offering our commercial customers for a while,” says Joe Rottinghaus, president of Conway Bank in Conway Springs, Kan., “but we waited until we hired the people who can operate it. The worst thing you can do is flip the switch and it’s a failure.”

Security First Bank of North Dakota in New Salem, N.D., plans to offer Positive Pay to business customers in 2025. “There has been increased interest in Positive Pay due to the rise in check fraud,” says CEO Sarah Getzlaff. “Several of our customers have asked about this service.”

Rottinghaus says Conway Bank plans to roll out treasury management services in early 2025, too. “The more of a customer’s business you have, the less likely they are to switch banks,” he says. “Offering treasury management is a key component of becoming a customer’s primary bank.”

New Tech on the Horizon

Community bank executives listed a few new technologies they’re considering rolling out in 2025 to serve customers’ needs and improve internal operations. These include website revamps, new loan origination software, fraud mitigation software, online chat, enhanced mobile banking, remote deposit capture, Apple Pay and Google Pay, and electronic signature and payments software.

Security First Bank of North Dakota is rebuilding its intranet to improve internal communication. “This will make it easier to share news about employees’ achievements and recognize birthdays and anniversaries,” says Getzlaff. The intranet will also be a central location where employees can access all forms and documents.

On the customer side of things, Conway Bank plans to provide instant debit card issuance. “A lot of our competitors offered this, but we didn’t,” says Rottinghaus. “It will increase customer convenience and help reduce fraud. Without it, customers have to wait two or three days to have a card replaced, which is very inconvenient. We can now replace a customer’s card in an hour or so.”

Several CEOs said their banks planned to forge a fintech partnership in 2025. This includes Andy Johnson, chairman, co-CEO and CFO of $361 million-asset Bank of Vernon in Vernon, Ala.

“We are utilizing our long-term relationship with Jack Henry to roll out a new mobile banking app, online banking platform and updated website,” he says. “We spent a year planning the rollout, and this is the year of implementation.” The bank has also installed new ATMs that accept cash and check deposits.

According to Johnson, Bank of Vernon’s new website improved responsiveness and customer satisfaction. The community bank retained a third party for the planning, negotiation and implementation phases to make sure everything stayed on track and the bank’s goals were met as it updated its systems.

“With some previous installations, we found that even small projects can get bogged down and fall behind,” says Johnson.

He is excited about how improved efficiencies and digital-friendly systems will improve Bank of Vernon’s performance in 2025. “Our efforts to improve internal and customer-facing systems while reducing touches in our workflows should improve our overall numbers,” he says. “More importantly, I believe these efforts will result in higher customer satisfaction along with a more efficient and happier employee experience.”

Is Software the Key to Effective Loan Origination?

Several community bank executives are planning to implement loan origination software in 2025 to improve responsiveness and turnaround on business loan applications.

“Anybody in the industry knows that the commercial and small business loan application process is [laborious] inside most community banks,” says Scott McComb, chairman, president and CEO of Heartland Bank in Whitehall, Ohio. “It’s a very manual process.”

Heartland Bank will be upgrading its loan origination software in the first half of the year to a new system where borrowers can upload their financial information and communicate with the bank securely. “These processes have historically been performed manually or through email,” says McComb. “We hope this will help us reply quicker and better to smaller commercial loan requests. If it’s a commercial loan application for less than $50,000, you shouldn’t have to take a blood sample and ask for a first-born to get something done.”

The Bank of Vernon in Vernon, Ala., will implement LoanVantage from ICBA Preferred Service Provider Jack Henry to boost efficiency and improve data collection. “We are building out a system to collect data from customers that meets our needs for managing loans and reporting,” says the community bank’s chairman, co-CEO and CFO, Andy Johnson. “Our lending team and support staff can collect and input data on customers once instead of having to fill out a spreadsheet or document and pass it on to someone else to enter.”

LoanVantage will reduce touches of documents by up to 80%, says Johnson. “It will allow us to offer online lending where the customer [can provide] their data [for analysis]. This will put us in a position to collect all the necessary data points for our reporting as a requirement to move forward with an application or credit analysis.”

