When Jeff McCarthy’s teenage daughter, Ashleigh, visited colleges, she looked at their dorms, dining halls and libraries. But there was one factor that was more important to her than any other: the price tag.

She pondered: Could she afford these colleges? Would they give her a good return on investment in her field of study?

It was a proud papa moment for McCarthy, vice president and marketing director of $1.5 billion-asset Bank Five Nine in Oconomowoc, Wis. It was also a very Generation Z set of questions to ask.

“[The pandemic] was a real moment of financial reflection. They were just starting to create a sense of financial independence and self-reliance.”—Jason Dorsey, Center for Generational Kinetics

Generation Z, the 72 million Americans born between 1997 and 2012, are coming of age. They’re the country’s most racially and ethnically diverse generation: Just 52% are white, and one in four are Hispanic, according to the Pew Research Center. They’re also well educated: 57% go to college at 18–21 years old, compared with 52% of millennials, according to the Pew Research Center. Gen Zers are developing a reputation for being pragmatic and financially savvy.

It’s a trait they come by honestly. Primarily raised by skeptical Gen Xers, Gen Z grew up during the Great Recession and its aftermath. While they were too young to understand the financial crisis, they still experienced fear and anxiety as families struggled. They saw people—possibly their parents—lose their homes. They witnessed how college debt weighed on millennials, making it difficult to launch financially independent lives and to buy homes.

Source: 2020 Center for Generational Kinetics report

Then came the COVID-19 pandemic, which hit Gen Z particularly hard. They were the most likely to lose their jobs—typically entry level or in the service industry—or have their pay or hours reduced. Others ran into the “last hired, first fired” dynamic. A third had to reduce their spending and dip into their savings accounts, and 14% accumulated new credit card debt, according to a survey by the Transamerica Center for Retirement Studies. Many had to move in with their parents.

“It’s been a real moment of financial reflection,” says Jason Dorsey, president and cofounder of the Center for Generational Kinetics (CGK) and co-author with Denise Villa of Zconomy: How Gen Z Will Change the Future of Business—and What to Do About It. “They were just starting to create a sense of financial independence and self-reliance.”

Saving for a rainy day

But Gen Z is not easily defeated. The silver lining is that they have learned from these experiences and come out more resourceful. They tend to value individual expression and experiences over acquisition, and stability over risk.

They’re also big savers. Of working Gen Zers, 70% are already saving for retirement, and they are doing it earlier than any other generation did (age 19 versus age 25 for millennials), according to Transamerica. More than three quarters (78%) say retirement benefits are a major factor when considering a job offer.

