How long is your to-do list?

Like most other community bankers, you spent many long nights processing Paycheck Protection Program (PPP) loans, planning how to do business in a pandemic and much more throughout 2020 and 2021.

And as local economies continue to stabilize and many challenged industries bounce back, 2022 may be the year community bankers put the rubber to the road by revisiting goals and turning them into action items.

“When I talk to other CEOs across the country, they tell me the same thing: PPP borrowers who were first rejected by their larger bank decided to stop being customers there and brought over their entire relationship to the community bank that gave them a PPP loan.”—Janet Silveria, Community Bank of Santa Maria

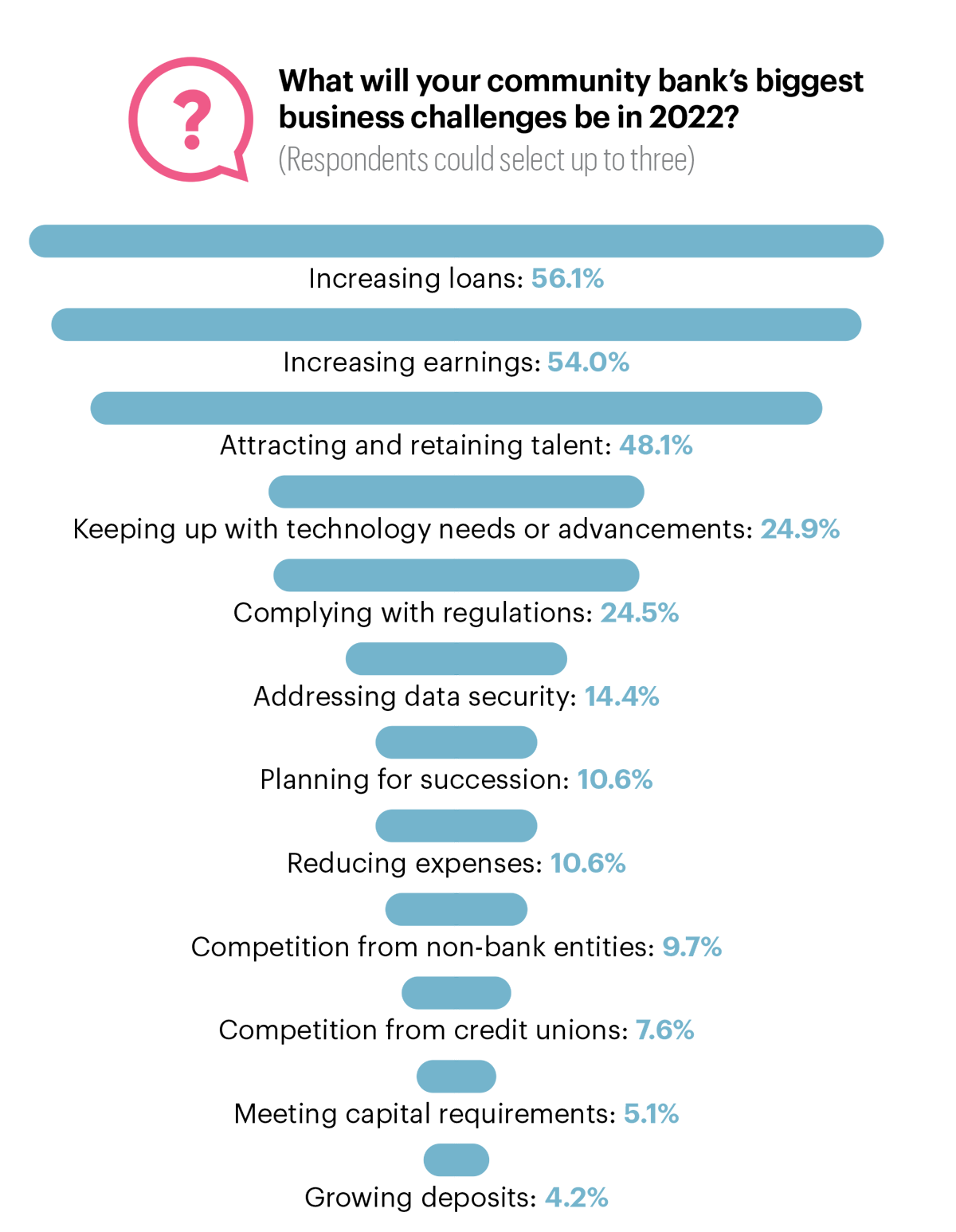

So, what’s at the top of community bank leaders’ to-do lists? According to Independent Banker’s 2022 Community Bank CEO Outlook Survey, it’s making more loans to offset a flood of deposits, as well as finding and keeping key talent in this new era for workplaces. Leading the challenges for bankers responding to this year’s survey are increasing loans (56.1%) and increasing earnings (54%).

“Customers are sitting on a lot of cash, and they have not needed to borrow using traditional loans at the pace they were before,” says R. Blake Chatelain, president and CEO of $2.9 billion-asset Red River Bank in Alexandria, La. “Plus, continued economic uncertainty has caused many borrowers to be cautious in their growth plans.”

Fortunately for Red River Bank, loan demand is picking up in Louisiana as cities stabilize from the pandemic and businesses reopen. However, continued supply chain issues might still hamper business customers’ growth for a time, Chatelain says.

Janet Silvera, president and CEO of Community Bank of Santa Maria

Janet Silveria, president and CEO of $402 million-asset Community Bank of Santa Maria in Santa Maria, Calif., says loan growth is needed because community banks like hers are sitting on quite a bit of liquidity, in part because Paycheck Protection Program (PPP) borrowers also opened new checking accounts there.

