When Alex Burnette decided to start a general contracting business in Nashville, Tenn., he was already an experienced builder. He had worked as an intern at large commercial builders and as an independent subcontractor. Nevertheless, when he formed his firm Nashville Siteworks in 2018, he could not lean on a bank line of credit. He needed to reach into his own pocket to pay the bills.

“I essentially bootstrapped everything from the ground up,” recalls Burnette. “As soon as I had made enough money to buy a piece of equipment, I would pay cash or, occasionally, I would be able to find a dealer that would do a note on something with us.”

Eventually, Burnette got a small line of credit from a major commercial bank. That helped, but when his company expanded and he needed more cash, that bank was not willing to increase the line.

In 2022, Burnette learned about Sonata Bank, which had just opened in Nashville. The $200 million-asset community bank recognized that Burnette was successfully growing his business—which handles a multitude of construction projects, such as swimming pools, commercial storm drains, and concrete driveways and sidewalks—and offered financing and guidance to support that growth.

“Sonata Bank was looking for local business owners, individuals that were interested in working with a community bank,” says Burnette, “and at the time I was just getting acclimated to the importance of having banking relationships as a small business owner. I was struggling to find a bank that was compatible with us, somebody that had a little bit of an appetite to work with a younger business that didn’t have a lot of years of credit history. So, we started a relationship, and we have been able to grow very quickly since then.”

Burnette’s experience with Sonata Bank reveals how community banks power small businesses not just in Nashville but across the nation. With their tradition of personal, hands-on service and a commitment to helping businesses grow, community banks are truly responsible for much of Music City’s business success.

Healthy growth

Nashville and the broader area of middle Tennessee have enjoyed healthy business growth in recent decades. According to data from the Bureau of Labor Statistics, the Nashville metropolitan statistical area added 24,000 jobs during 2023. And those weren’t just any jobs; the high-paying category of “professional, scientific and technical services” led job growth with a 7.4% increase.

“We have a very business-friendly environment here in middle Tennessee when it comes to taxes, both on the individual part and the business part,” says Dan Dellinger, CEO of Sonata Bank. “A lot of younger folks are moving to middle Tennessee, not only folks that are migrating here from other parts of Tennessee, but a lot who are coming from other parts of the nation, including California, Illinois and New York. In general, we are a really, really strong market.”

Healthcare plays a large role in Nashville’s economy, contributing $67.9 billion in 2022, according to a study by the Nashville Area Chamber. Other major industries include education, professional sports and, of course, music.

But there are thousands of smaller businesses that exist in the area. Some labor at the periphery of Nashville’s major industries, and others have carved their own path. Either way, many of these small and midsize businesses rely on community banks.

When Dellinger and his partners bought the Kentucky bank that became Sonata Bank in 2022, it had $25 million in assets. It has grown quickly to its current $200 million by serving businesses primarily at the edges of the major Nashville industries. “Most of our loans are under $5 million, so we’ve been able to find that niche in middle Tennessee that has allowed us to grow that portfolio to a pretty significant level of our overall portfolio,” says Dellinger.

That lending is fueling Nashville Siteworks’ growth, Burnette says. People with good-paying jobs who move into the Nashville area often want swimming pools and other exterior amenities added to the homes they buy. That means more work for Nashville Siteworks, but Burnette must finance the materials and labor while such projects are underway. Since he switched his banking relationship to Sonata, funding that work is much easier.

“The base of our relationship was a line of credit to help fund our projects, to help scale the amount of work that we were able to take on,” says Burnette. “I was getting to a point where I was paying hundreds of thousands of dollars in materials and labor, and I would have a big receivables balance but really wasn’t able to pay myself or float the company without constantly going all the way out of pocket. Sonata Bank has actually increased our line of credit significantly in the past couple of years since we’ve been working with them, and I’m hoping that trajectory continues.”

Financing Nashville’s healthcare industry

Nashville, Tenn., is home to 18 publicly traded healthcare companies and hundreds of other related firms. Big ones include Vanderbilt University Medical Center, HCA Healthcare and Envision Healthcare.

About 25% of Nashville-based Insbank’s lending portfolio is in healthcare, says CEO Jim Rieniets. This includes financing for ambulatory surgery centers, dialysis and nephrology practices, and healthcare management companies. The community bank’s niche began with a relationship with the Tennessee Medical Association and now includes a separate brand called Medquity Healthcare Banking, which serves clients in 27 states.