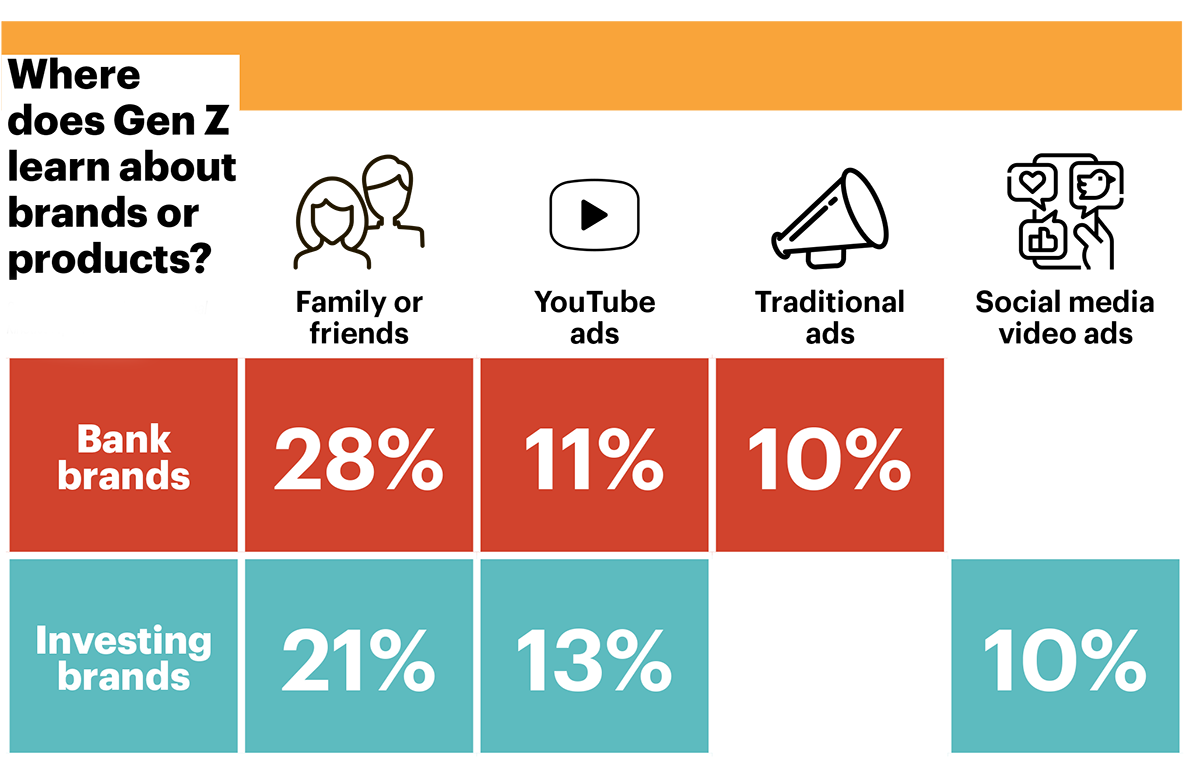

They also have the wisdom not to go it alone. Older Gen Zers, those aged 18 to 24, have been more likely to seek out financial advice than millennials since the pandemic began, according to CGK. Common sources of information include parents (27%), friends (25%), YouTube (25%) or social media (21%), but they’ve also turned to banks. Fifteen percent reached out to a bank or credit union associate for help during the pandemic, showing there is significant demand for financial education and advice. This is especially true for men, who are nearly twice as likely to turn to financial institutions as are women.

Become part of their world

This is welcome news for community banks. Just because Gen Z are digital natives who have never known a world without smartphones doesn’t mean they don’t desire connection. They expect the companies they do business with to understand who they are and what they value. Nearly a third of Gen Zers say they feel more loyal to brands that support causes they agree with, compared with just a quarter of millennials, according to CGK.

The key is to meet them where they are, and it doesn’t hurt to entertain them along the way. So where are they? Mostly, online—and we’re not talking about Facebook.

“We’re using [TikTok] more as a personality piece. This is who we are. [We’re saying] we’re a little quirky, we’re a little different and maybe not what you think of when you think of a standard community bank.”—Shelby Myler, Farmers State Bank

One important thing to note is that influencers play an outsized role in the life of Gen Zers, including in the financial realm. This means community banks should create meaningful content on sites like Instagram, Spotify, YouTube and TikTok (see Two community banks going viral sidebar below).

Farmers State Bank in Waterloo, Iowa, began creating TikTok videos during the pandemic after surveying staff and learning that social media was one of the top reasons younger employees applied to the community bank. Now, the bank regularly posts to TikTok under the handle @fsb1879, often filming light-hearted videos on a Friday afternoon as a teambuilding exercise, says Shelby Myler, marketing coordinator at the $1.3 billion-asset community bank.

“We’re using it more as a personality piece,” says Myler of the short, “goofy” videos, including a series with the bank’s mascot, Hap the Pig, celebrating holidays like the Fourth of July and Oktoberfest. “This is who we are. [We’re saying] we’re a little quirky, we’re a little different and maybe not what you think of when you think of a standard community bank.”

Myler says making TikTok videos may seem like a silly thing for a community bank to do, but the feedback has been worth it to Farmers State Bank. College students mentioned seeing them during campus outreach events.

One of the most powerful ways to reach Gen Z is through a streamlined and intuitive user experience, says Shelley Wang, vice president of strategic sales at Zafin, a Toronto-based bank technology company.

“Connecting on their terms and on their turf, such as popular social media platforms, can kick off the start of a lifelong relationship,” she says.

Personalized products

In addition to its online presence, Bank Five Nine looks to the other place Gen Z hangs out: school. Its Mascot Banking program offers local high school students a debit card with a school logo. If they meet the minimum requirements, students get $150 deposited into their account and the school booster club gets $150.

Younger students are eligible for the Good Savers program, which rewards them with a gift card after they make 20 deposits of $10 or more.

“Often, it’s better getting kids or grandkids of those who are customers,” says Dorsey of these outreach efforts. “There are lots of things you can put in the path of kids and grandkids.”

Bank Five Nine debated requiring students to complete some of its online financial education modules before earning the $150 but decided the extra steps could turn off students who might be intimidated by the process, McCarthy says.

