When it comes to small businesses, a personal touch is needed to develop the relationship between bank and business. Here are six concrete tips on how to improve relationships with current customers and attract potential ones.

6 Ways to Deepen Small-Business Relationships

April 25, 2024 / By Taylor Hugo

When it comes to small businesses, a personal touch is needed to develop the relationship between bank and business. Here are six concrete tips on how to improve relationships with current customers and attract potential ones.

Community banks play a significant role in the success of small businesses in the areas they serve. According to the Federal Reserve’s 2023 Report on Employer Firms: Findings From the 2022 Small Business Credit Survey, overall financing approval rates were highest at small banks—defined as those with less than $10 billion in total deposits—with 82% of financing applicants at least partially approved, compared with 68% at large banks. Additionally, small businesses were most satisfied with the lending experiences they received at small banks.

That’s no surprise: Community bankers know that a strong relationship between a bank and a business goes beyond the transactional experience of opening a business bank account or issuing a loan or line of credit. It’s the personal touch that makes a difference.

Here, community bankers and service providers offer six tips for deepening relationships with existing small-business customers and attracting new ones.

1. Designate a personal banker

Small-business customers appreciate a single point of contact they can reach out to with questions about their unique needs.

“The personal relationships help build trust between the customer and the bank, and by getting to know our business owners on a personal level, banks can better understand their needs, provide tailored financial solutions and talk about our specific products that might benefit them,” says Julie Waddle, vice president and marketing officer for $509 million‑asset FNB Community Bank in Midwest City, Okla.

