By sharing information … we can also stop fraud in its tracks for the benefit of our banks, customers and the industry at large.

Rebeca Romero Rainey: Communication Is Key to Mitigating Fraud

October 01, 2024 / By Rebeca Romero Rainey

By sharing information … we can also stop fraud in its tracks for the benefit of our banks, customers and the industry at large.

Where I’ll be

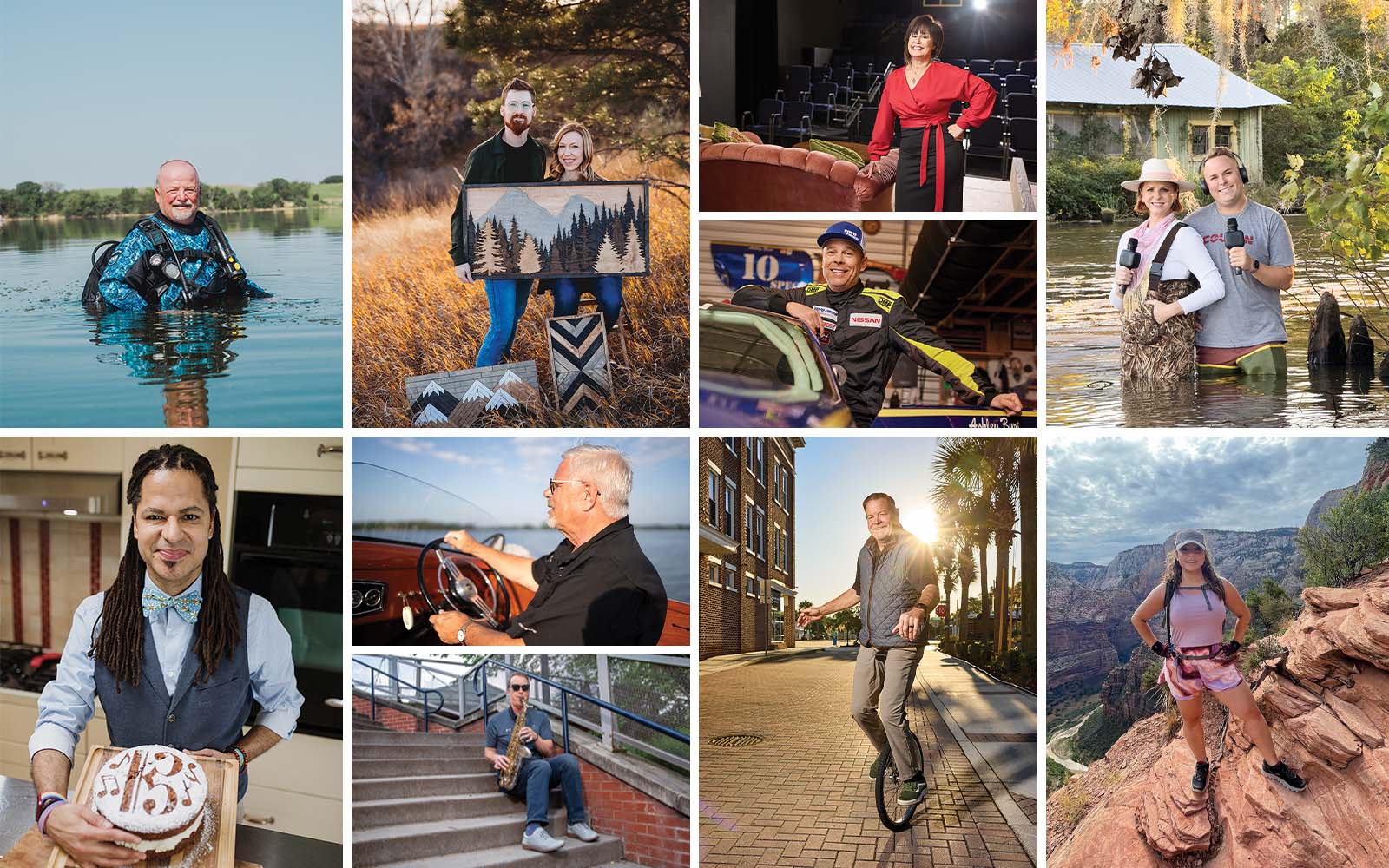

this month

I’ll be attending the Virginia Association of Community Banks’ Annual Convention, and then I’ll be holding our fall leadership meetings with all of our volunteer committee leaders in Salt Lake City.

Cybersecurity and fraud mitigation remain significant priorities for community banks as attacks get more creative and targeted. While today’s technologies assist with anomaly detection, flagging rogue transactions and spotting those that need greater scrutiny, at the end of the day, one of the main methods of mitigating this risk is to Know Your Customer (KYC).

For community banks, saying this is like preaching to the choir. Our relationship-banking model ensures that we know who we are dealing with and what constitutes “normal” for those accounts. In fact, with the surge in check fraud, I’ve heard countless stories of community banks holding up transactions because they seem out of character, only to find out that they were looking at washed checks being pushed through the system. Many of these stories have one common denominator: big banks as the bank of first deposit.

Fraudsters have figured this out. They can go to a big bank—where they can be anonymous and where the detailed KYC present at the community bank level doesn’t happen—to open accounts with minimal effort. Those fraudulent transactions slide through.

It’s an issue that’s playing out in check fraud and other areas, and we’re talking with the heads of agencies and Congress to ensure they understand the imbalance between big banks and community banks on KYC. Because true KYC requires the personal connection and relationship that community banks maintain—one that often gets lost in a larger institution.

Yet, community banks still must deal with the rise in fraud, and increasingly, communication is the best mitigation tactic. Whether it’s bankers on our check fraud task force informing our efforts, others sharing lessons learned in ICBA Community (community.icba.org) or bankers working more closely with law enforcement, communication helps us get ahead of the fraudsters.

ICBA stands ready to support those efforts. We continue to encourage community bankers to share your insights on the challenge of check fraud at checkfraud@icba.org.

At the end of July, we were alerted by several members about a new form of fraud: check fraud related to home equity lines of credit. Within a day, we were able to issue a warning to community bankers and offer tips for safeguarding HELOCs.

Communication is vital, because knowledge is power. When we are aware of new scams or attacks, we can better protect our banks and customers. So, use ICBA as a facilitator of communication. By sharing information, we not only help one another fight back against fraud; we can also stop fraud in its tracks for the benefit of our banks, customers and the industry at large.

Subscribe now

Sign up for the Independent Banker newsletter to receive twice-monthly emails about new issues and must-read content you might have missed.

Sponsored Content

Featured Webinars

Join ICBA Community

Interested in discussing this and other topics? Network with and learn from your peers with the app designed for community bankers.

Subscribe Today

Sign up for Independent Banker eNews to receive twice-monthly emails that alert you when a new issue drops and highlight must-read content you might have missed.

News Watch Today

Join the Conversation with ICBA Community

ICBA Community is an online platform led by community bankers to foster connections, collaborations, and discussions on industry news, best practices, and regulations, while promoting networking, mentorship, and member feedback to guide future initiatives.