“When I talk to other CEOs across the country, they tell me the same thing: PPP borrowers who were first rejected by their larger bank decided to stop being customers there and brought over their entire relationship to the community bank that gave them a PPP loan,” Silveria says. “As a result, we’re more challenged with liquidity than the larger banks.”

Will climate factors affect planning?

One topic that’s surfacing for community banks is investor expectations of environmental, social and governance issues (ESG) and potential climate-related disclosure requirements.

“That hit our strategic planning agenda for the first time this year,” says Janet Silveria, president and CEO of Community Bank of Santa Maria. “We know something is going to come down the road. At this time we’re not feeling pressure to do the disclosures, but we know we need to [have] a game plan on how we are going to tackle that.

“The buzz at the community bank level is just starting,” she adds.

Community Bank of Santa Maria is listed on the OTCQX, and when the larger exchanges start requiring climate-related disclosures, “that’s when we’ll start paying more attention, because we know we’ll be next,” Silveria says.

Regulators haven’t yet broached the subject with them. “Addressing ESG is one thing,” she says. “The greater concern is how the regulatory agencies will expect us to update our risk profile based on climate factors.”

What will drive profit in 2022?

Steve Dehnert, president and CEO of Badger Bank

So, where to put those deposits to use? Nearly half (46.8%) of community bank leaders say income from commercial real estate (CRE) loans is the revenue stream most likely to drive their profitability in 2022. That’s followed by residential mortgage lending (36.3%), small business lending (32.1%), commercial and industrial (C&I) lending (30%) and agricultural lending (23.6%).

While demand for CRE and construction lending remains robust in the Santa Maria Valley, Silveria says C&I loan demand is “lackluster,” and many businesses still have unused lines of credit. “But we still need more of everything to keep pace with deposit growth,” she adds.