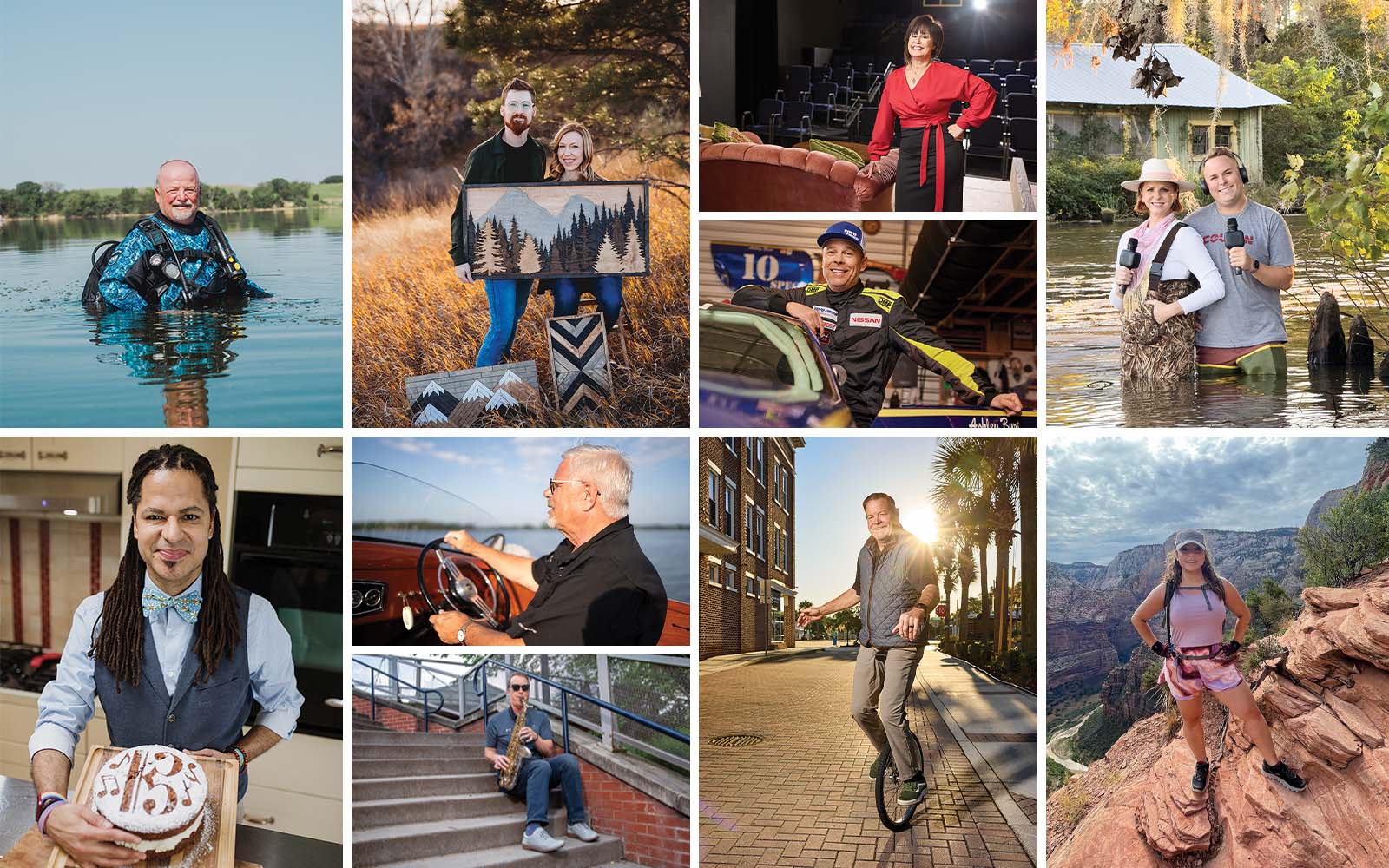

Waddle suggests getting to know your small-business clients over hobbies they enjoy. “Small-business owners only have so much free time,” she says. “We’ve found that if you can cultivate a relationship where they want to share that free time with you as the banker—maybe playing golf or getting coffee while discussing their goals and plans—then you are providing value to that customer, as well as highlighting the bank and how we can help them.”

2. Offer multiple channels of communication

Engage small-business customers where they are—whether that’s in a branch, over the phone, through email or even texting. Agent IQ, an ICBA ThinkTECH Accelerator alum, integrates with community banks’ digital platforms to offer secure messaging and video chatting between small-business owners and their personal bankers.

“People nowadays are on the go. They want to do everything on their phone, on their terms and on their time,” says Agent IQ chief marketing officer Matt Phipps.

BAC Community Bank, an $830 million-asset community bank in Stockton, Calif., partnered with Agent IQ to install its customized platform, Smart ALAC, in 2022.

“It gives our customers one more way they can communicate with their relationship manager [and banking team],” says Jackie Verkuyl, BAC’s executive vice president and chief administrative officer. “The customers who use it love it. They have somebody at their fingertips during business hours.”

3. Show up for them

Attend events hosted by your small-business customers, spend money at their establishments and encourage others across your served community to do the same.

FNB Community Bank hosts Cash Mobs, where the public is asked to meet and shop at the featured local business on a specific date and time. FNB even hands out $5 to participants to spend at the business.

4. Promote their business

Share information about your small‑business customers on social media sites or allow them to advertise in your branches. FNB Community Bank started its Side Hustle Series to reward its customers for banking there. After collecting submissions online, selected businesses were featured in a bank blog post and invited to host a pop-up shop at the branch of their choosing.

“For small-business owners who don’t have a storefront, who are just online, this is a way to promote a business that people may not know about,” says Waddle.

5. Simplify the lending process

Providing the capital for businesses to grow is a significant piece of the relationship between community banks and their small-business customers. Fintech solutions can help remove friction and therefore increase client satisfaction.

“The faster a bank can respond to a client, the more they’re helping them,” says Darren Hecht, senior vice president and head of growth for Biz2X, a platform that streamlines the application process for unsecured and secured business lending. “A business might have a short-term, immediate need for working capital, and they need to count on their community bank to help them, but it can’t be a long, drawn-out process or they may take their business elsewhere.”

6. Make yourself visible and approachable

Join your chamber of commerce or other local business groups, which not only demonstrates your bank’s commitment to the community but is also an organic way to meet potential customers. Even if your existing small-business customers don’t have any pressing banking needs, keep in contact with them and regularly invite them into a branch to meet with the executive team.

“Our customers have access to the decision-makers. They have access to the people who can solve their business problems or their banking problems and help them move forward with their business,” says Verkuyl. “It’s really a matter of making sure your customers know that you’re there for them.”

Subscribe now

Sign up for the Independent Banker newsletter to receive twice-monthly emails about new issues and must-read content you might have missed.

Sponsored Content

Featured Webinars

Join ICBA Community

Interested in discussing this and other topics? Network with and learn from your peers with the app designed for community bankers.

Subscribe Today

Sign up for Independent Banker eNews to receive twice-monthly emails that alert you when a new issue drops and highlight must-read content you might have missed.

News Watch Today

Join the Conversation with ICBA Community

ICBA Community is an online platform led by community bankers to foster connections, collaborations, and discussions on industry news, best practices, and regulations, while promoting networking, mentorship, and member feedback to guide future initiatives.