“You have larger banks that go after the bigger healthcare company deals, and then you have a lot of banks that will serve the personal needs of the physician. We are kind of in that space in the middle that’s not as heavily populated,” Rieniets says. “And what we have found is that the physicians or the management companies appreciate the fact that our team has an expertise in this space.”

Community banks’ role in the entertainment industry

Nashville’s music scene is world famous. Elvis may not be headlining shows on Broadway Street anymore, but more than 3,000 working musicians ply their trade in the city, according to the Nashville Area Chamber. There are also 190 recording studios and eight major music-related associations, including the Academy of Country Music and the Gospel Music Association.

The major record labels and other big players in the city probably rely on larger banking institutions, but the thousands of smaller businesses count on community banks to fuel growth.

Icon Entertainment & Hospitality is a real estate development and hospitality company that operates Johnny Cash Museum, Patsy Cline Museum, Nudie’s Honky Tonk, House of Cards, Show Pony and several other businesses in Nashville. Millions of visitors to Nashville make memories in establishments operated by Icon.

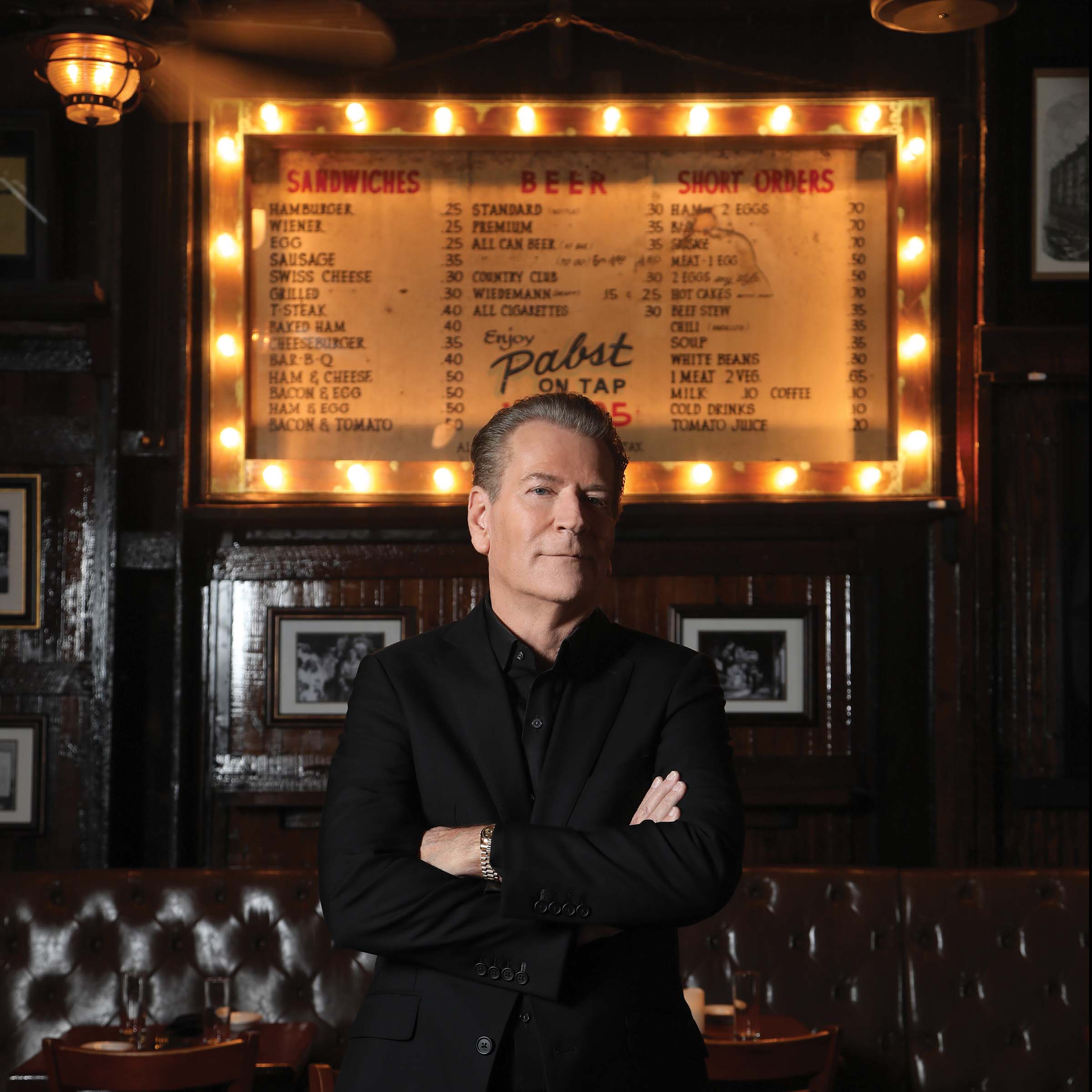

For the past 10 years, Icon’s founder and CEO Bill Miller has worked with $869 million-asset, Nashville-based Insbank for the financial services that help Icon to continue creating memorable moments for Nashville visitors.