Carlos P. Naudon, president and CEO of Ponce Bank

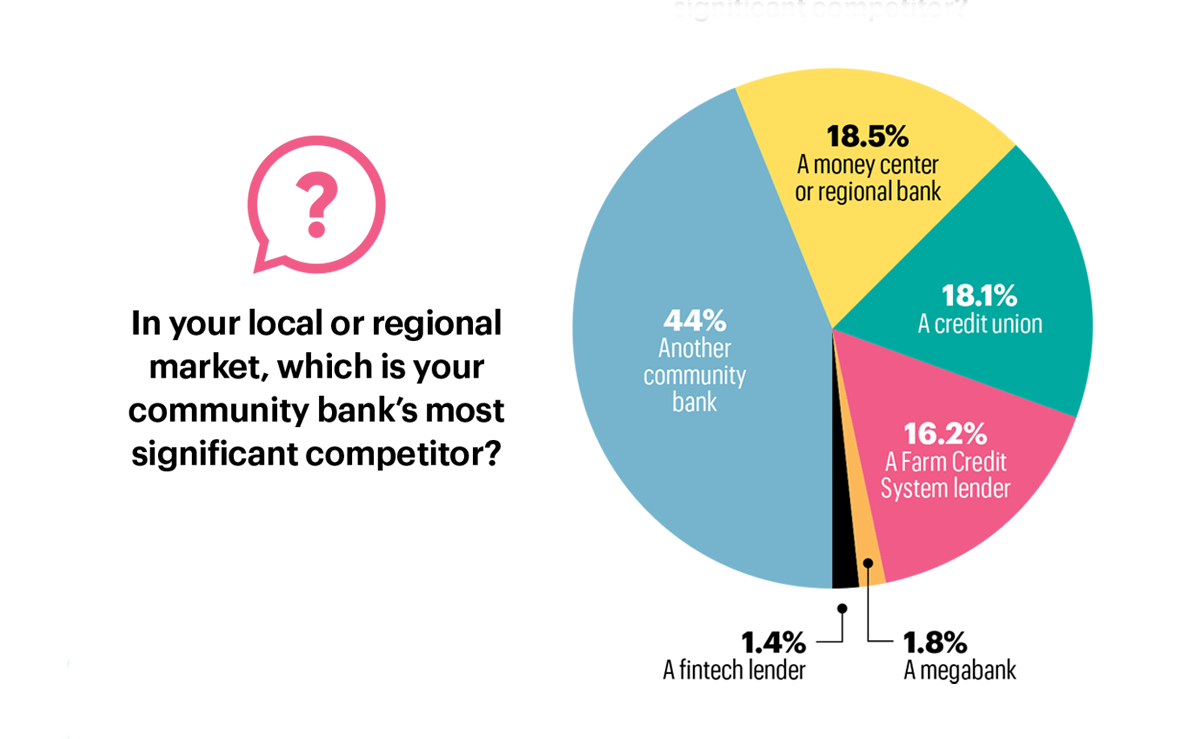

Badger Bank in Fort Atkinson, Wis., is facing increased competition in its home market from other banks, nonbanks and even credit unions that are aggressively pricing loans to businesses, says president and CEO Steve Dehnert. To counter such competition, the $186 million-asset community bank plans to hire another lender to seek deals across the state, sticking to smaller towns and avoiding the saturated Milwaukee and Madison, Wis., markets.

Ponce Bank, a $1.5 billion-asset community development financial institution (CDFI) in Bronx, N.Y., will continue its mission to fund microloans to new small businesses in New York City’s low-income neighborhoods, says president and CEO Carlos P. Naudon.

“There has to be a follow-up to PPP loans to small businesses, and we view that as one of our missions. Because if we don’t strengthen our small businesses, we can’t strengthen our communities.”—Carlos P. Naudon, Ponce Bank

“PPP loans at least gave them a lifeline, so, post-pandemic, we’re trying to reach out to the surviving entities and help strengthen them so they can continue to grow,” Naudon says. “There has to be a follow-up to PPP loans to small businesses, and we view that as one of our missions. Because if we don’t strengthen our small businesses, we can’t strengthen our communities.”

Holding onto talent

Another top challenge for community banks in 2022 is attracting and retaining qualified staff. Nearly half (48.1%) of respondents listed it as one of their primary business challenges.

“It’s particularly difficult today in the environment that we have, where a person being hired has so many choices, including staying home with their kids while working remotely,” Naudon says. “I think many people today are making a lot more short-term decisions to satisfy them over the next few months, versus having a long-term commitment and more of a mission.

“We are very much a mission-driven organization, so our challenge is to find the talent that is a match, and that’s very tough to do now.”