The Income Initiative

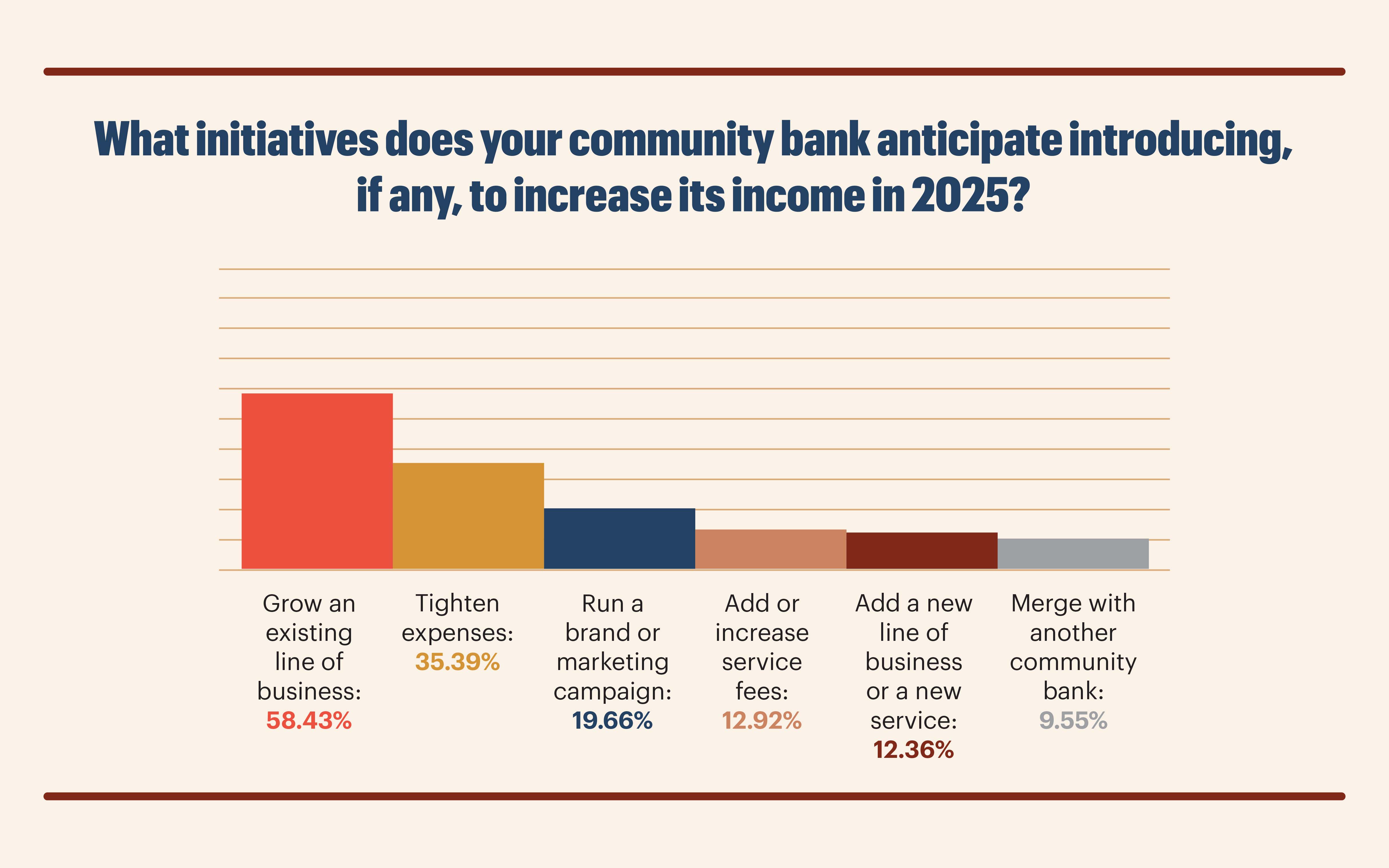

When it comes to boosting income, CEOs listed several different initiatives their banks are planning in 2025. These include growing an existing line of business, running a new brand or marketing campaign, and adding a new line of business or service.

“We have ample room to do more of what we already do, because we’re not currently restricted by the size of our market,” says Shettlesworth, referring to the greater Albuquerque area, which has a population of 800,000. “We still have plenty of room to grow without sacrificing our business model and delving into other products and services that, quite frankly, we aren’t good at yet. We have done this in the past with mixed results.”

Main Bank can’t grow, however, without talented new employees. “Thankfully, we don’t have to double the size of our staff to double the size of the bank,” says Shettlesworth. “That’s the beautiful thing about increasing efficiency. What we’ve done over the past five to 10 years to get to where we are now will not be what gets us to the next level of doubling in size.”

Main Bank plans to focus on expanding merchant services in 2025, which Shettlesworth calls “low‑hanging fruit.” “We have not made an intentional effort to reach out to our business customers and ask for this business,” he says. “It’s such an easy ask, though, because we will only ask customers to switch their merchant services to us if we can save them money. It’s a win-win for everybody.”

Yampa Valley Bank also plans to emphasize merchant card processing in 2025. “We have a really strong merchant product with a lot to offer customers and competitive pricing,” says Wharton. “We’re in a resort area, so there are a lot of retailers, restaurants and ski shops. It just comes down to capacity and manpower; we haven’t had time for outbound calling.”

Merchant services aren’t highly profitable, says Wharton, but they are sticky. “They solidify relationships with our existing customers and increase overall customer satisfaction.”

Wharton is bullish on community banking in 2025 and beyond. “Community banking is alive and well,” he says. “The megabanks have abandoned many rural areas and are relying more heavily on technology like AI, while we are investing in our community and growing market share. This gives me great hope for the future of community banking.”

The Link Between Efficiency, Scale and Earnings

As community banks seek to boost earnings in the current interest rate environment, they are focused on increasing efficiency. About a third (35%) of bank executives say they plan to tighten expenses this year.

One way to slash expenses and increase efficiency is to merge with another community bank. One out of 10 CEOs say their bank is planning a merger in 2025, including Scott McComb, chairman, president and CEO of Heartland Bank in Whitehall, Ohio.

“Our markets, Cincinnati and Columbus, dictated that we need a bigger balance sheet [capability] in order to continue doing what we’re doing,” says McComb. “This is especially true when you consider new regulatory requirements coming down the pike, as well as the cost of everything increasing exponentially.”

Heartland Bank will merge with German American Bank in Jasper, Ind., during the first quarter of 2025. “This merger will help us gain scale,” says McComb. “We think it’s a really good move for our shareholders, so they can have a growth stock that continues to increase dividends and [liquidity] along with [increased non-interest income] to bring home those returns.”

![[2024-12-05-11-02-42]___2000-x-1250-(feature-image)_Option-1](https://www.independentbanker.org/images/independentbankerlibraries/default-album/sponsored-content-images/-2024-12-05-11-02-42-___2000-x-1250-(feature-image)_option-1.jpg?sfvrsn=15afe117_1)