“It’s been a really incredible relationship,” says Miller. “We love the people there; they’re more like family than our bankers.”

When there’s a need

Nashville in numbers

3K+

working musicians in Nashville

190

recording studios

8

major music-related associations

60%

of businesses in the city have fewer than 25 employees.

89%

of the merchants in downtown Nashville are local or regional.

Source: Nashville Area Chamber

80K

expected new jobs in Tennessee’s healthcare and social service industry by 2030

Source: Nashville Convention & Visitors Corp.

A key moment in the Insbank and Icon relationship came when COVID hit, Miller says. The company had about 500 employees at that time, and they were suddenly unable to do their jobs. Insbank recognized the company’s dilemma.

“First of all, they deferred our loans, and they advanced us some capital so that we could keep our employees afloat,” says Miller. “We kept one of our restaurants open, not to the public but so that three times a week we could prepare three-course meals for every single employee and all of their family members. Having some capital at our fingertips during that time was a blessing to us, a blessing to our employees, and that’s something I'll never forget.”

More recently, Insbank funded the complete renovation of the Southern Turf Building, which has four stories plus a basement. The historic structure now houses Sinatra Bar & Lounge, which is Icon’s newest entertainment venue, as well as Skull’s Rainbow Room, a 76-year-old speakeasy-like restaurant in the basement. The two middle floors of the building are short-term rental lofts, and the top floor is a private club called Southern Turf Lofts.

“Not only did they finance the building, but they financed the infrastructure for three brand new businesses,” Miller says. “That was really an intense build-out, because we were building out three separate projects in the same building, which was nearly 200 years old.” The build‑out took about 16 months, Miller says. Sinatra Bar & Lounge opened in April 2023, and the other businesses within a few months of that. Miller says about 60 people are employed among the businesses in Southern Turf Building. The company has about 800 employees today.

Growth on the horizon

A growing business such as Icon fits Insbank’s target market, which serves a diverse range of business clients in the area, says CEO Jim Rieniets.

“The unique connection, if you will, from the community banking industry to the prosperity of our nation is that we have a banking system that supports the entrepreneurship, free-market mentality,” Rieniets says.

According to Rieniets, Icon Entertainment & Hospitality is one of several businesses in the Nashville entertainment scene that Insbank counts as clients.

“We don’t do nearly as much in the entertainment space as a handful of other, mostly larger banks, but we do have expertise in some music catalog finance,” Rieniets says. “And we’ve got a loan officer that has some clients in the coach business, for providing tour buses to artists that travel with their tours.”

Nashville’s economic growth is projected to continue. The Nashville Convention & Visitors Corp. reports that 16.8 million people visited in 2023, and that figure should grow to 20 million by 2033. Tennessee’s healthcare and social service industry—much of it centered in Nashville—is projected to add more than 80,000 new jobs by 2030. And recent investments by GM and Nissan reveal the city’s industrial strength.

Underlying all of this economic fortitude is the fact that small businesses power the city. According to the Nashville Chamber, 60% of businesses in the city have fewer than 25 employees, and 89% of the merchants in downtown Nashville are local or regional. Community banks are vital to the success of those businesses.

“When people ask me why I bank with a smaller community bank, I tell them I’ve got really good personal relationships with my bankers,” Burnette says. “It’s cool to know individuals at the bank who are pushing on your behalf, who are wanting you to be successful, wanting you to grow, and not just worrying about making money off you.”

Success through service

CedarStone Bank in Lebanon, Tenn., serves Main Street businesses like auto dealers, laundromats and grocery stores. The $345 million-asset community bank has grown more quickly in the past two years than at any other time in its history, reports president and CEO Bob McDonald.

He believes that the key to CedarStone Bank’s success is people who know how to serve. “We believe that service is key, and so we only hire people who have a genuine desire to serve,” McDonald says. “We can train people on how to be a teller or a customer service representative or a loan officer or a controller or a CFO or a CEO. All those things can be taught, but you can’t teach service.”