Badger Bank is having trouble finding staff “across the board,” from operations to tellers and trust officers. “We don’t even get applications,” Dehnert says. “It’s a struggle.”

In 2022, existing staff—Dehnert included—will continue to wear multiple hats until labor market conditions ease.

While Red River Bank also finds it a challenging labor market, especially for frontline tellers and administration staff, it sees an opportunity to lure away dissatisfied bankers from bigger banks that have either exited smaller markets in Louisiana or drastically reduced in-person services, Chatelain says.

“A lot of customers aren’t happy about that, and a lot of bankers aren’t happy as well,” he says, “so we continue to add experienced bankers to our team.”

“In this very low interest-rate environment, deposits aren’t necessarily what we want, but that’s where we are. We’re here to service our customers.”—Steve Dehnert, Badger Bank

Using deposits in 2022

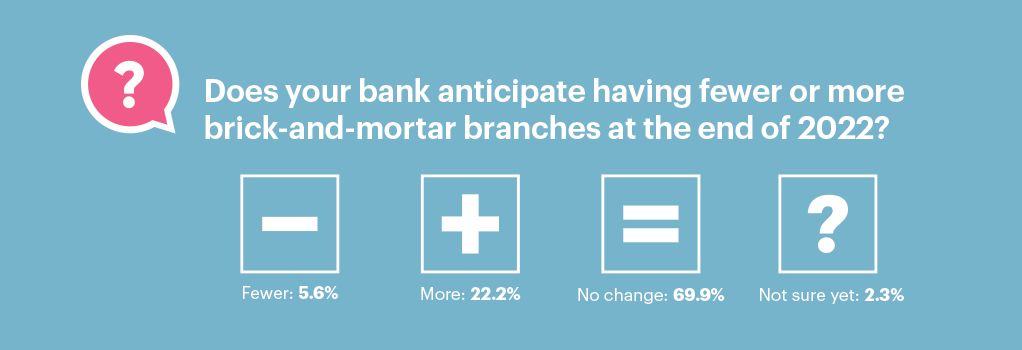

Several things were not much of a concern at all for bankers in the survey. For example, just 2.1% are worried about direct effects of COVID-19 and only 4.2% feel they need to grow deposits in 2022.

“We’re flush with deposits. It’s crazy how much our deposit base has grown,” Dehnert says. “So much money has been pumped into accounts from stimulus checks, and people aren’t spending it. Even PPP money is sitting in deposit accounts. In this very low interest-rate environment, deposits aren’t necessarily what we want, but that’s where we are. We’re here to service our customers.”

At the Community Bank of Santa Maria, deposits grew $71 million from Sept. 30, 2020, to Sept. 30, 2021, while loans grew just $18 million, and current loan demand is still not keeping pace with deposit levels.

“Deposits are necessary, and we need to have that service for our customers, but they are not free; they cost us money,” Silveria says. “So, we have to look at how we can pay for those deposits. Typically, it’s not tough to make loans, but if we can’t get enough loans to pay for all these deposits, we have to find other ways.”

Launching new revenue streams

In this environment, many community banks are looking for alternative methods of making money, including starting new businesses under their holding companies.

“For example, we don’t do mortgage lending right now, because we don’t have the compliance expertise and staff knowledge,” Silveria says. “But perhaps we could find a team somewhere else that has such expertise and start another entity under the holding company that would do mortgage lending.”

Another community bank structured a new entity in a similar way, Silveria says. The institution hired a Small Business Administration (SBA) lending team to work at a newly created entity under the community bank’s holding company. “Those are the types of things we could look at in 2022 to increase non-interest income streams,” she says.

For much of the community banking sector, earnings for the past two years have been supplemented significantly by making PPP loans. If earnings drop off this year, Silveria worries investors will get concerned.

“But the message we need to send to everybody is that community banking remains strong,” she says. “Their respect and perception in their communities has been strengthened even further through the pandemic, and we just need to re-emphasize the role we’ve played during the pandemic. In 2022, community banks will continue to play a vital role, and we need to get that message out.”