Offers that solve financial challenges for Gen Z are particularly welcome, Dorsey says. Fintechs have had success creating apps to help consumers avoid hidden fees—a major Gen Z pet peeve, he adds—manage student loans and offer early access to paychecks.

Bank Five Nine has seen many students take advantage of its credit builder product. While the community bank originally introduced the program for adults who needed to repair their credit, students have adopted the program to build a credit history to make it easier to rent an apartment or buy a car when they graduate. “It’s positioning themselves as a good credit risk,” McCarthy says.

Personalized offers can be an important tool when serving this generation. “Being able to tailor your offerings and engage digitally on a personalized level will establish a unique relationship without having to ever meet face to face,” Wang says.

The mobile generation

Farmers State Bank knows that funny videos alone aren’t going to win over the next generation of customers, so it invests in the technology that Gen Z expects, especially mobile capabilities. Visitors to the community bank’s mobile website can open an account or apply for a loan in 10 minutes and use its app to access online tools that show real-time feedback on debit card spending.

“Our message is that we get who you are, we’re also young and we’re here to help you figure it out,” Myler says.

Almost three in four Gen Zers say they won’t use a bank or credit union that doesn’t offer online account opening, even though just 57% prefer to open an account online, according to research by MANTL, a New York City-based bank technology company. “It’s indicative of how forward-thinking that financial institution is,” says Nathaniel Harley, CEO of MANTL.

This is especially true for Gen Z small business customers. Ninety-one percent say they are most likely to open an account online, and 82% say they are likely to open an account with a community bank or credit union, though 100% also said they’d open an account with a fintech.

While Gen Z is just as entrepreneurial as previous generations and open to new ways of banking, they are more risk averse and less likely to jump in with both feet, Dorsey says. “They like the idea of starting a business on the side, partnering with friends and starting their own business as a second income stream,” he adds. “They want a side hustle.”

That creates opportunities for community banks to mentor small businesses—perhaps even in person. Although Gen Zers spend much of their time online, they are more likely to want to engage face to face with their primary financial institution (17%) than are millennials (12%), according to Raddon, a Fiserv-owned research firm.

A note of caution

This is a reminder that while Gen Zers share many characteristics, it’s dangerous to paint them with a broad brush. In the end, they are a diverse group of individuals and expect to see that diversity reflected back at them in advertising, employees and board representation. They can be loyal customers, but they want to know they are being treated right, and that means nimbly serving up banking services the way they want them: both in person and online.

“Step back and look at the generations and regions you serve,” Dorsey says. “Don’t rely on a sample group of one. [Gen Z is] a diverse group with diverse views of the world.”

Two community banks going viral

To reach the next generation of community bank customers, some banks are adopting the latest social media platforms, including TikTok. This platform is focused on spreading viral content, sometimes far outside a community bank’s market.

The most popular TikTok video from Farmers State Bank in Waterloo, Iowa, has more than 100,000 views. Piggybacking on the “Make That Sound” trend, the video shows a staffer demonstrating the noises a money counter, a piggy bank, a stapler and other bank-related items make. Then they ask employees to recreate them.

Julie Waddle (pictured), assistant vice president and digital marketing manager at $570 million-asset FNB Community Bank in Midwest City, Okla., has one video that’s garnered 3.9 million views on Instagram and 505,000 views on TikTok.

In the video, Waddle appears with a caption reminding users that the payments app Venmo isn’t FDIC-insured like a community bank.

“One of our goals is to remind Gen Z why banking local is important and that we are relevant to their lives,” Waddle says.

A green light for Gen Z fee income

Imagine if parents paid your community bank $4.99 so their kids could use your debit card. That’s exactly what Greenlight gets from 4.5 million parents and kids on top of interchange income.

The Mastercard-branded debit card is linked to a mobile app that lets parents automate allowance payments, manage chores, set spending controls for specific stores and track spending with real-time alerts for up to five kids. Kids can collect interest, add the cards to Apple Pay or Google Pay, set up direct deposit for their paychecks, engage in charitable giving and get 1% cashback on purchases.

Money can also be placed into a connected savings account that earns 2% interest. The card is issued by $730 million-asset Community Federal Savings Bank in Woodhaven, N.Y.

“It solves the problem of parents giving money to their 14-year-old kid,” says Jason Dorsey of the Center for Generational Kinetics (CGK) in Austin, Texas. He notes that kids prefer digital funds that can be spent online and at cashless establishments. “The child probably thinks Greenlight is a bank, even though it isn’t,” he adds.