“It’s a constant balancing act between ensuring thoughtful, tailored solutions and responding to today’s immediate needs.”

Rebeca Romero Rainey: Offering Financial Freedom to Communities Nationwide

July 01, 2025 / By Rebeca Romero Rainey

“It’s a constant balancing act between ensuring thoughtful, tailored solutions and responding to today’s immediate needs.”

![]()

Where I’ll be

this month

A highlight of the month will be our summer board meeting, where we will build out our strategic plan and incorporate feedback we’ve heard from all of you as we continue to create and promote an environment where community banks flourish.

As we celebrate Independence Day this month, I can’t help but equate that sense of freedom with what we do as community bankers. We are champions of our local communities, ensuring our customers have access to financial services that afford opportunities for individual freedoms.

Take lending, for example. Community bankers bring with us unique attributes—including our nimbleness, creativity and problem-solving—that help us take a long-term focus to our customer relationships. We listen to what customers need, factoring in our deep knowledge of our local market, and we offer solutions that address the individual opportunities and challenges of that very community.

No two customers are exactly alike, and community bankers identify the right mix to help customers succeed over time. It’s in our DNA to consider the ebb and flow of our landscapes and tailor solutions accordingly.

But today’s customers want it all. They seek the relationship and knowledge their community banker provides, but they also want the decision immediately. We live in an instant gratification society, and today’s lending decisions are accompanied by a ticking clock. It’s a constant balancing act between ensuring thoughtful, tailored solutions and responding to today’s immediate needs. Fortunately, community banks can deliver both a holistic, thoughtful process and timely decision-making.

When we look at outstanding lenders, we see a strong thread of commonality: They have a unique ability to maximize local knowledge, combine it with their personal relationships and offer tools that support the speed and ease of customer experience. By combining technology’s efficiencies and insights with the creativity and nimbleness anchored in a community banker’s personal relationship, we achieve a near-perfect lending solution.

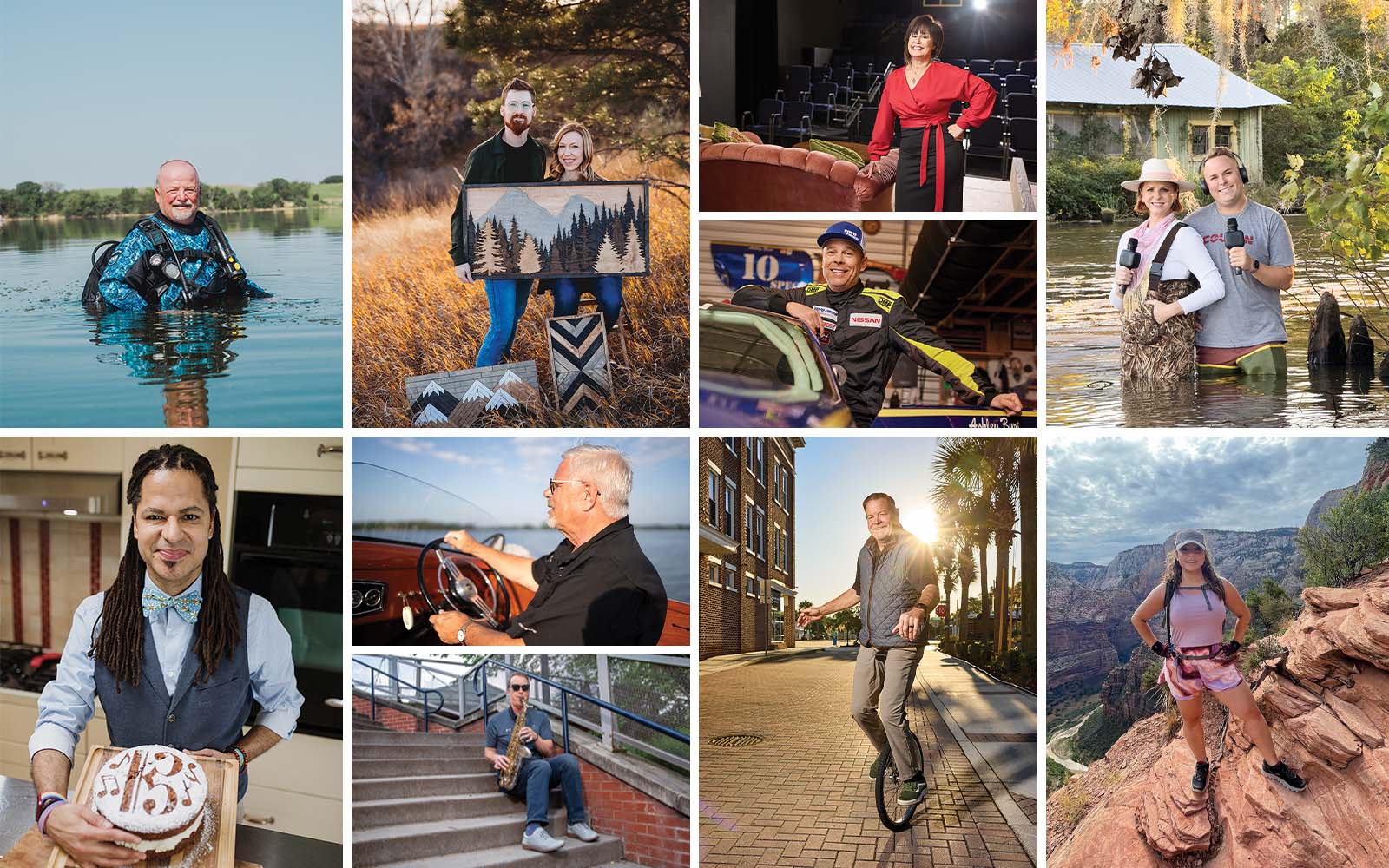

So, as you read this month’s issue, I hope you are inspired by three examples of outstanding lenders. Each of their stories is unique in terms of how they have approached lending in the markets in which they operate, and they offer a powerful demonstration of why community banks are such successful lenders overall. It’s precisely because we are responsive to individual local needs, and we offer solutions tailored to them.

At the end of the day, our flexibility and creativity are what set us apart from other providers. Those attributes allow us to be the relationship bankers we are, speaking directly to the financial needs of those we serve. For our customers and communities, I’d say that’s an independence worth celebrating.

Subscribe now

Sign up for the Independent Banker newsletter to receive twice-monthly emails about new issues and must-read content you might have missed.

Sponsored Content

Featured Webinars

Join ICBA Community

Interested in discussing this and other topics? Network with and learn from your peers with the app designed for community bankers.

Subscribe Today

Sign up for Independent Banker eNews to receive twice-monthly emails that alert you when a new issue drops and highlight must-read content you might have missed.

News Watch Today

Join the Conversation with ICBA Community

ICBA Community is an online platform led by community bankers to foster connections, collaborations, and discussions on industry news, best practices, and regulations, while promoting networking, mentorship, and member feedback to guide future initiatives.