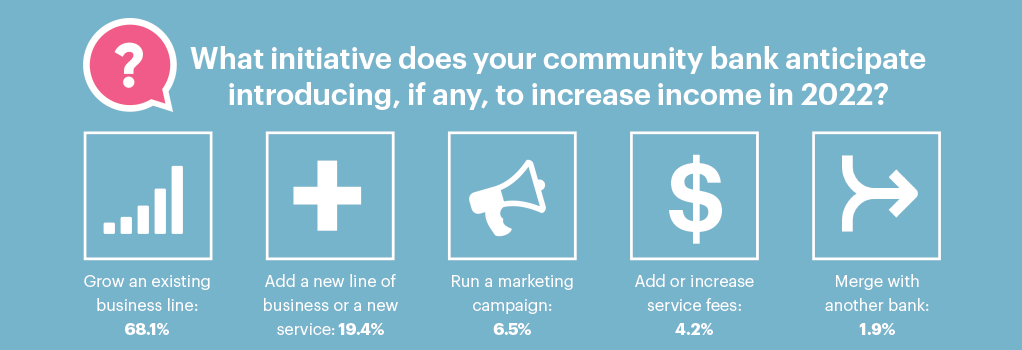

Adding business lines

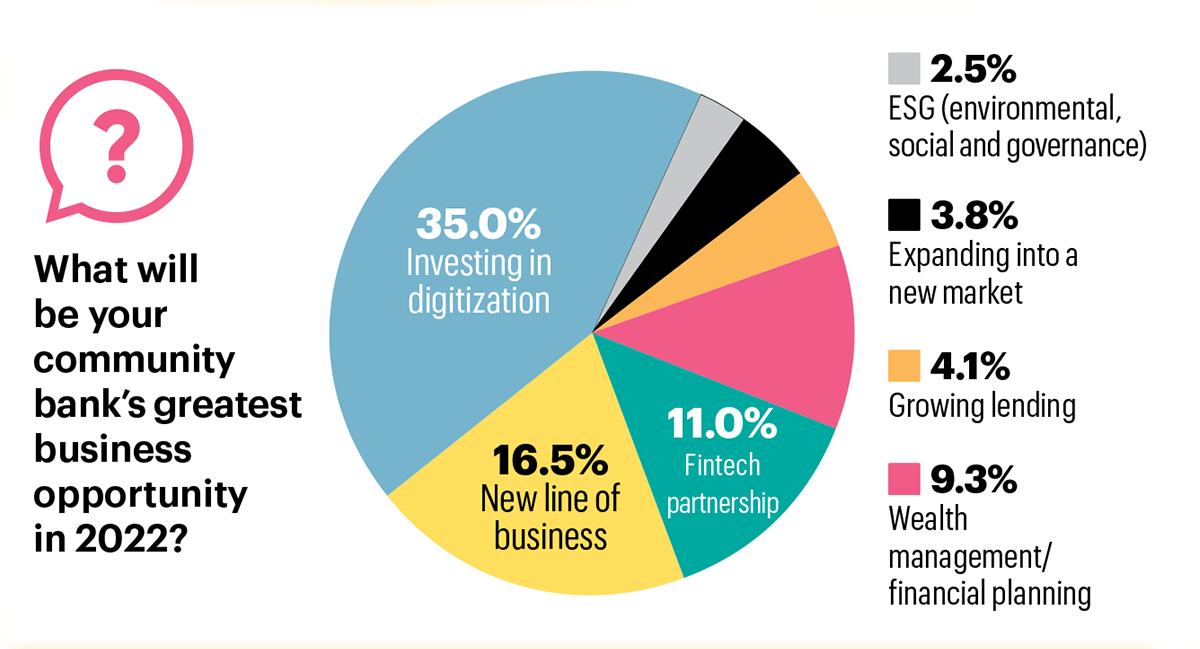

While most community bank executives (68.1%) plan to focus on leveraging existing business to increase income in 2022, nearly one in five (19.4%) hope to boost earnings by adding new lines of business. In fact, 16.5% of respondents say it will be their greatest opportunity.

