Bank boards can’t operate in 2023 the way they did in 1993, 2019, or even 2022.

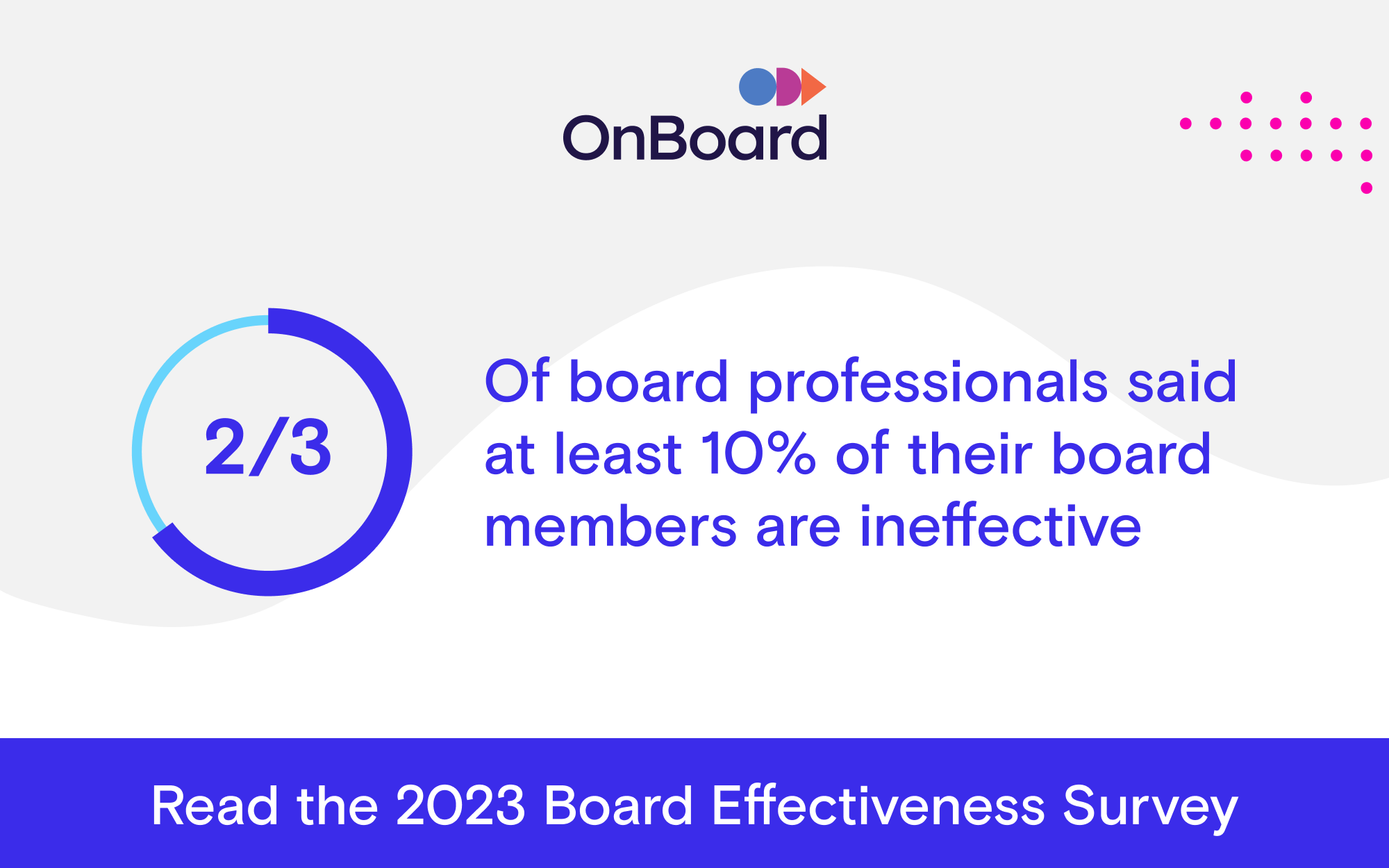

In OnBoard’s 2023 Board Effectiveness Survey, boards across industries shared their thoughts on how they could operate more efficiently and effectively. Financial institutions were well-represented in the survey, accounting for 19% of survey respondents, ranking second among all industries.

What’s Going Wrong?

Fortunately, the problems bank boards face are easy to identify, and solutions exist.

Survey respondents listed the following obstacles:

• Lack of diversity on boards: A whopping 95% of respondents said a lack of diversity and new ideas was the main driver of an ineffective board environment. Nearly three-fourths (73%) said their boards struggle with collaboration and engagement, while 69% said their boards need more turnover.

• Lack of focus on mission: 84% claimed their boards lack a clear mission or measurable objectives and seventy-nine percent said their boards needed more governance maturity.

• Outdated technology: Eighty-three percent were frustrated about their inability to access board resources from a single, centralized location, and three-fourths said board members and staff rely too much on email as a primary communication method.

What’s Going Well?

It’s not all doom-and-gloom for boards. Compared to a similar survey in 2022, 62% of respondents said their boards were more collaborative than they were 12 months ago, and 71% said their boards were more effective.

What else are boards doing well?

• Board continuity (76%): This, of course, would conflict with concerns about board diversity and lack of board turnover, but respondents said board continuity is essential to maintaining effective board operations.

• Board recruitment (58%): Respondents believe their boards are effective at recruiting new members. Another 52% rated their boards as strong at ensuring a diverse board.

Solutions to the Problems

So, what makes a board effective?

- Having a more engaged board

- Having a better prepared board

- Increasing use of board management software

Respondents offered solutions to the 3 main problems cited above:

- Lack of diversity on boards: In addition to bringing on board members with diverse ages, genders, and backgrounds, board members suggested seeking board members with expanded skill sets and experience.

- Lack of focus on mission: Respondents suggested that boards remove red tape/bureaucracy; clarify roles and responsibilities; build more accountability and greater efficiencies; and track key performance indicators and objectives.

- Outdated technology: Survey respondents wished their boards would maximize investment in existing board management technologies; improve information organization; automate processes and avoid use of paper, phone, and email; and build confidence in security.

The Bottom Line on Bank Board Effectiveness

Bank board members want change in how they operate. Also, there’s plenty that bank boards do well. As technology continues to evolve, artificial intelligence (AI) will likely be a focal point in the future. How will banks utilize it to their advantage? How should they?