Some of the lines that community banks plan to add include fraud and ID theft protection services, treasury management solutions, wealth management, property and casualty insurance, credit cards and specialized loan products.

Badger Bank in Fort Atkinson, Wis., will continue to work with fintechs, says president and CEO Steve Dehnert. The bank increases its loan balances by partnering with fintech loan producing companies on a national scale, and this year it will switch its insurance operations to digital as the bank’s onsite agent retires, adding more policy types, including travel insurance.

Ponce Bank in Bronx, N.Y., hopes to add several business services in the future, possibly including wealth management, cash management, life insurance, products that have guaranteed returns and products that have tax advantages, says president and CEO Carlos P. Naudon. However, before it launches any new products or services, Ponce Bank first needs to educate people within its underserved communities on how these offerings could help them build their wealth. Naudon likes to call such educational programs “financial mastery.”

“We can’t really launch them until we see distinct demand, or else we’ll [be unsuccessful],” he says. “We need to get the critical mass. That’s why it’s very important to educate people on these types of products first, so they’ll be more comfortable using them.”

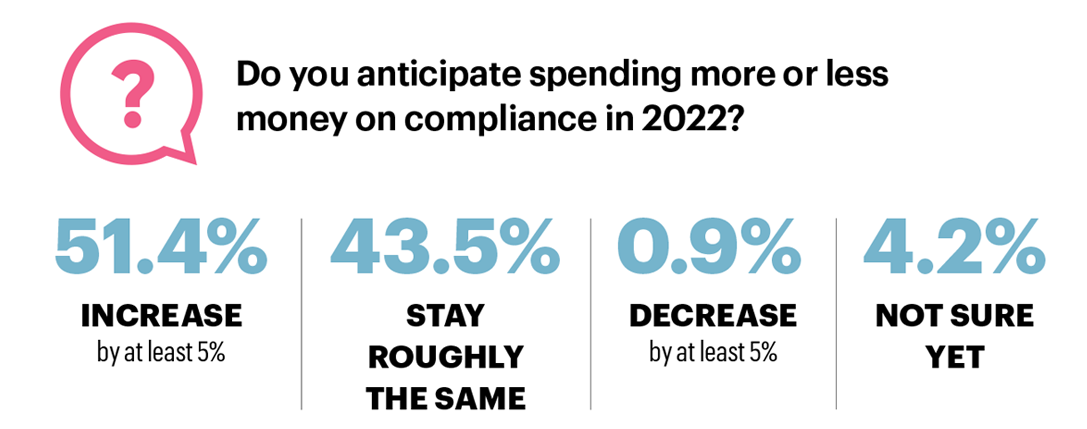

Planning for increased compliance costs

With legislators contemplating a number of new regulatory requirements, community bankers are particularly engaged this year.

A quarter (24.5%) say complying with regulations will be one of their top challenges in 2022, and more than half (51.4%) anticipate compliance spending will increase by at least 5%.

Carlos P. Naudon, president and CEO of Bronx, N.Y.-based Ponce Bank, is concerned about efforts to force banks to monitor activity within bank accounts on behalf of the IRS. This would further alienate people within the CDFI’s “disenfranchised underserved community.”

“This is particularly true with immigrants, as many come from areas of the world where they built up a well-founded distrust in government,” Naudon says. “So, to now have an additional layer of reporting activities by the government would be detrimental to all of our efforts to further increase banking in these communities.”

Janet Silveria, president and CEO of Community Bank of Santa Maria in Santa Maria, Calif., finds talk of raising capital thresholds concerning. She believes it is premature due to the pandemic’s lingering effects on the asset side of community banks’ balance sheets.

“The regulatory agencies were great during the pandemic and temporarily lowered the leverage ratio, but now those ratios are coming back up,” she says. “But my contention with the agencies is that our risk factors have not increased. They are the same level of risk that we had pre-pandemic.”

Credit quality is strong, community banks are not posting many charge-offs and loan loss reserves are significant, Silveria says. None of that has changed, but banks’ asset growth due to increased deposits has. Hopefully in 2022, loan demand will start to rebalance that.

“Regulatory agencies, please give us a little bit more time,” she says. “Cut the community banks some slack, as we’re not the ones putting the financial sector at risk.”

Technology is on community bankers’ to-do lists

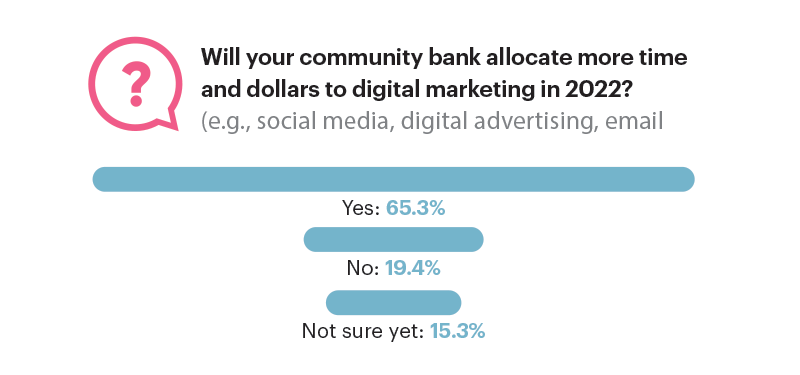

Technology is both a challenge and an opportunity for community banks in 2022. A quarter (24.9%) believe keeping up with technology needs or advancements will be a top challenge for their institution this year, while more than a third (35%) view investing in digitalization as their top business opportunity.

“There are so many changes happening in our industry that as a banker you have to be mindful [of them], but at the same time the pace of change can be a little bit overwhelming, and the options are so vast,” says R. Blake Chatelain, president and CEO of Red River Bank in Alexandria, La. “For us, we’re trying to stay focused on determining the right technology that we need to be offering to serve our target customer base, and we just have to be cautious and not chase every new shiny object.”

This year, Red River Bank will enhance its mobile banking and treasury management services and automate more back-office operations. Ponce Bank also plans to enhance its mobile app and its online banking site, making the channels more user-friendly, says president and CEO Carlos P. Naudon. To be successful, the community bank in Bronx, N.Y., will need to teach customers who are unfamiliar with technology on how to use—and trust—these digital channels.

Community Bank of Santa Maria is expediting a planned conversion of its core to gain efficiencies as the Santa Maria, Calif.-based bank grows, says president and CEO Janet Silveria.

“When you first buy a core system, technology in general advances, and you start picking up all these products along the way, like imaging processes and mobile banking products,” she says. “Right now, we have a whole bunch of components that don’t talk to each other very well, and that challenges workflows. By accelerating the conversion, we’re going to get a better workflow of all those components pieced together so they can talk to each other better.”

Badger Bank in Fort Atkinson, Wis., recently formed a new relationship with a merchant services provider and is considering instant card issuance, as well as implementing an enterprise risk management (ERM) tool—“a real buzz with regulators,” president and CEO Steve Dehnert says.

“We’re looking at a fintech ERM product that is very intuitive, and I think it’s going to be a great tool for us,” he says. “For a small bank like ours, it’s unusual to go that far, but we think it will improve efficiency, increase profits and reduce risk.”

From our sponsor

Payments yoga: Flexibility is key

The past year has proven to be full of change for banks, as cardholder spending patterns, preferences and in some cases, financial lives, changed quite rapidly. FIS’ Pace Pulse survey revealed that more than a quarter of respondents now use online or mobile banking tools to handle needs they used to take care of in person.

To modernize your payments, consider how you can further use technology to put cardholders in control. Self-service tools let cardholders set parameters over how and where their card can be used and allow them to receive mobile or email spending alerts to help them manage budgets and prevent fraud. You can further improve servicing by arming your customer service staff with technology that offers an easily searchable user interface and holistic view into the customer relationship they need to accurately answer and resolve customer needs.

In order to keep up with the innovation, banks must acknowledge that many cardholder needs, preferences and expectations have changed significantly over the past year and act on it.

David Fura, SVP, head of card payments, FIS